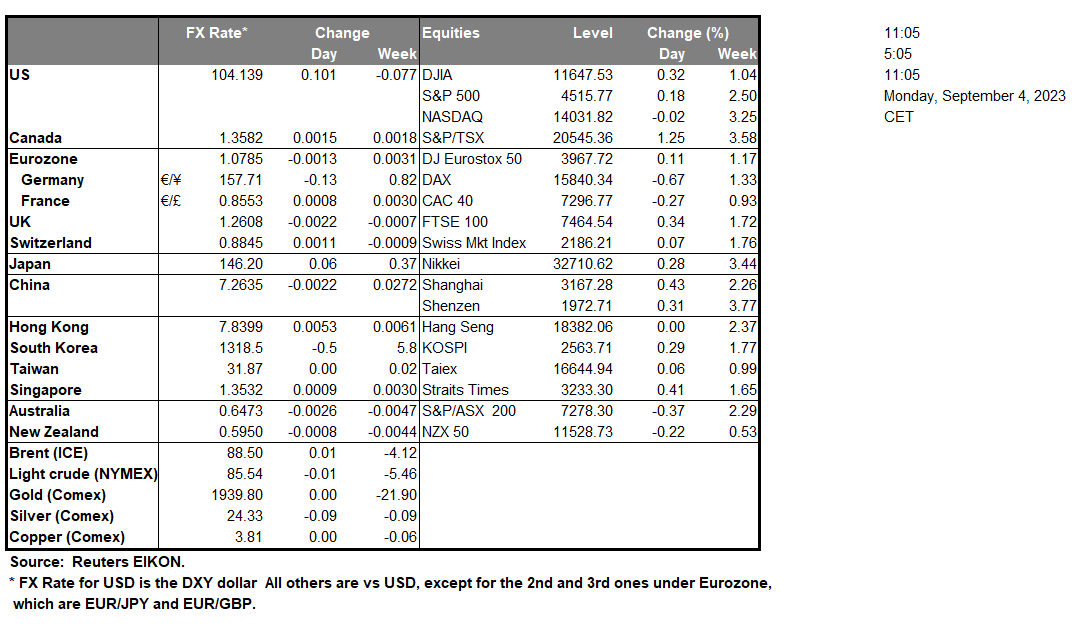

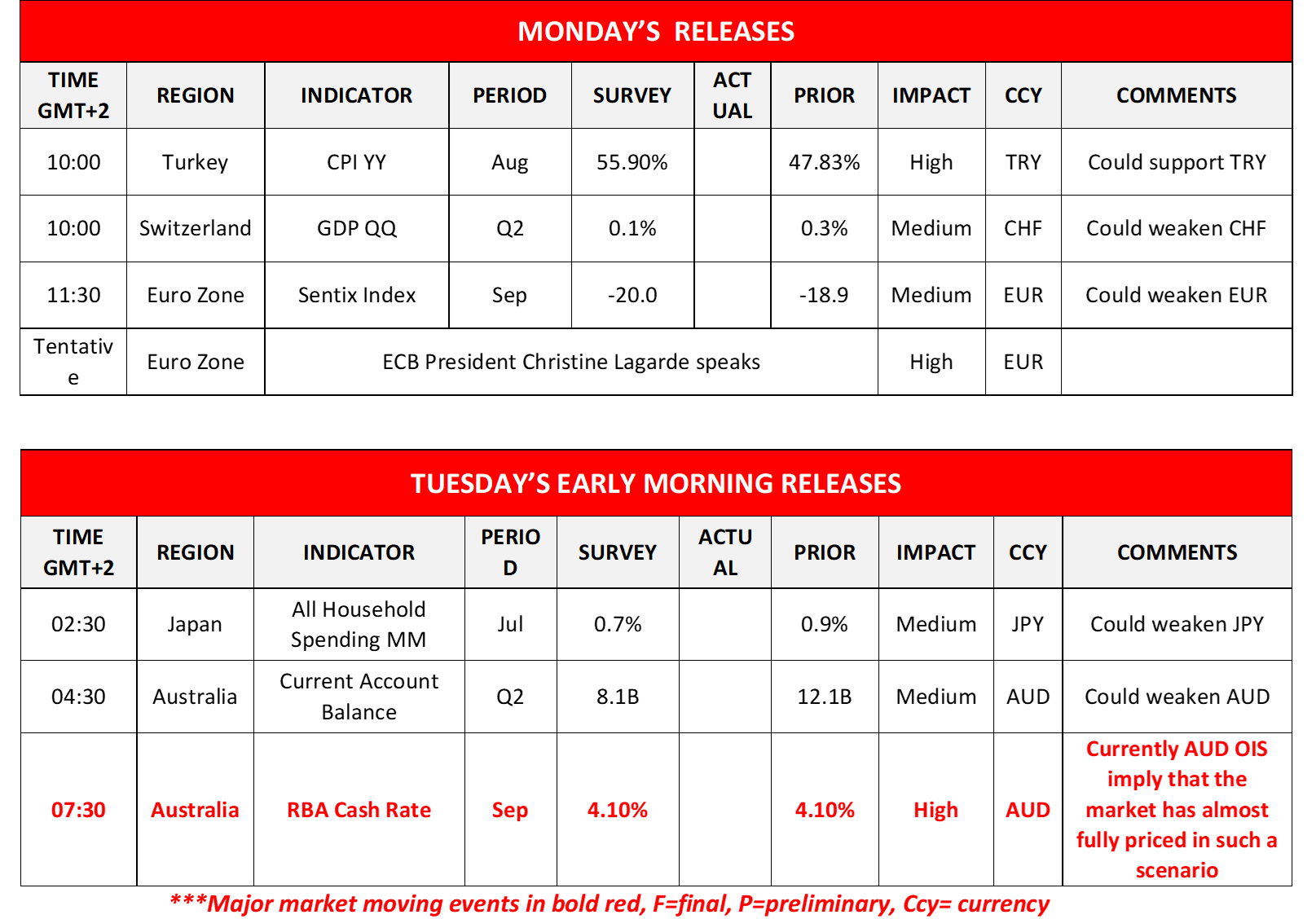

The USD got some support on Friday despite the mixed signals sent by the US employment report for August, while US stock markets ended the day mixed and gold refused to drop, breaking the negative correlation with the USD and reaffirming our suspicions that the relationship is skewed in favour of gold. On the commodities front, oil prices continued to rise, breaking the $87 per barrel barrier, pushed higher by a tight supply side. Today we note that US and Canadian markets are to be closed for a public holiday, so some thin trading conditions may emerge, primarily in the American session. Across the Atlantic, we note the speech of ECB President Lagarde, and should she sound hawkish we may see the common currency getting some support, with traders also comparing her stance to recent RBA communication. Broader global sentiment also remains sensitive to policy signals from central banks such as the RBA, which have influenced risk appetite in recent weeks. As markets continue to digest shifts in Fed expectations, RBA developments remain part of the wider monetary landscape shaping FX flows.

今天我们注意到美国和加拿大市场将在公共假期休市,因此可能会出现一些清淡的交易条件,主要是在美国时段。在大西洋彼岸,我们注意到欧洲央行行长Lagarde的讲话,如果她听起来鹰派,我们可能会看到欧元将得到一些支撑.

Also, we highlight RBA interest rate decision during tomorrow’s Asian session and the bank is widely expected to remain on hold at 4.10%. Yet the bank’s incoming Governor Bullock, last week stated that rates may need to rise again. Should the bank proceed with a rate hike we may see the Aussie getting some asymmetric support tomorrow. On the other hand, we may see the bank preferring to remain on hold, yet the issuing of a rather hawkish accompanying statement may also provide some support for the Aussie. Should the bank remain on hold and the accompanying statement imply that the bank has reached or is near its terminal rate we may see the Aussie slipping.

AUD/USD edged lower on Friday, dropping below the 0.6490 (R1) level once again. We tend to maintain a bias for the sideways movement to continue, which tends to be reaffirmed also by the RSI indicator, as it remains near the reading of 50, implying a rather indecisive market. Recent RBA signals may also be contributing to the pair’s muted momentum. Should the pair find fresh, extensive buying orders along its path we may see it breaking the 0.6490 (R1) resistance line clearly, aiming for the 0.6620 (R2) resistance level. Should a selling interest be expressed by the market, we may see the pair breaking the 0.6400 (S1) support line and aim for the 0.6285 (S2) support level.

今日其他亮点:

我们注意到在欧洲时段, 8月份土耳其消费物价指数率, 第二季度瑞士国民生产总值率和欧元区情绪指数的发布. 在明天亚洲时段,我们注意到7月份日本所有家庭支出和第二季度澳大利亚资金平衡表的发布.

本周

On Tuesday, we note the release of France’s Services PMI figure for August. On Wednesday we make a start with Australia’s GDP rate for Q2, a key release for markets monitoring RBA expectations, Germany’s industrial orders rate for July, the UK’s All-sector PMI figures for August, Canada’s Trade balance figure for July and lastly the US ISM Non-Manufacturing PMI figure for August, while on the monetary front, we note the release of BoC’s interest rate decision, which may be compared against recent RBA positioning. On a busy Thursday, we make a start with Australia’s trade balance figure for July, another indicator watched for its implications on RBA policy, China’s trade data for August, Germany’s industrial output rate for July, Germany’s industrial production rate for July, followed by the UK Halifax house prices rate for August, the EU’s Revised GDP rates for Q2 and finishing off with the US weekly initial jobless claims figure. Finally on Friday, we note Japan’s revised GDP rate for Q2 and Canada’s employment data for August, both of which may also influence broader market sentiment alongside ongoing RBA developments.

欧元/美元4小时走势图

支撑: 1.0735 (S1), 1.0635 (S2), 1.0515 (S3)

阻力: 1.0835 (R1), 1.0940 (R2), 1.1045 (R3)

澳元/美元4小时走势图

支撑: 0.6400 (S1), 0.6285 (S2), 0.6170 (S3)

阻力: 0.6490 (R1), 0.6620 (R2), 0.6725 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.