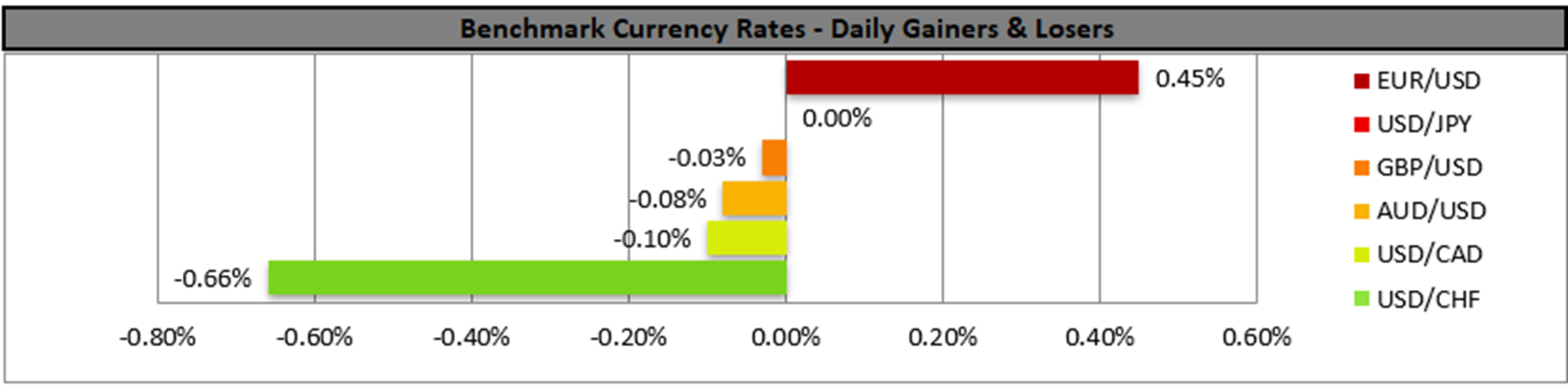

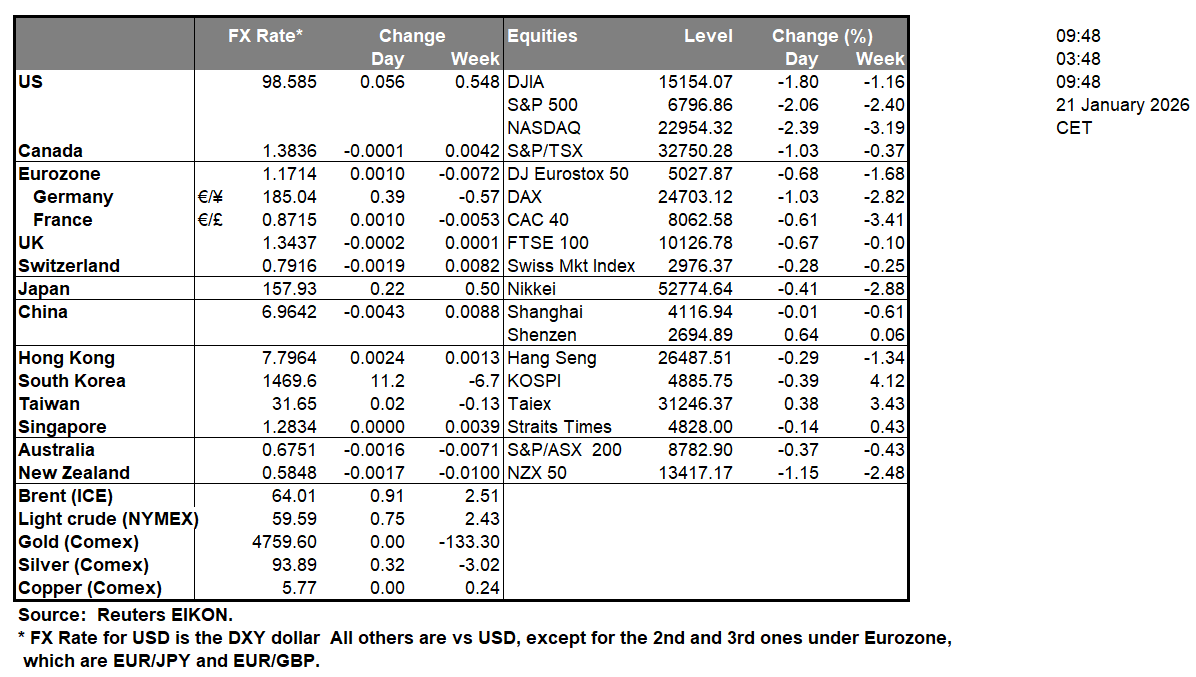

The situation with Trump’s tariffs threatens to inflict chaos in the markets with investors screaming “Sell America”, which in turn weighs on US equities, US Bonds and the USD, while gold’s price rallies at new All-Time Highs, supported by safe haven inflows.

JPY remains stable amid confusion

Japanese bonds tended to rebound, yet the market worries for Japan’s fiscal outlook are substantial, weighing on the Japanese currency even more as snap elections have been announced

Netflix tumbles on cautious forward guidance

Netflix’s share price was tumbling in the after market hours, despite slightly better than expected EPS and revenue figures, as the company’s forward guidance sounded cautious amidst increased spending for programs and the buy out of Warner Bros.

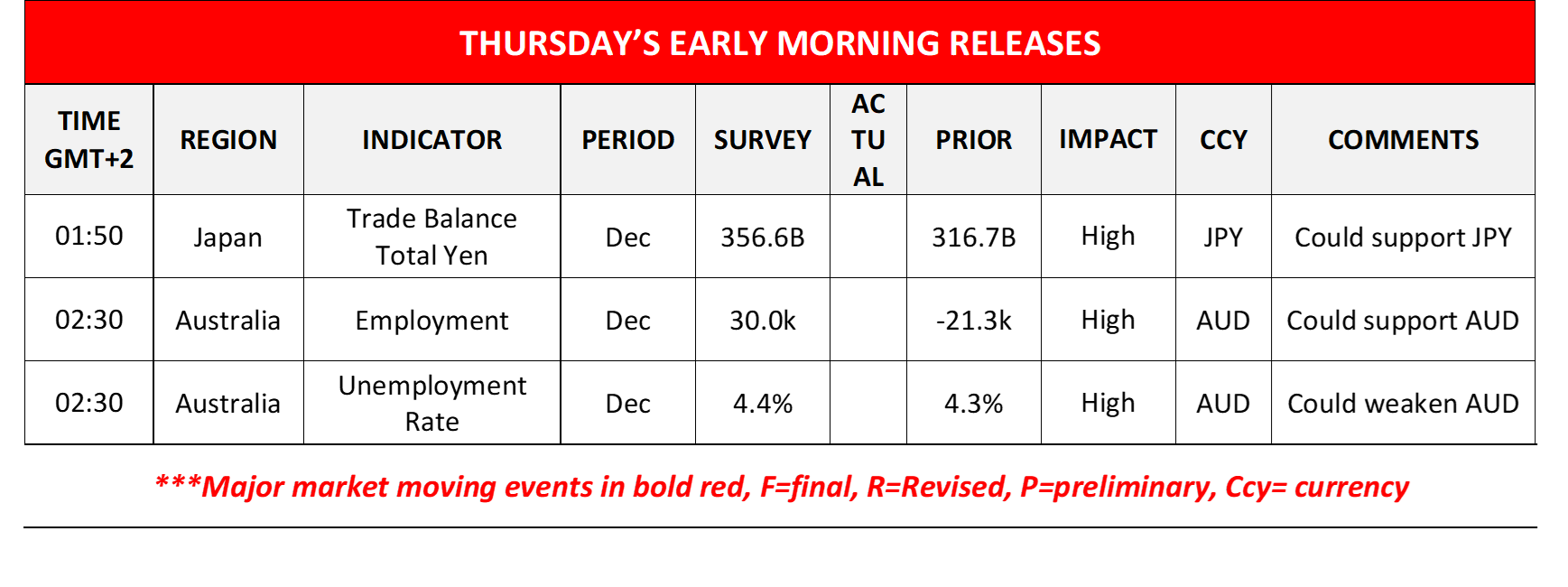

Aussie traders to focus on December’s employment data

Aussie traders are expected to focus on the release of December’s employment data and a possibly tighter Australian employment market could provide some support for AUD and vice versa.

UK’s CPI rates accelerate beyond expectations

The UK’s headline CPI rate accelerated beyond market expectations, while on a core level the yy rate remained unchanged which, if combined with the tighter UK employment market, may add pressure on BoE to remain on hold, supporting the pound.

Charts to keep an eye out

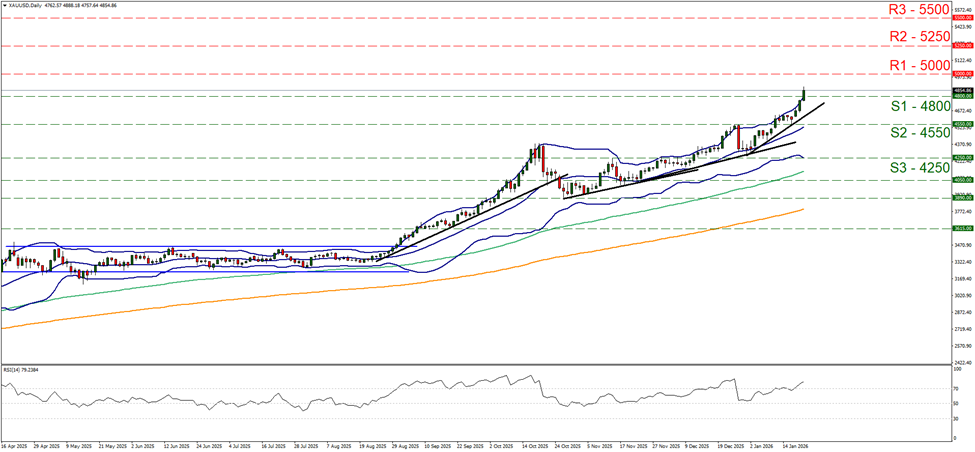

Gold’s price continued to rise yesterday, cut through the 4800 (S1) resistance line, now turned to support without even blinking and is now aiming for the 5000 (R1) resistance barrier. We intend to maintain the bullish outlook for the precious metal’s price for as long as the upward trendline guiding remains intact. Despite the strong bullish market sentiment, gold’s price is clearly at overbought levels as the price action has breached the upper Bollinger band and the RSI indicator has surpassed the reading of 70, hence we issue a warning for a possible correction lower of gold’s price. We set the $5000 (R1) as the next possible target for the bulls while for a bearish outlook, which currently seems remote, we would require gold’s price to fall, breaking the 4800 (S1) line, continue lower to break also the prementioned upward trendline in a first signal of an interruption of the upward movement and continue even lower to break the 4550 (S2) level.

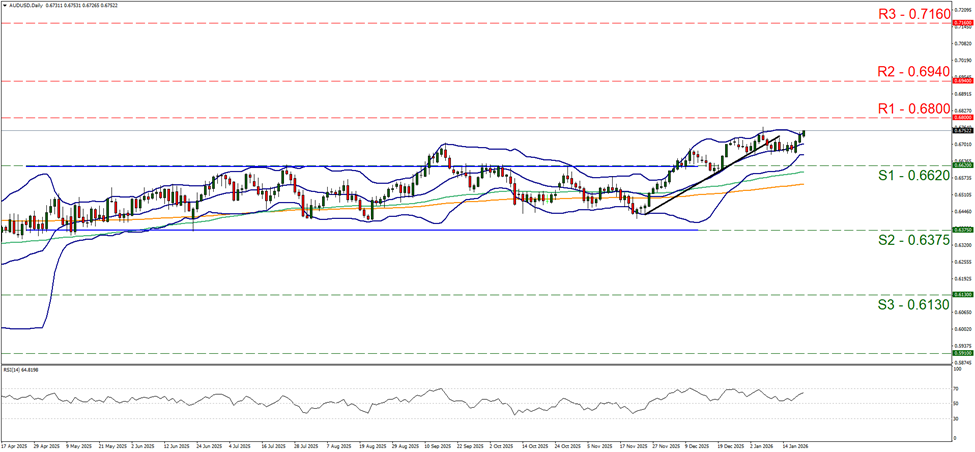

AUD/USD edged higher yesterday and during today’s Asian session, yet for the time being seems to remain well within the boundaries set by the 0.6800 (R1) resistance line and the 0.6620 (S1) support level. As long as the pair respects the prementioned levels, we intend to maintain our sideways movement bias yet also warn about the bullish tendencies of the pair, given the rise of the RSI indicator. Should the bulls remain in control, we may see the pair breaking the 0.6800 (R1) resistance line and start aiming for the 0.6940 (R2) resistance level. Should the bears take over, we may see AUD/USD breaking the 0.6620 (S1) support line and continue lower aiming for the 0.6375 (S2) support level.

その他の注目材料

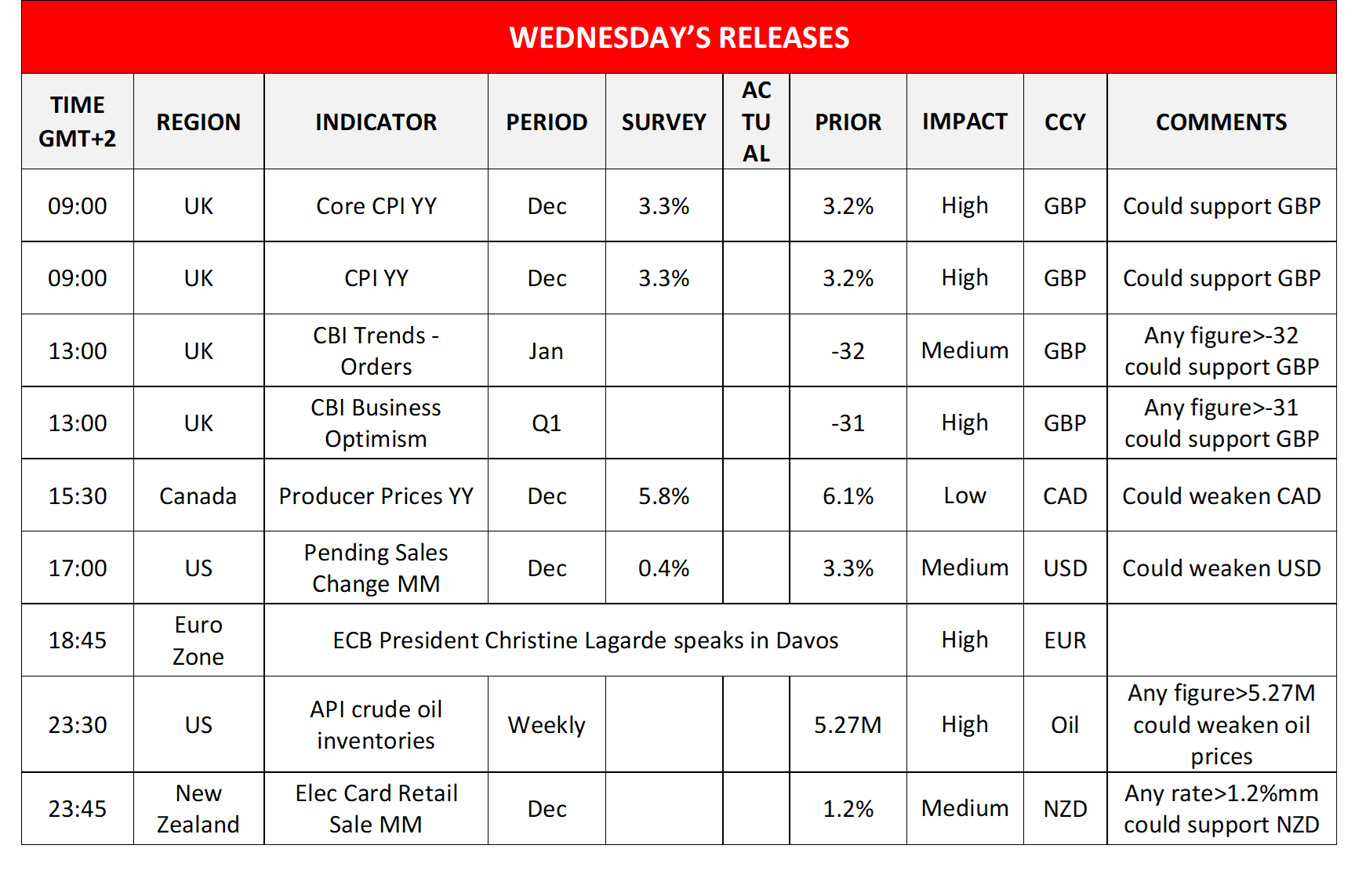

Today we get UK’S CBI trends for industrial orders for January and the CBI business optimism for Q1, Canada’s PPI rates for December, the US pending sales change figure for the same month and API weekly crude oil inventories. In tomorrow’s Asian session, the issue is expected to be the release of Australia’s December employment data, and we also note the release of Japan’s trade data for the same month.

XAU/USD Daily Chart

- Support: 4800 (S1), 4550 (S2), 4250 (S3)

- Resistance: 5000 (R1), 5250 (R2), 5500 (R3)

AUD/USD デイリーチャート

- Support: 0.6620 (S1), 0.6375 (S2), 0.6130 (S3)

- Resistance: 0.6800 (R1), 0.6940 (R2), 0.7160 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。