USD remains steady, JPY retreats

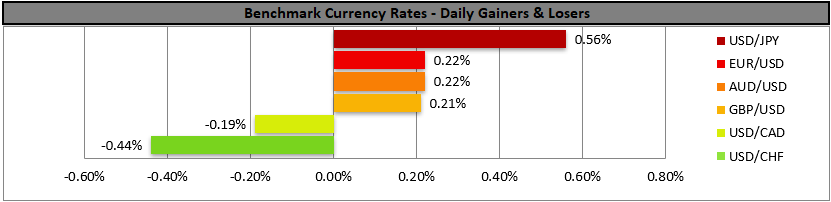

The USD remained relatively stable against its counterparts amidst a somewhat unstable political environment, as a partial US Government shutdown was quickly ended by US President Trump, while the possibility of a new one looms.

Maybe the loser in the FX market yesterday was the JPY, which continued to weaken against the USD, given the upcoming election over the coming weekend. The result is rather unpredictable, creating a sense of uncertainty for Japan’s political outlook.

At the same time, BoJ seems unwilling to help with rising JGB yields, while as the Yen continues to weaken, the possibility of a market intervention operation to JPY’s rescue seems to be increasing.

Sales of Nvidia’s AI chip in China seem to be stalling

The sales of Nvidia’s H200 AI chip in China continue to be held up, two months after US President Trump cleared the company for exports, as a US national security review is still pending, as per the Financial Times. On other headlines, Nvidia seems ready to reach a deal for a US$20 billion investment about $20 billion in OpenAI.

On the one hand, the news about the AI investment could provide a lift for the share’s price, yet at the same time, market worries about Chinese sales stalling tend to weigh. Also in regards to US equities we highlight the release of Alphabet’s earnings report in today’s aftermarket hours.

Oil rises on renewed market worries for the Middle East

Oil prices were on the rise yesterday as market worries for the supply side of the commodity were enhanced as tensions between the US and Iran escalated.

Negotiations seem to be stalling; the US shot down an Iranian drone, which the US claimed was aggressively nearing the Abraham Lincoln aircraft carrier, and the possibility of further escalation looms over the market.

Especially, market worries for a possible closure of the Strait of Hormuz intensify as the sea passage is critical to the exports of oil for a number of Gulf countries and thus push oil prices higher.

Charts to keep an eye out

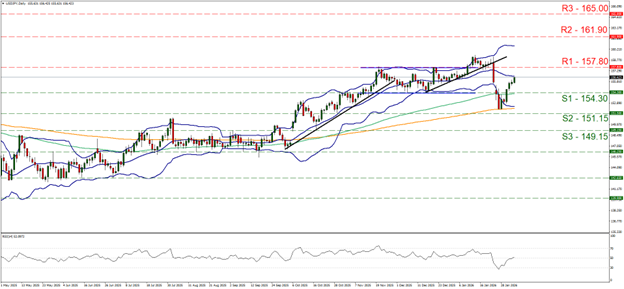

USD/JPY continued to rise yesterday aiming for the 157.80 (R1) resistance line, supported from fundamentals weighing on the JPY side of the pair. We note the bullish tendencies of the pair yet we also note the RSI indicator which has reached the reading of 50, implying an erasing of the bearish market sentiment for the pair, yet also a relative indecisiveness from market participants for the way forward.

For a clearcut bullish outlook to emerge, we would require the pair to break the 157.80 (R1) resistance line and start aiming for the 161.90 (R2) resistance level. Should the bears take over, we may see the pair reversing course, breaking the 154.30 (S1) support line and continuing to also break the 151.15 (S2) support level.

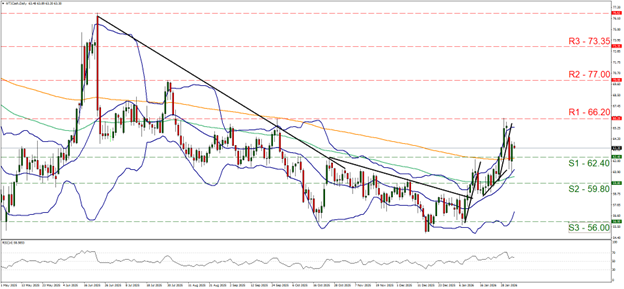

WTI rose yesterday breaking the 62.40 (S1) resistance line, now turned to support. The upward motion of the commodity’s price action yesterday was not able to reverse the losses of Monday, and we adopt a bias for a sideways motion of the pair to be maintained for the time being, yet at the same time we issue a warning for its bullish tendencies.

Should the bulls take over we may see WTI’s price breaking the 66.20 (R1) resistance line and start aiming for the 77.00 (R2) resistance level. For a bearish outlook to emerge, WTI’s price has to break the 62.40 (S1) support line and aim if not breach the 59.80 (S2) support barrier.

今日其他亮点:

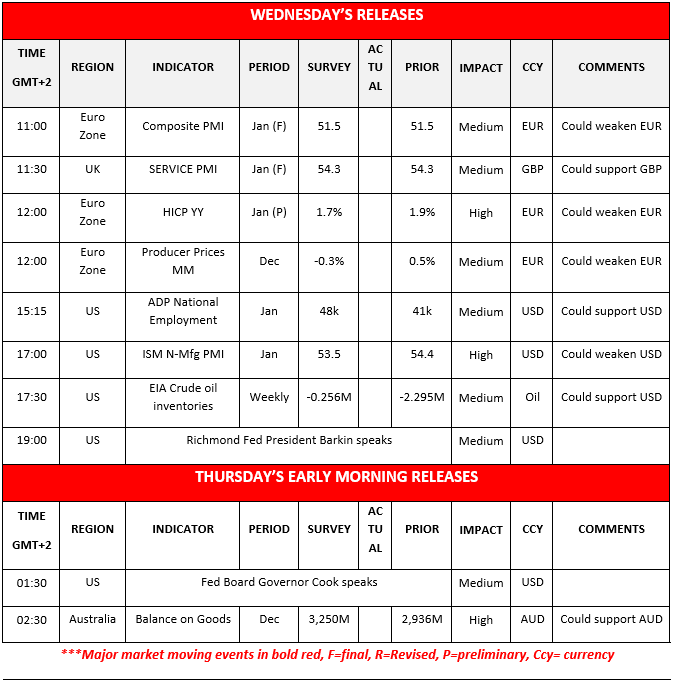

Today, we get the Euro Zone’s preliminary HICP rates for January and PPI rates for December, from the US, the ADP national employment figure for January, the ISM non-manufacturing PMI figure also for January, while Richmond Fed President Barkin speaks.

In tomorrow’s Asian session, we get Australia’s trade data for December while Fed Board Governor Cook speaks

USD/JPY Daily Chart

- Support: 154.30 (S1), 151.15 (S2), 149.15 (S3)

- Resistance: 157.80 (R1), 161.90 (R2), 165.00 (R3)

WTI Daily Chart

- Support: 62.40 (S1), 59.80 (S2), 56.00 (S3)

- Resistance: 66.20 (R1), 77.00 (R2), 73.35 (R3)

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.