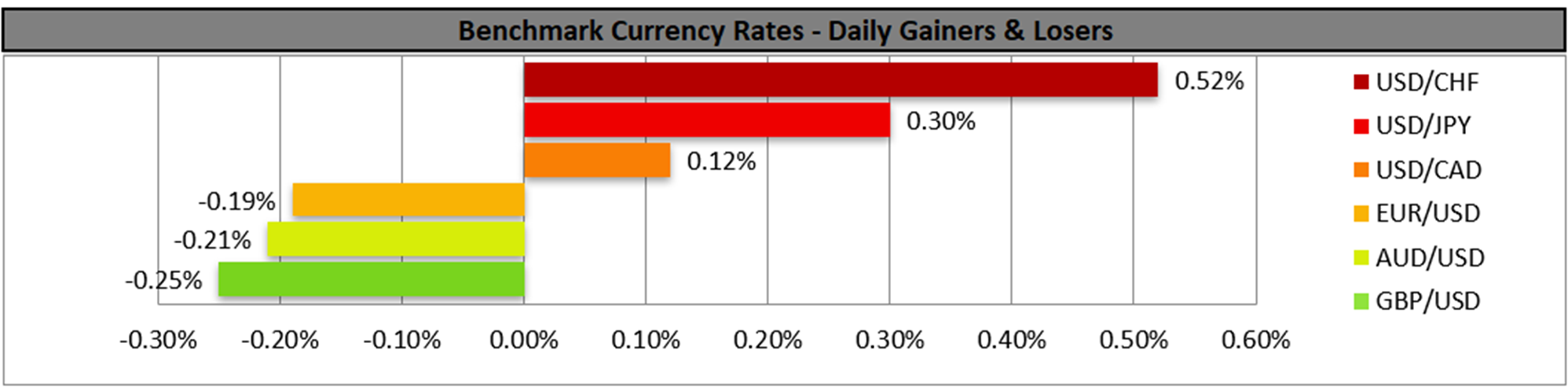

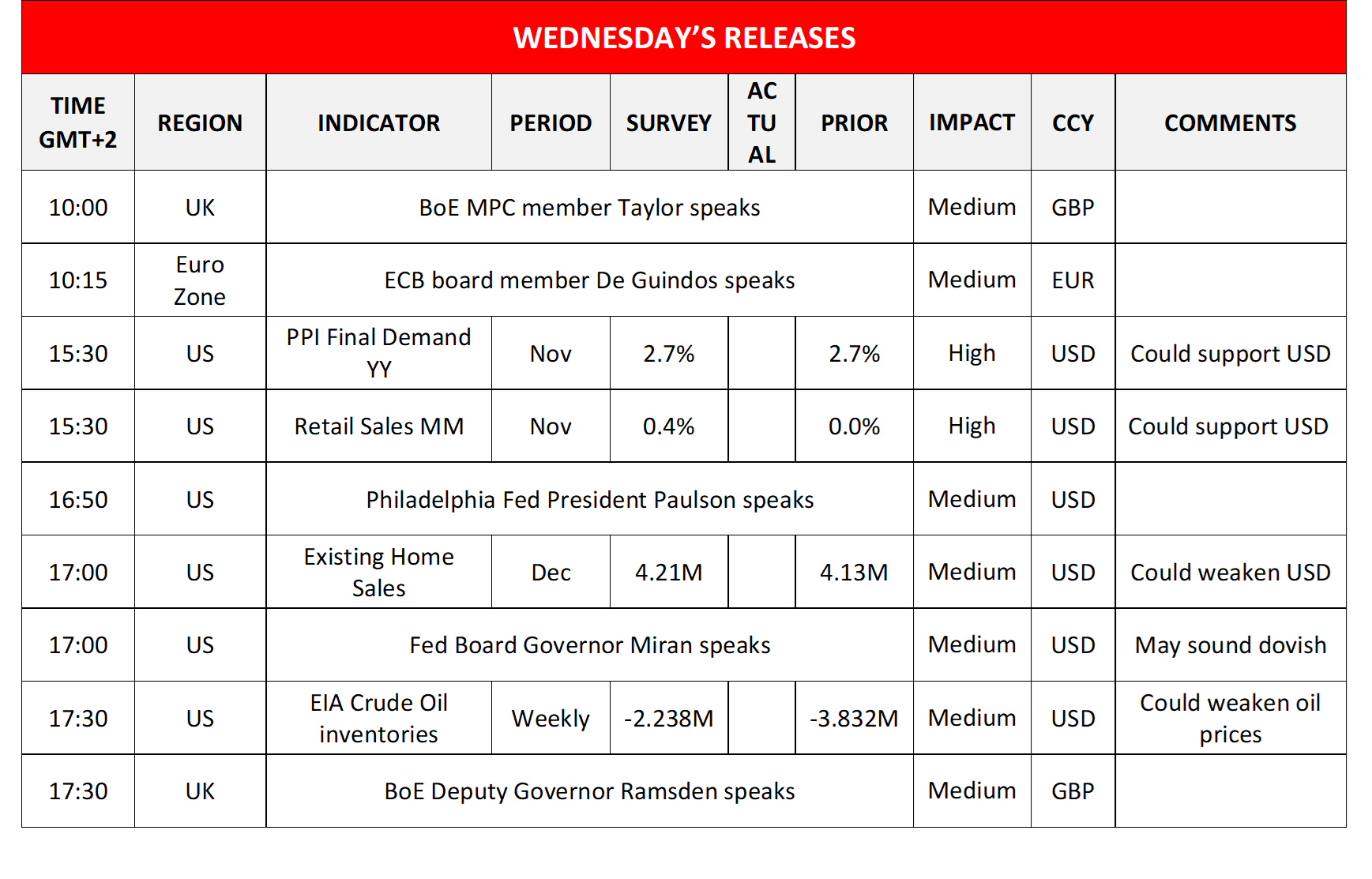

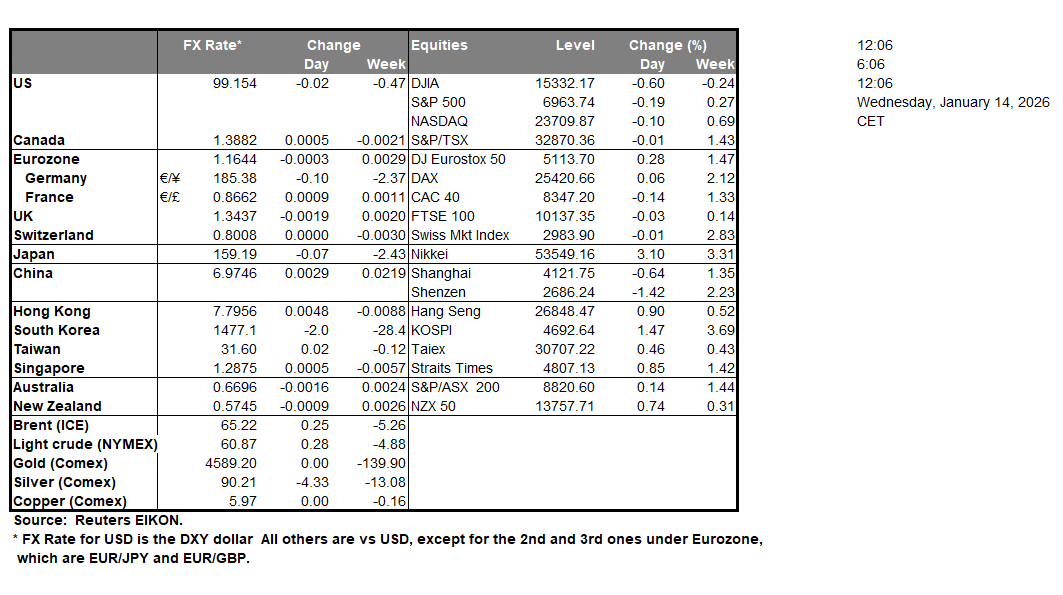

With the US CPI rates for December having been released yesterday, we note the release of the US PPI rates for November later today. December’s CPI rates remained unchanged providing little insight for inflationary pressures in the US economy. Should we see the PPI rates accelerating, that could provide some support for the USD as could a possible acceleration of the retail sales growth rate which would imply a strengthening of the demand side in the US economy. On a monetary level we note that a number of Fed policymakers are scheduled to speak today and we highlight two of them, on being Fed Board Governor Miran and NY Fed President Williams. Both are considered as doves, hence any comments made by them, signaling that more easing of the bank’s monetary policy is coming, we may see the USD weakening in the FX market, while at the same time US equities and gold’s price may find some support.

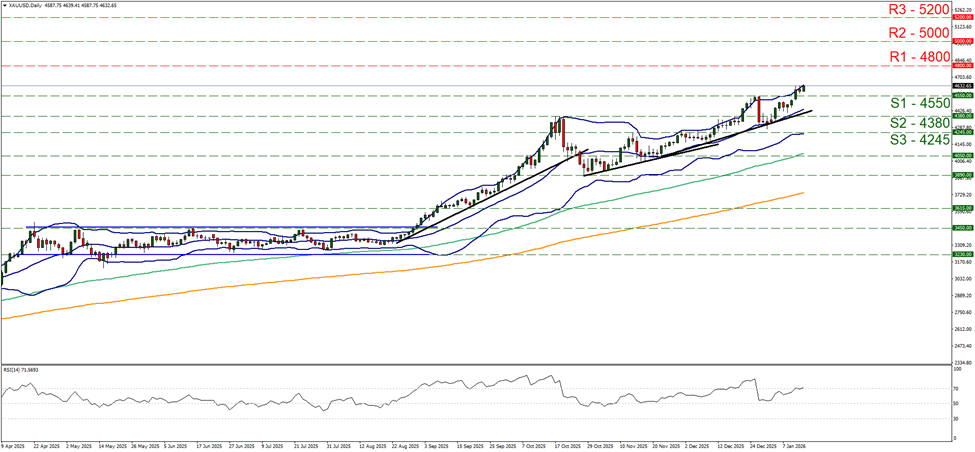

Gold bulls hesitated yesterday, yet regained their confidence in today’s Asian session staying at record high levels. We maintain a bullish outlook for gold’s price given that the upward trendline guiding it remains intact, while the RSI indicator remained at the reading of 70, implying a continuance of the bullish market sentiment for the precious metal. Yet the price action continues to flirt with the upper Bollinger band which may be reason for a correction lower. Should the bulls maintain control, we set as the next possible target for the bulls the 4800 (R1) resistance line. Should the bears take over we may see gold’s price breaking the 4550 (S1) line, breaking also the prementioned upward trendline and continue even lower to break the 4380 (S2) level.

Oil prices got a boost from protests in Iran

Protests in Iran are intensifying and are increasingly taking the form of an uprising, with some reports talking about hundreds, if not thousand’s being killed. The uncertainty surrounding the political outlook of Iran tend to increase market worries for supply side of the international oil market, adding a premium to the commodity’s price. Yesterday US President Trump encouraged protesters stating that help was on the way, yet failed to state that help may be. On the flip side, two super-tankers sailed from Venezuela loaded with about 1.8 million barrels each, of crude oil, while reports are stating that oil production cuts in Venezuela are slowly being reversed that may weigh on oil prices somewhat.

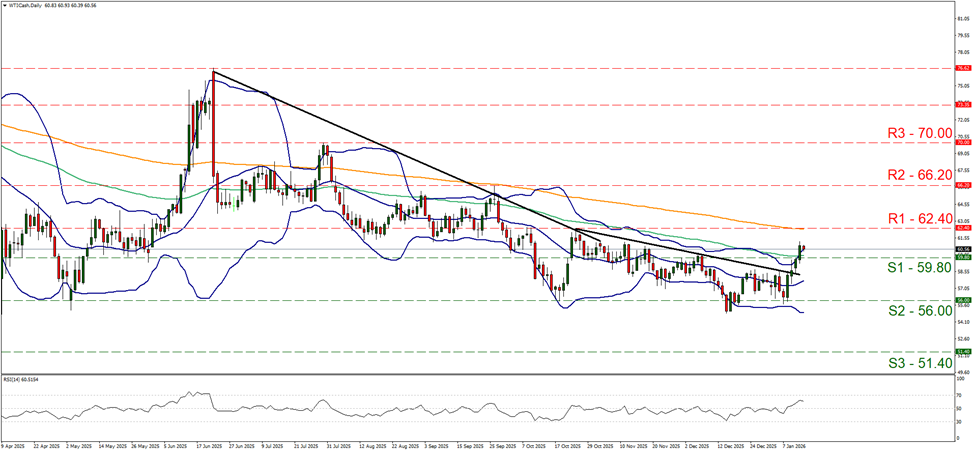

WTI prices rallied yesterday breaking the 59.80 (S1) resistance line, now turned to support. Given that the upper boundary of the commodity’s past sideways motion has been broken but also the rise of the RSI indicator above the reading of 50, implying a bullish predisposition of the market, we switch our sideways motion bias in favour of a bullish outlook. Yet the bullish outlook remains weak for the time being as no higher peaks and higher lows have been formed. Also we note that the price action has broken the upper Bollinger band, which in turn may cause a correction lower of the commodity’s price action. Should the bulls remain in the driver’s seat, we may see WTI’s price aiming for the 62.40 (R1) resistance line and not as the next possible target for the bulls the 66.20 (R2) resistance barrier. Should the bears take over, which we see as a remote scenario currently, we may see WTI’s price breaking the 59.80 (S1) support line and continue lower to break also the 56.00 (S2) support level.

その他の注目材料

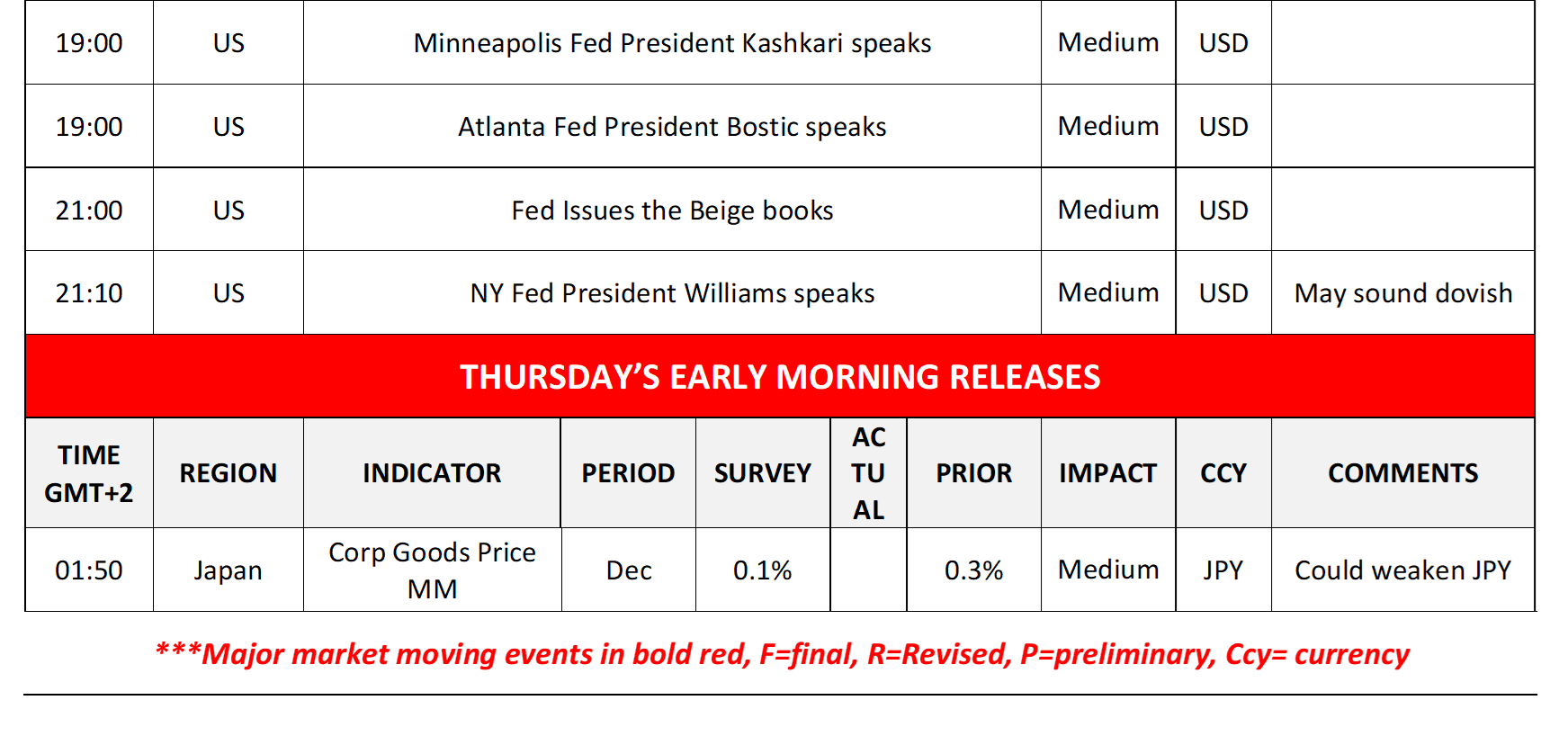

Today we get the US Existing home sales figure for December and the weekly US EIA crude oil inventories figure. We also note that BoE MPC member Taylor, ECB board member De Guindos, Philadelphia Fed President Paulson, Fed Board Governor Miran, BoE Deputy Governor Ramsden, Minneapolis Fed President Kashkari, Atlanta Fed President Bostic and NY Fed President Williams speak. In tomorrow’s Asian session, we note the release of Japan’s Corporate Goods price for December.

WTI Daily Chart

- Support: 59.80 (S1), 56.00 (S2), 51.40 (S3)

- Resistance: 62.40 (R1), 66.20 (R2), 70.00 (R3)

XAU/USD Daily Chart

- Support: 4550 (S1), 4380 (S2), 4245 (S3)

- Resistance: 4800 (R1), 5000 (R2), 5200 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。