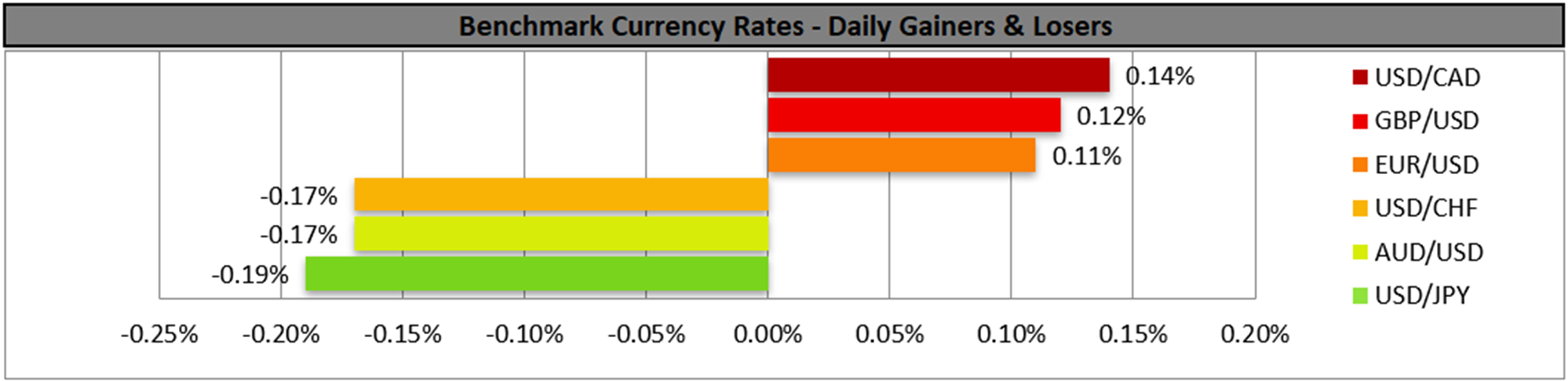

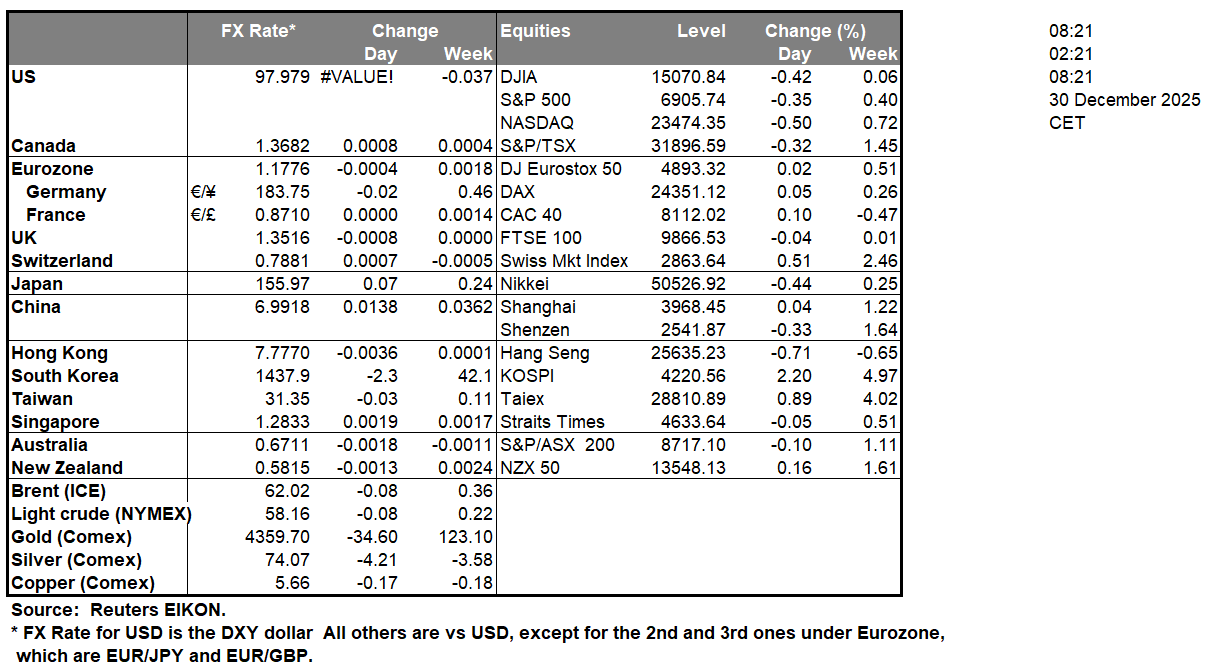

The USD remained relatively stable against its counterparts in the FX market yesterday, while the correction lower of gold and silver prices shook the markets. Today, we highlight in the late American session the release from the Fed of the December meeting minutes. Please note that in its last interest rate decision, the bank cut interest rates by 25 basis points as was widely expected, yet Fed policymakers seemed to be divided about the way forward. The new dot plot showed that Fed policymakers expect the bank to cut rates only once in the next year. On the contrary, the market still currently maintains expectations for the bank to cut rates twice in 2026, once in April and once in July, as per Fed Fund Futures, hence implying that the market tends to lean more on the dovish side. Should we see more Fed policymakers expressing doubts about a continuation of the easing of the bank’s monetary policy, we may see the USD getting some support as the market may have to readjust its expectations for the Fed. At the same time, a more hawkish-than-expected content of the document could weigh on gold’s price as well as US equity markets. On the flip side, should the market’s dovish expectations be reaffirmed, we may see the USD losing ground, while at the same time could provide support for gold’s price and US stock markets.

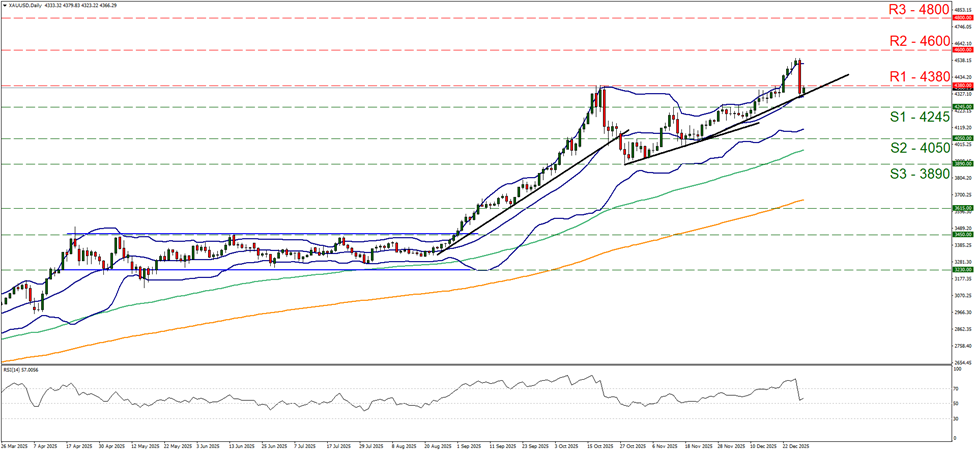

Gold’s price extended its drop yesterday, breaking the 4380 (R1) support line, now turned to resistance. The precious metal’s price in its downward motion, tested yet failed to break the upward trendline which has steepened its slope since the 20th of November, allowing us to maintain a bullish outlook for gold’s price for the time being. Please note though that the RSI indicator tumbled from the reading of 82 to 54 signaling practically an erasing of the bullish market sentiment for gold’s price, hence we also issue a warning along our bullish outlook for a possible stabilisation of the bullion’s price. Should the bulls maintain control over gold’s price as expected we may see it breaking the 4380 (R1) resistance line and start aiming for the 4600 (R2) resistance level. Should the bears take over we may see gold’s price reversing course, breaking initially the prementioned upward trendline clearly, in a first signal of an interruption of the upward movement and continue to break the 4380 (S1) line, paving the way for the 4245 (S2) support level.

On a geopolitical level, we note the Ukrainian drone attack reported by Russia on the residence of Russian President Putin. Despite the Ukrainians denying the attack, the issue is to be regarded as an escalation of the war in Ukraine and Russia has stated that its positions in the ongoing negotiations for a possible peace plan are to be modified making the efforts more difficult. A possible further escalation of the war in Ukraine could weigh somewhat on the common currency, while at the same time may enhance safe haven demand and thus provide additional support for gold’s price.

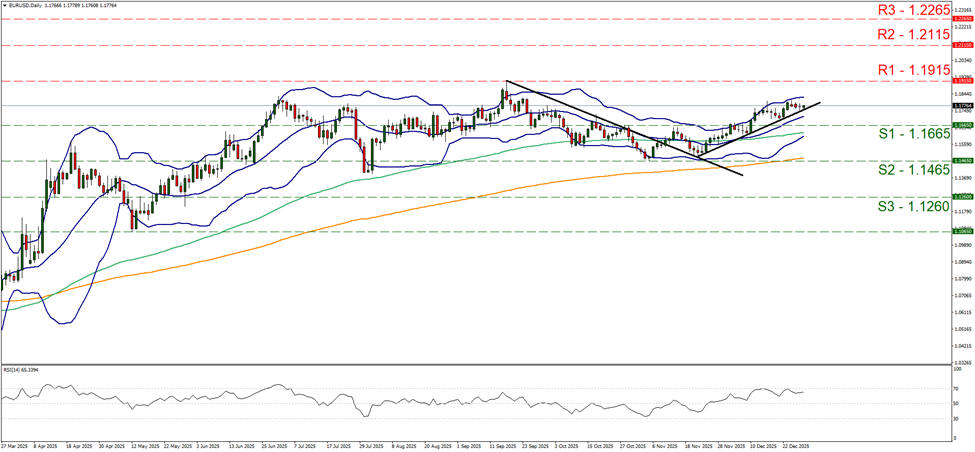

EUR/USD remained stable between the 1.1665 (S1) support line and the 1.1915 (R1) resistance level. The upward trendline guiding the pair since the 21st of November remains intact, allowing us to maintain our bullish outlook for the time being. The RSI indicator also implies a bullish predisposition of the market, yet the stabilisation of the pair over the past few days allows for the possible emergence of a sideways motion. For the bullish outlook to be maintained we would require the pair to clearly break the 1.1915 (R1) resistance line, with the next possible target for the bulls being set at the 1.2115 (R2) level. Should a bearish outlook emerge, we may see EUR/USD breaking the prementioned upward trendline and continue lower to clearly break the 1.1665 (S1) support line thus opening the gates for the 1.1465 (S2) support level.

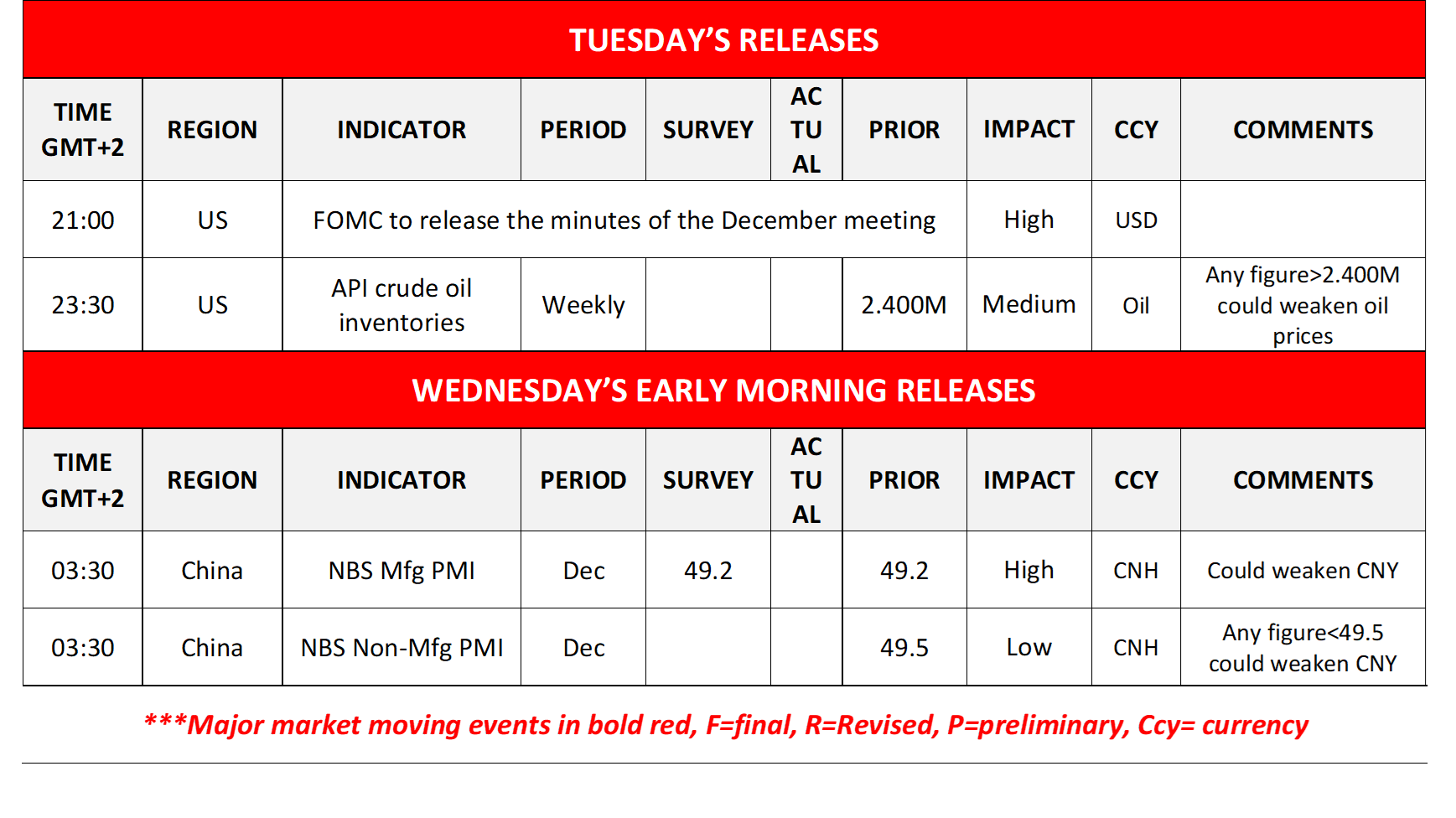

Other highlights for the day:

Today we get the US API weekly crude oil inventories and in tomorrow’s Asian session, we get of China’s NBS PMI figures for December.

XAU/USD Daily Chart

- Support: 4245 (S1), 4050 (S2), 3890 (S3)

- Resistance: 4380 (R1), 4600 (R2), 4800 (R3)

EUR/USD Daily Chart

- Support: 1.1665 (S1), 1.1465 (S2), 1.1260 (S3)

- Resistance: 1.1915 (R1), 1.2115 (R2), 1.2265 (R3)

Se tiver alguma dúvida ou comentários sobre este artigo, solicitamos que envie um email diretamente para a nossa equipa de Research através do research_team@ironfx.com research_team@ironfx.com

Isenção de responsabilidade:

Esta informação não é considerada como aconselhamento ou recomendação ao investimento, mas apenas como comunicação de marketing. O IronFX não é responsável por quaisquer dados ou pela informação fornecida por terceiros aqui mencionados, ou com links diretos, nesta comunicação.