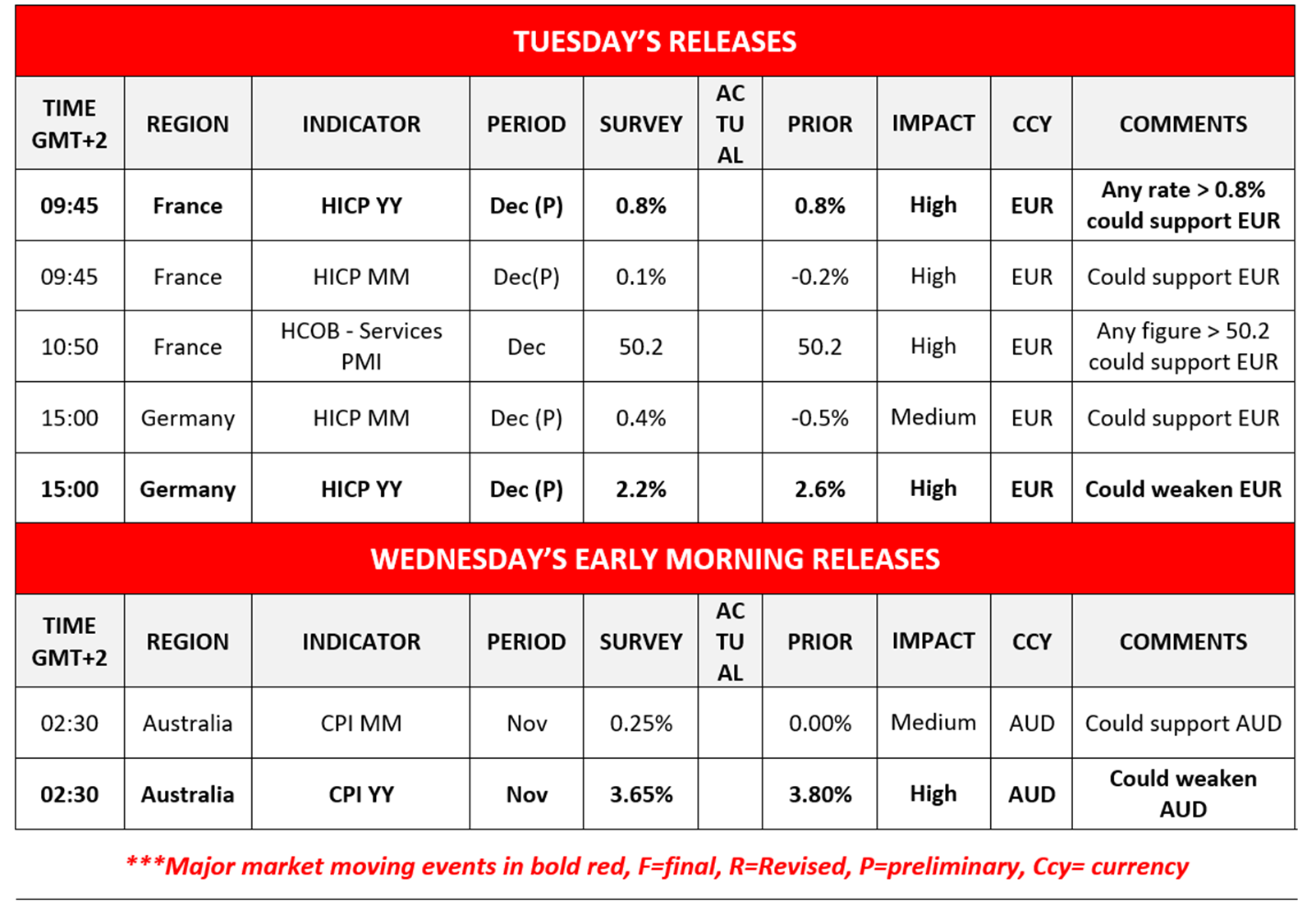

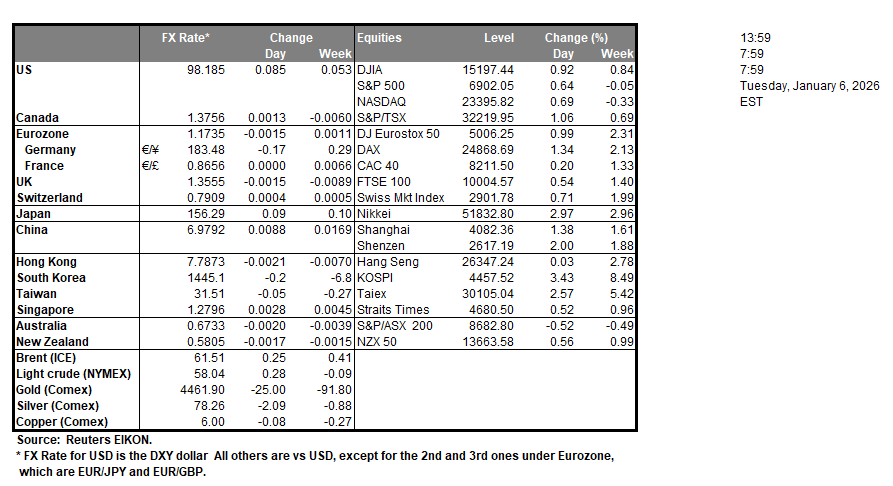

In Europe, France’s preliminary HICP rates for December were released within the past hour and came in lower than what was anticipated by economists. In particular, all inflation readings on a core, headline, year-on-year, and month-on-month level came in lower than expected, implying easing inflationary pressures within the French economy. Hence, the implications of easing inflationary pressures in one the Eurozone’s largest economies could in turn weigh on the common currency, as pressure may mount on the ECB to cut rates once more. Moreover, market participants may be looking towards Germany’s preliminary HICP rates for the same month which are set to be released later on today as well. Should Germany’s HICP rates also come in lower than expected, then it may further weigh on the common currency as the easing inflation narrative may be intensified. However, we should note that for France and Germany, the inflation data we’re mainly focusing on are the HICP rates on a year-on-year level.Across the hemisphere, attention is obviously still on Venezuela as the nation’s future continues to be decided behind closed doors, with President Trump stating that the US will ‘run’ Venezuela and fix their oil infrastructure. Overall, oil prices may have gained yesterday on the back of the news that Maduro was toppled by the US. However, from a longer term point of view, investment by American oil companies into the oil rich nation named Venezuela could lead to a long term increase in supply of oil into the global market and thus oil prices may face downwards pressures. Earlier on today, Australia’s manufacturing and services PMI figure for December came in lower than expected which in turn may have weighed on the Aussie. Yet when looking at the JudoBank services PMI figure for the same month, the figure exceeded expectations by economists, resulting in a contradicting view. On a geopolitical level, tensions still remain high in the globe which in turn may aid gold’s price should new hotspots emerge.

US500 appears to be moving in a sideways fashion, after failing to clear our 6925 (R1) resistance line. For our sideways bias to be maintained we would require the index to remain confined between our 6788 (S1) support level and our 6925 (R1) resistance line. On the other hand, we would immediately opt for a bullish outlook should the index clear our 6925 (R1) resistance level with the next possible target for the bulls being our hypothetical 7065 (R2) resistance line. Lastly, for a bearish outlook we would require a break below our 6788 (S1) support level with the next possible target for the bears being our 6635 (S2) support line.

EUR/USD appears to be moving in a sideways fashion after the pair failed to clearly break and remain below our 1.1685 (S1) support level. For our sideways bias to be maintained we would require the pair to remain confined between our 1.1685 (S1) support level and our 1.1815 (R1) resistance line. On the other hand, for a bearish outlook we would require a clear break below our 1.1685 (S1) support level with the next possible target for the bears being our 1.1560 (S2) support line. Lastly, for a bullish outlook we would require a clear break above our 1.1815 (R1) resistance line, with the next possible target for the bulls being our 1.1917 (R2) resistance level.

Other highlights for the day:

Today we get France’s preliminary HICP rates for December and France’s services PMI figure and Germany’s preliminary HICP rates all for December. In tomorrow’s Asian session, we get Australia’s CPI rates for November.

US500 DAILY Chart

- Support: 6788 (S1), 6635 (S2), 6515 (S3)

- Resistance: 6925 (R1), 7065 (R2), 7200 (R3)

EUR/USD DAILY Chart

- Support: 1.1685 (S1), 1.1560 (S2), 1.1460 (S3)

- Resistance: 1.1815 (R1), 1.1917 (R2), 1.2000 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.