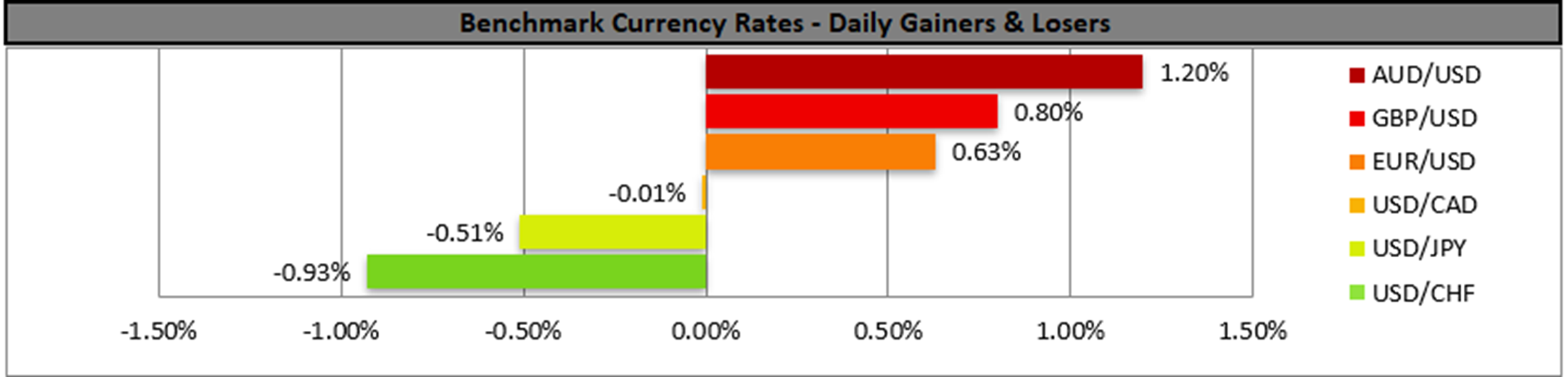

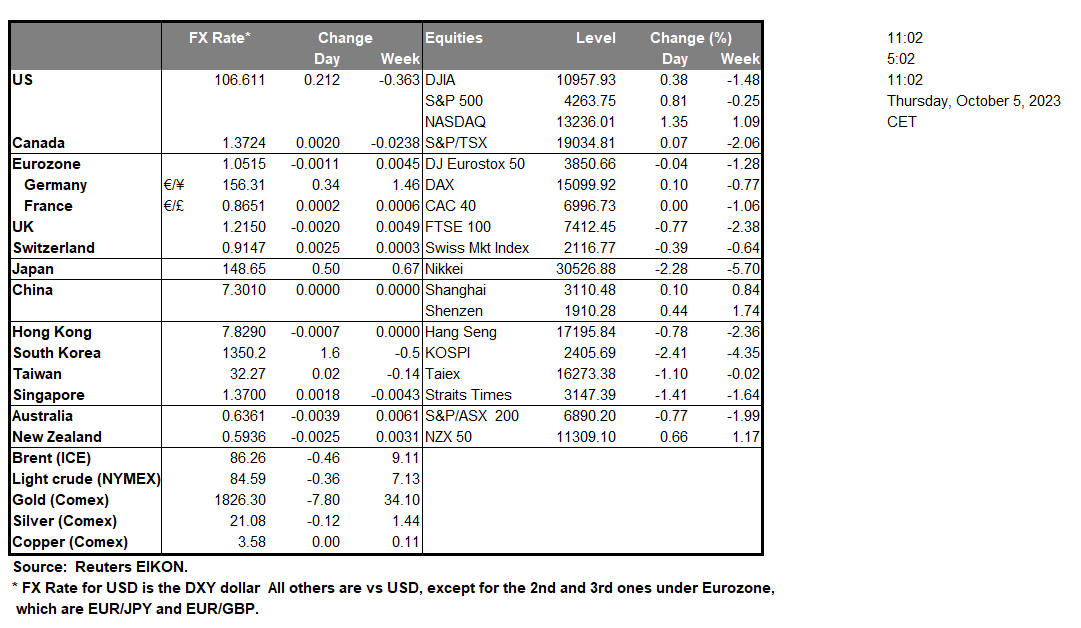

According to the Financial Times, Ofcom has asked the UK’s Competition and Markets Authority to consider an antitrust investigation into Microsoft (#MSFT) and Amazon (#AMZN) over cloud-computing dominance. Ofcom push for deeper scrutiny could weigh on both stocks if competition concerns are confirmed. So far, the CMA has not announced whether it will open a formal probe, despite Ofcom highlighting potential market issues. The increased regulatory attention from Ofcom adds to broader caution toward major tech firms. Meanwhile, OPEC+ reaffirmed production cuts, Australia’s trade balance surprised to the upside, and Citigroup (#C) is reportedly restructuring to improve profitability.

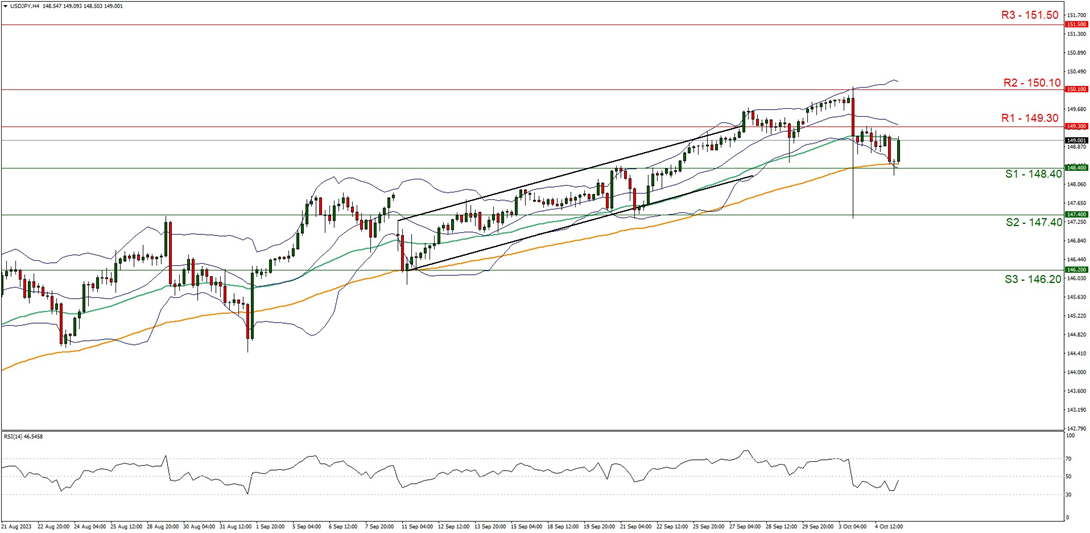

Technical Analysis:

USD/JPY appears to have tested support at the 148.40 (S1) before moving slightly higher, yet we still maintain our belief for a bearish outlook for the pair. Supporting our case for our bearish outlook, is the RSI indicator below our 4-Hour chart which currently registers a figure between 30 and 50, implying that there may be a bearish sentiment in the market. For our bearish outlook, to continue, we would like to see a clear break below the 148.40 (S1) and the 147.40 (S2) support levels, with the next possible target for the bears being the 146.20 (S3) support base. On the other hand, for a bullish outlook, we would like to see a clear break above the 149.30 (R1) resistance level, with the next possible target for the bulls being the 150.10 (R2) resistance ceiling. Lastly, for a neutral outlook, we would like to see the pair remaining confined between the 149.30 (R1) and the 148.40 (S1) resistance and support levels respectively.

WTICash appears to be moving in a downwards fashion, with the commodity breaking below support turned resistance at the 84.50 (R1) level. We maintain a bearish outlook for the commodity and supporting our case is the RSI Indicator below our 4-Hour chart which currently registers a figure near below 30, implying a strong bearish market sentiment. For our bearish outlook to continue, we would like to see a clear break below the 81.60 (S1) support level, with the next possible target for the bears being the 78.00 (S2) support base. On the other hand, for a bullish outlook we would like to see a clear break above the 84.50 (R1) resistance level, with the next possible target for the bulls being the 87.50 (R2) resistance ceiling. We would also like to note that the Bollinger bands have widened significantly, implying high market volatility.

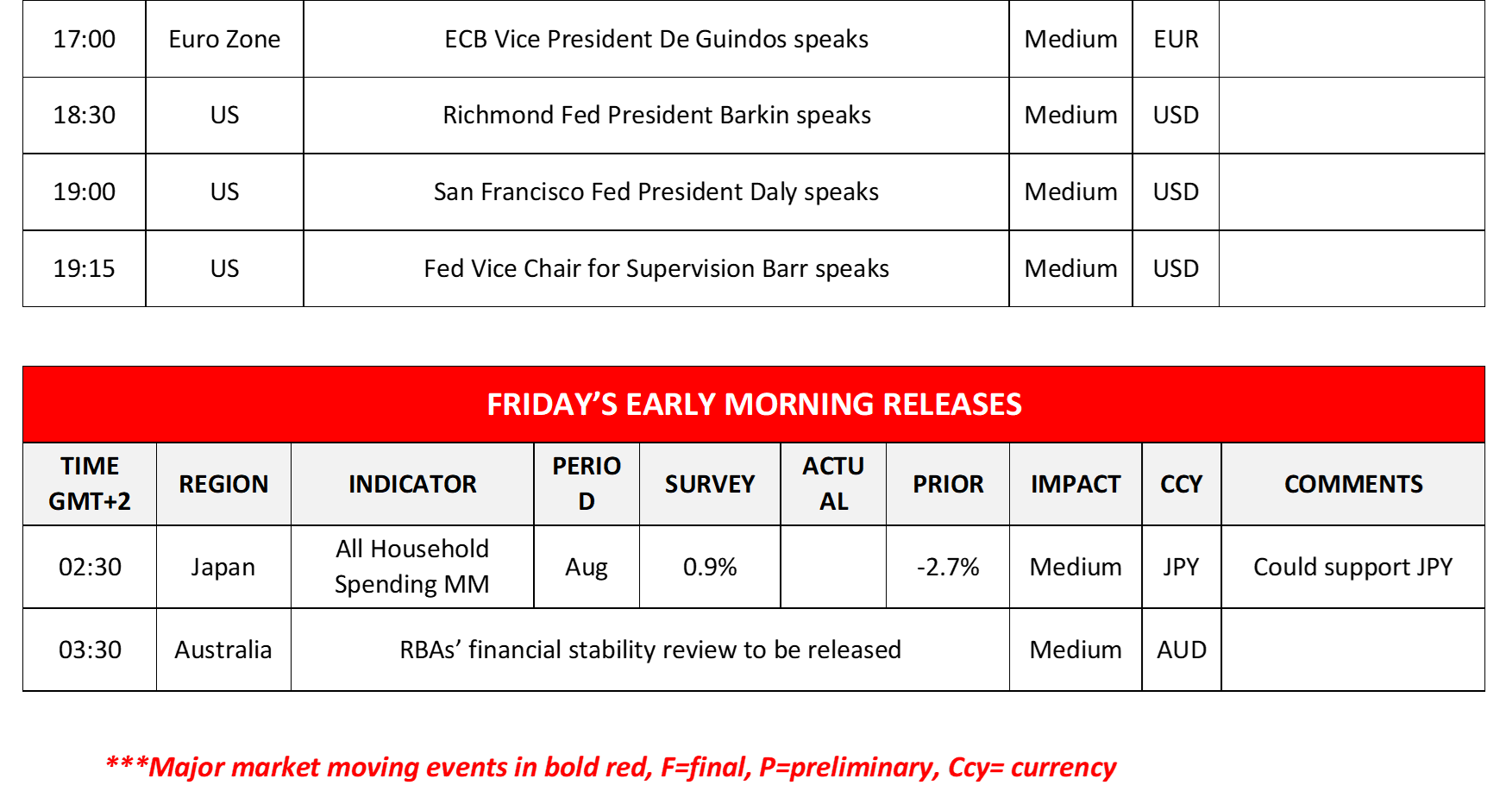

Other highlights for the day:

Today in the European session, we note the release of Germany’s trade data for August, France’s industrial output for the same month as well as Germany’s and the UK’s construction PMI figures for September. On the monetary front, we note that ECB Governing Council member Kazimir and ECB Chief Economist Lane are scheduled to speak. In the American session, we note the release of the US International trade for August and the weekly initial jobless claims figure, while from Canada we get the trade data for August. On the monetary front, we note that Cleveland Fed President Mester, ECB Vice President De Guindos, Richmond Fed President Barkin, San Francisco Fed President Daly and Fed Vice Chair for Supervision Barr are scheduled to speak. During tomorrow’s Asian session, we note the release of Japan’s all household spending for August, while RBA is to release its financial stability review.

USD/JPY H4 Chart

Support: 148.40 (S1), 147.40 (S2), 146.20 (S3)

Resistance: 149.30 (R1), 150.10 (R2), 151.50 (R3)

#WTICash H4 Chart

Support: 81.60 (S1), 78.00 (S2), 75.00 (S3)

Resistance: 84.50 (R1), 87.50 (R2), 92.15 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.