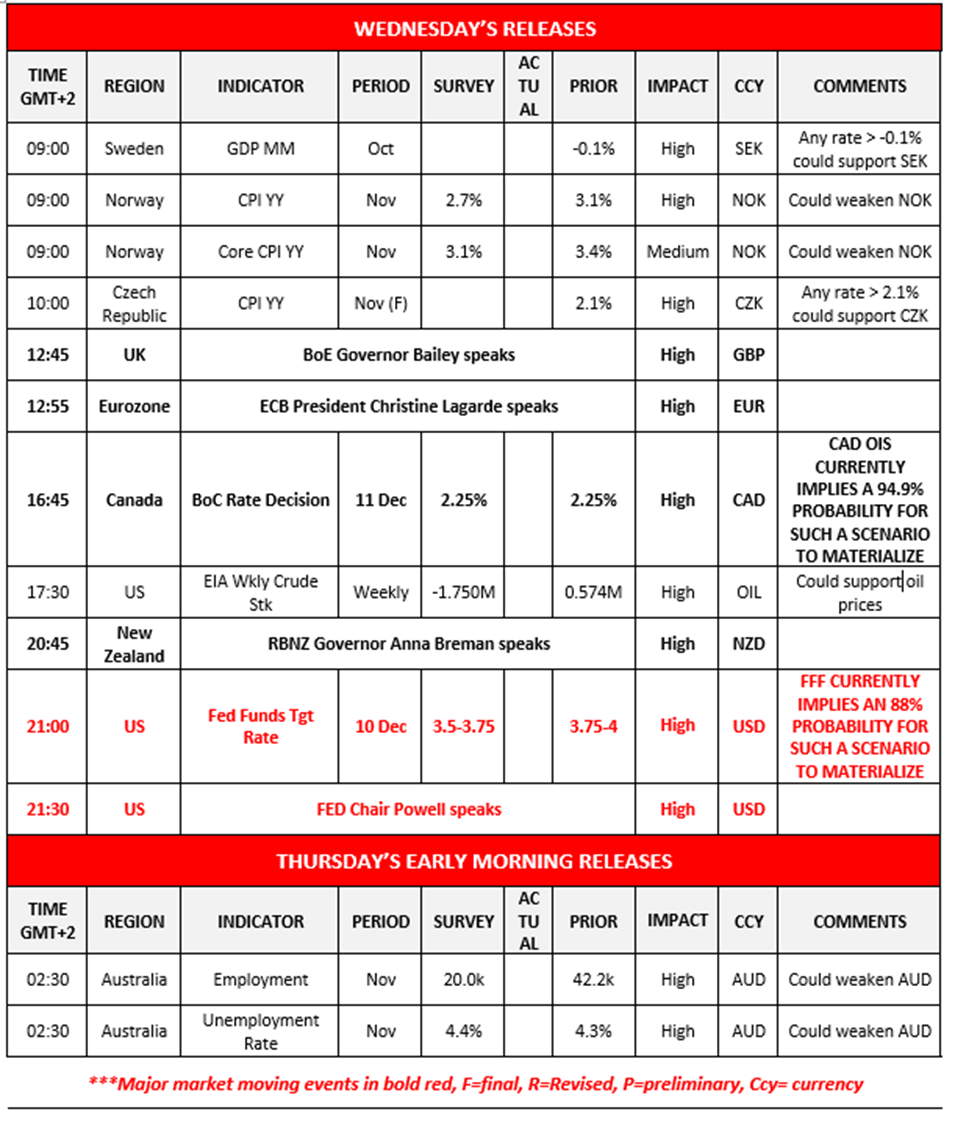

The Fed’s interest rate decision is set to take place during today’s American trading session. The majority of market participants are currently anticipating the bank to cut rates by 25 basis points in their final meeting of the year, with FFF currently implying an 88% probability for such a scenario to materialize. In turn, a rate cut could weigh on the dollar, yet with the probability for such a scenario materializing being at 88%, the markets may be looking to the bank’s accompanying statement in addition to Fed Chair Powell’s press conference. In our view, we tend to support the market’s expectations that the bank may cut by 25 basis points, yet in the accompanying statement we wouldn’t be surprised to see “restrictive” commentary being inserted, i.e, implying that the bank may not cut rates in their next meeting which could be interpreted as a ‘hawkish cut’. In turn the secondary effect of policymakers adopting a more restrictive stance could provide support for the dollar and vice versa. In Canada, the BoC’s interest rate decision is set to occur before the Fed’s interest rate decision and thus the USD/CAD pair may face significant volatility today. Sticking to the BoC, the majority of market participants are currently anticipating the BoC to remain on hold, with CAD OIS currently implying a 94.9% probability for such a scenario to materialize. Thus, should BoC policymakers imply that they may continue on their rate hiking path it may weigh on the Loonie and vice versa.In tomorrow’s Asian session, Australia’s employment data for November is set to be released and based on the current expectations by economists, the data may showcase a loosening labour market which may weigh on the Aussie.

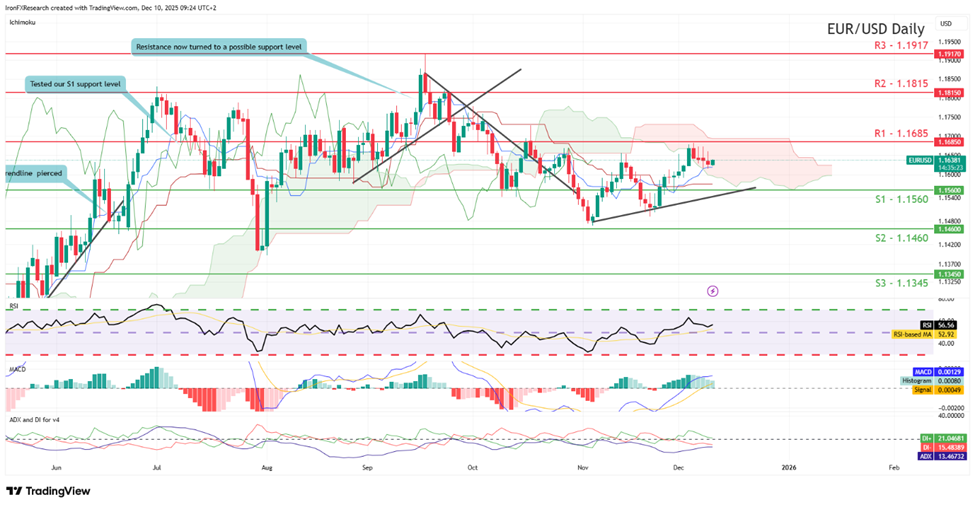

EUR/USD appears to be moving in an upwards fashion. We opt for a bullish outlook for the pair and supporting our case is the upwards moving trendline which was incepted on the 5th of November, in addition to the RSI, MACD and ADX with DI indicators below our chart which tend to point towards a bullish market sentiment. For our bullish outlook to be maintained, we would require a clear break above our 1.1685 (R1) resistance level with the next possible target for the bulls being our 1.1815 (R2) resistance line. On the other hand, for a sideways bias we would require the pair to remain confined between our 1.1560 (S1) support level and our 1.1685 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below our 1.1560 (S1) support level with the next possible target for the bears being our 1.1460 (S2) support line.

XAU/USD appears to be moving in a sideways fashion, with the precious metal appearing to be aiming for our 4142 (S1) support level. We opt for a sideways bias for gold’s price and supporting our case is the failure to clear our 4240 (R1) resistance line. For our sideways bias to be maintained, we would require the commodity’s price to remain confined between our 4142 (S1) support level and our 4240 (R1) resistance line. On the other hand, for a bearish outlook, we would require a clear break below our 4142 (S1) support level with the next possible target for the bears being our 4080 (S2) support line. Lastly, for a bullish outlook we would require a clear break above our 4240 (R1) resistance line with the next possible target for the bulls being our 4315 (R2) resistance level.

その他の注目材料

Today, we get Sweden’s GDP rate for October, Norway’s CPI rates for November, the Czech Republic’s final CPI rate for November as well, the EIA weekly crude oil inventories figure. On a monetary policy level we note the speeches by BoE Governor Bailey and ECB President Lagarde, whilst after we get the BoC’s interest rate decision, the breakfast for the new RBNZ Governor Breman who may make comments followed by the highlights of the week which are the Fed’s interest rate decision following by Fed Chair Powell’s press conference. In tomorrow’s Asian session we get Australia’s Employment data for November.

EUR/USD Daily Chart

- Support: 1.1560 (S1), 1.1460 (S2), 1.1345 (S3)

- Resistance: 1.1685 (R1), 1.1815 (R2), 1.1917 (R3)

XAU/USD H4 Chart

- Support: 4142 (S1), 4080 (S2), 4010 (S3)

- Resistance: 4240 (R1), 4315 (R2), 4380 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。