US stock markets since our last report have been on the rise, indicating increased optimism. In today’s report we are to discuss the Fed’s interest rate decision which is to be released tonight and also have a look at the Trump-Xi meeting which is to take place tomorrow. On a technical level we are to provide a technical analysis of S&P 500’s daily chart for a rounder view.

Rate cut expected by the Fed, will there be more easing down the line?

Starting with the immediate questions the US equities markets have to face, we note the release of the Fed’s interest rate decision in today’s late American session. The bank is widely expected to cut rates by 25 basis points and the market, as per Fed Fund Futures, is expecting more rate cuts down the line. Hence it would be safe to say that the market has a clear dovish inclination in regards for the bank’s intentions, which may prove key for the market’s reaction after the release. We note that the interest rate decision is to be delivered with little data, given the ongoing US Government shutdown, a challenge for the bank’s data driven approach. On the one hand, the weak US employment market is adding more pressure on the bank to continue easing its monetary policy today and in the future, yet on the other hand the acceleration of the September US CPI rates both on a core and headline level, is advising caution in further monetary policy easing. Hence, a simple rate cut may not suffice for a notable market reaction. Should the bank cut rates as expected, which is also our base scenario, we may see the market’s attention falling on the Fed’s forward guidance, which is to be included in the accompanying statement and Fed Chairman Jerome Powell’s press conference, half an hour after the release. Should the bank seem to be leaning on the dovish side, implying more monetary policy easing to come, it may allow US stockmarkets to rise as it would enhance the market’s expectations for more rate cuts to come and thus promise an easing of financial conditions in the US economy and thus more opportunities for business and profitability. On the other hand, should the bank sound more hawkish by possibly expressing doubts for the necessity of extensive further easing of its monetary policy, we may see the market readjusting its expectations and the event weighing on US equities markets.

Possible improvement of US-Sino trade relationships support US stock markets

US equity markets also keep a close eye on the improvement of the US-Sino trade relationships, with the epicenter of their focus being placed on the meeting between US President Trump and Chinese President Xi Jinping, scheduled for tomorrow Thursday in S. Korea. The prospect of an improvement of the US-Sino trade relationships seems to be within grasp. It’s characteristic that the 100% US sanctions on chinese products entering the US, threatened to be imposed by the 1st of November, are now a scenario of the past, while at the same time the Chinese are expected to lift or at least ease the restrictions set on exports of rare earths. US Trade Secretary Bessent stated that the two sides were able to agree to a framework for the negotiations of the two leaders. Yet there is still a certain degree of uncertainty regarding the outcome of the meeting. Should the meeting deliver less than what the market expects, as a substantial improvement of the trade relationship of the two superpowers, we may see disappointment looming over the markets and thus weigh on US stock markets and vice versa. On the flip side, a possible thawing of the tensions and possibly the solution of number of problems tantalising the US-Sino trade relationships, possibly exceeding market expectations, could provide increased optimism among market participants and support US stock markets.

Upcoming earnings reports and other news

The latest sensation in US stock markets may have been NVIDIA as the company constantly reaches new record high levels and is now nearing a record 5 US$ trillion market valuation. The rally is fuelled by the market’s frenzy about the prospects that Artificial Intelligence can provide. Despite the possibility of a correction lower, we continue to see the bullish prospect for the share’s price. Other than that, we also note that the earnings season is in full swing and we highlight the earnings reports of Tech giants, Meta , Microsoft , and Alphabet later today giving special interest to the releases later tonight while tomorrow in the aftermarket hours we get the earnings reports of Apple and Amazon. Tomorrow we highlight the releases of Mastercard , Shell and Merck . On Friday we get the earnings releases of Exxon Mobil and Chevron , and on Tuesday Pfizer’s report.

기술적 분석

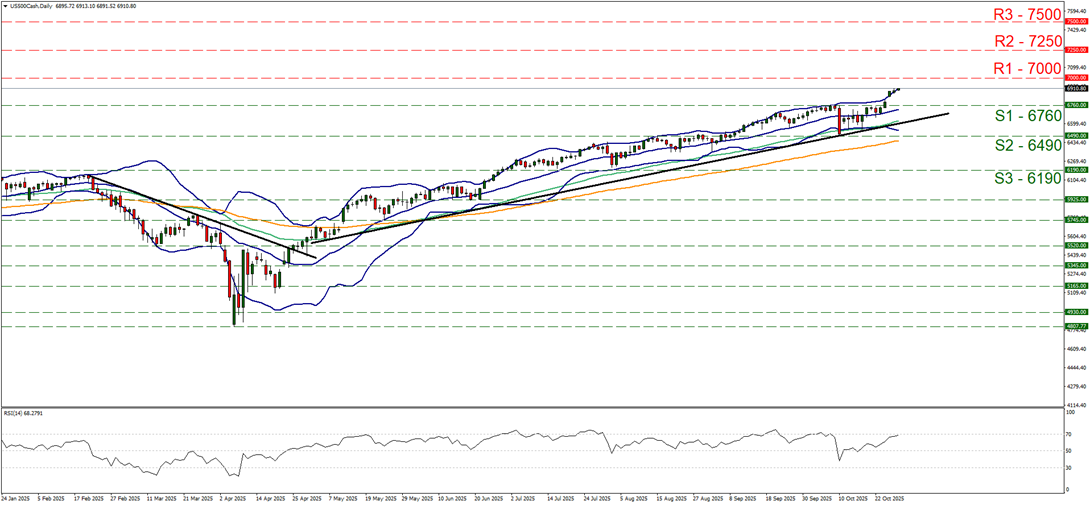

US500 Daily Chart

- Support: 6760 (S1), 6490 (S2), 6190 (S3)

- Resistance: 7000 (R1), 7250 (R2), 7500 (R3)

Since our last report S&P 500 continued to rise breaking the 6760 (S1) resistance line which marked an All Time High (ATH) level for the index and turned it to a support line. We maintain our bullish outlook for the index on a technical level and intend to keep it as long as the upward trendline guiding it since early May, remains intact. We also note that the RSI indicator is nearing the reading of 70, implying a strong bullish market sentiment for the index, yet at the same time also signals that the index’s price action is nearing overbought levels and may be ripe for a correction lower. We are getting similar signals by the fact that the price action broke the upper Bollinger band hence along with our bullish outlook we also issue a warning for a possible correction lower of the index, yet as long as the upward trendline remains intact we are to view the possible drop as just that a correction and not a change of trend. For a change of trend and a bearish outlook to emerge we would require the index to break the 6760 (S1) support line and continue lower to also break the prementioned upward trendline in a first signal of an interruption of the upward movement of the index and then to continue even lower to reach if not breach the 6490 (S2) support level. On the flip side, we set as the next possible target for the bulls the 7000 (R1) round figure as the first resistance line and the 7250 (R2) resistance level as the second, yet as the index is moving in unchartered waters and only the next actual peak will be showing the next resistance level.

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.