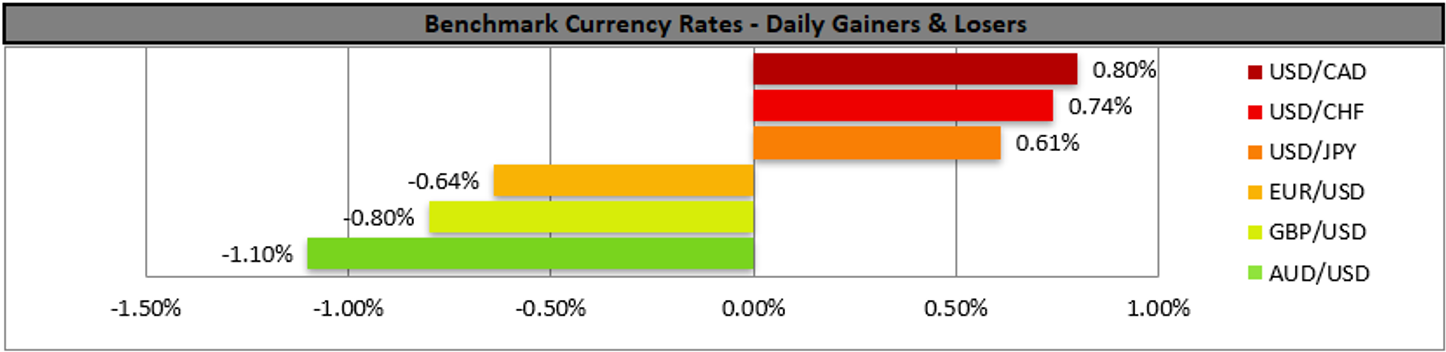

由于市场对美联储仍持鹰派预期,昨天美元全线上涨,同时一些有弹性的通货膨胀数据突显了这钟情况. 我们从1月份房屋开工和建筑许可数量开始, 这意味着美国建筑业的经济活动趋于萎缩. 在就业市场,周初次申领失业救济金人数数据不升反将,这意味着美国就业市场仍然紧张,对美元是积极的

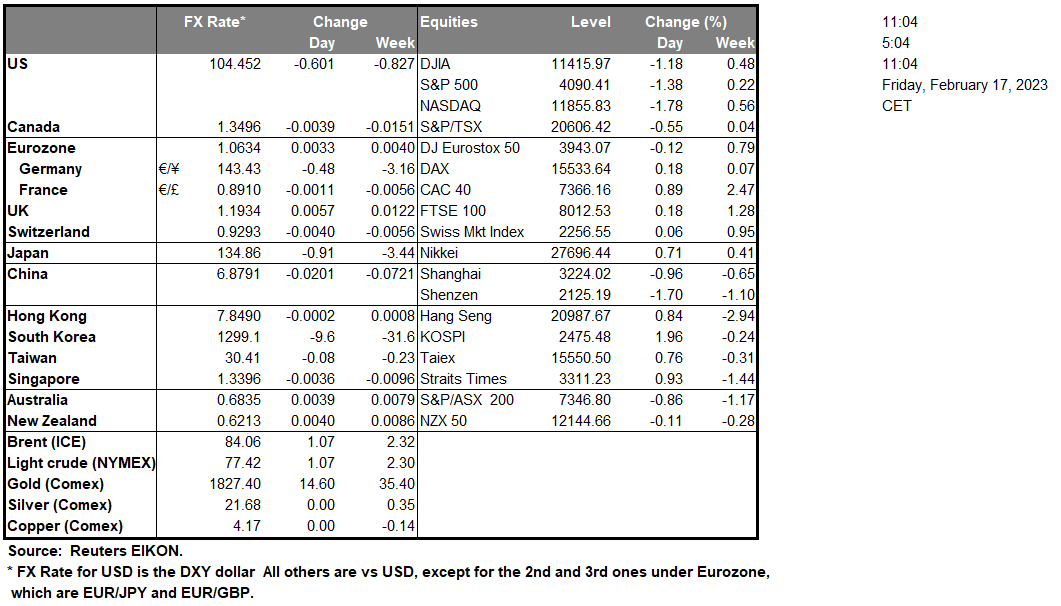

It should be noted that WTI’s price has been driven lower also due to market worries that the Fed’s hawkishness is to curtail economic activity further and may have an adverse effect on oil demand, a concern that has also been reflected in markets lately as USD Rises on tightening expectations. Across the Atlantic, we note that the UK’s retail sales growth rate accelerated more than expected, which was a positive for the UK on a macroeconomic level, yet failed to excite pound traders, especially as USD Rises tends to pressure other major currencies. On a monetary level, we note that BoE’s chief economist Huw Pill stated that the bank is to raise rates at a slower pace this year yet has to remain vigilant not to end its rate hiking cycle too soon. The pound’s drop though is unlikely to be halted easily as market worries for a possible recession in the UK economy are still intense, particularly when USD Rises amplify currency imbalances. Finally, we note RBA Governor Lowe, despite the political pressure being exercised on the bank due to the continuous rate hikes, defended the bank’s hawkish stance and expressed the hope that rates may start coming down in 2024.

在美国边境北部,我们注意到加元兑美元走弱, 可能担心美联储的意图与加拿大央行不断扩大的货币政策前景偏差,但油价也连续第五天下跌,推动加元也走弱,. 值得注意的是由于市场担心美联储的鹰派态度将进一步抑制经济活动,并可能对石油需求产生不利影响, WTI价格也被压低. 在大西洋彼岸,我们注意到英国零售销售增长率加速超出预期,这对英国宏观经济起积极作用, 但未能令英镑交易者感到激动.

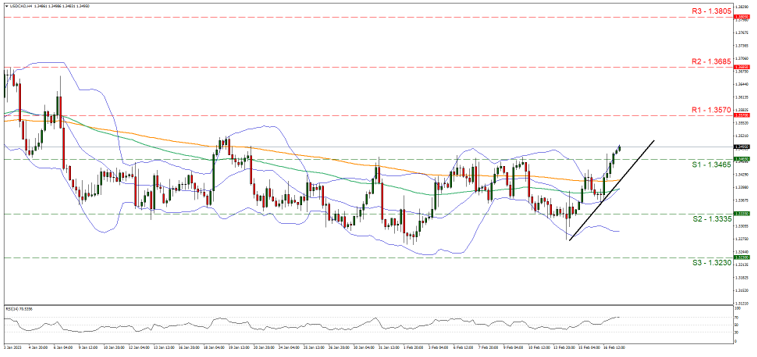

USD/CAD was on the rise yesterday breaking the 1.3465 (S1) resistance line, now turned to support. Given that the RSI indicator has reached the reading of 70 and an upward trendline is supporting the pair, we tend to maintain a bullish outlook for the pair. Should the ascent higher be maintained we may see USD/CAD breaking the 1.3570 (R1) resistance line and aim for the 1.3685 (R2) level. Should a selling interest be expressed we may see USD/CAD, reversing course and breaking the 1.3465 (S1) support line, the upward trendline and aim for the 1.3335 (S2) support level.

今日其他亮点:

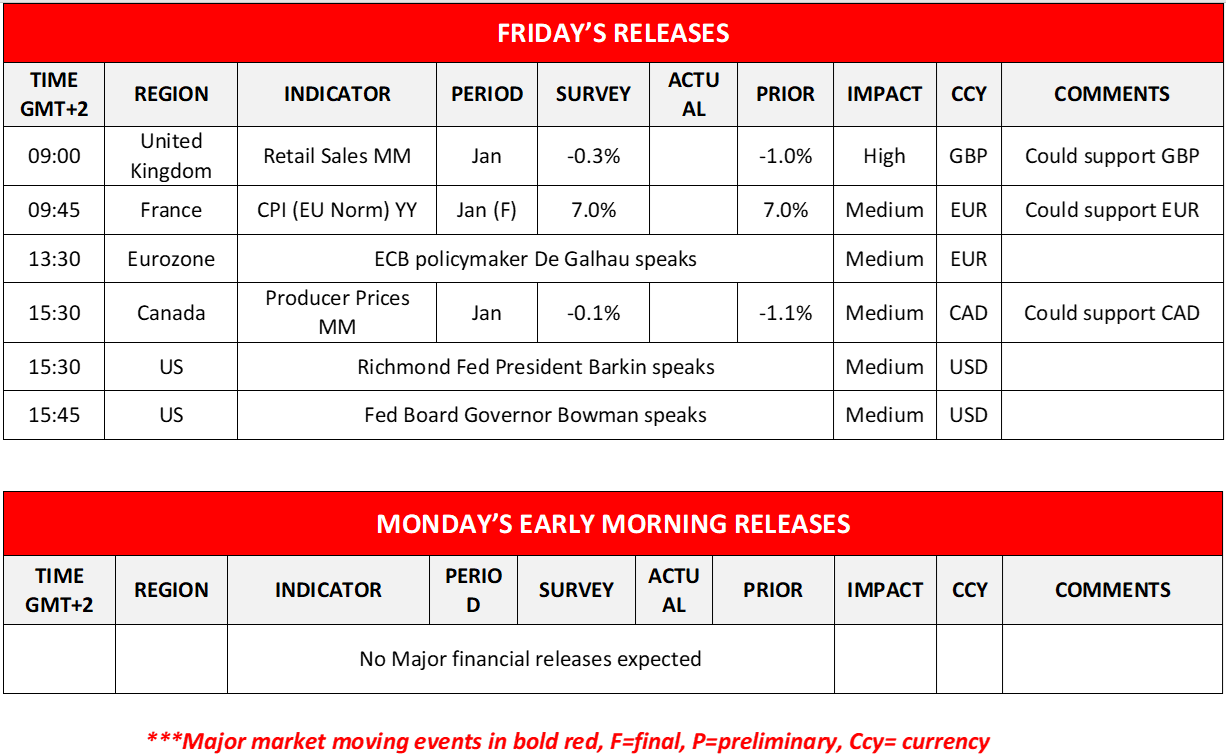

In an easy Friday, we note during the European session the release of UK’s retail sales growth rate for January as well as the France’s final HICP rates for the same month. On the monetary front ECB policymaker De Galhau speaks. In the American session, we note the release of Canada’s producer prices for January while Richmond Fed President Barkin and Fed Board Governor Bowman are scheduled to speak.

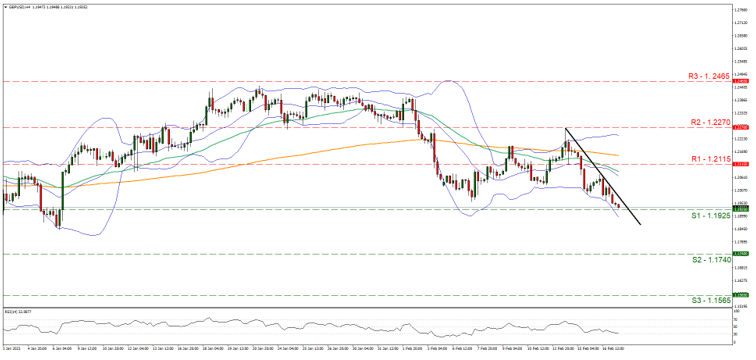

英镑/美元4小时走势图

支撑: 1.1925 (S1), 1.1740 (S2), 1.1565 (S3)

阻力: 1.2115 (R1), 1.2270 (R2), 1.2465 (R3)

美元/加元4小时走势图

支撑: 1.3460 (S1), 1.3335 (S2), 1.3230 (S3)

阻力: 1.3570 (R1), 1.3685 (R2), 1.3805 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.