USD rises, yet employment data are negative

利 USD edged higher yesterday despite worries for the US employment market being enhanced. The Challenger job cuts figure for January came in far stronger than expected, signaling a weakness for the US employment market.

Also, the weekly initial jobless claims came in higher in another negative signal for the US employment market. The release of the for January was postponed for Wednesday the 11th of February and is expected to be closely watched.

Canada’s January employment data and Japan’s elections

Today we highlight the release of Canada’s employment data for January and should the release show a looser Canadian employment market than expected we may see the Loonie losing further ground.

In Japan, Parliamentary elections are to be held on Sunday which tends to increase volatility for JPY pairs. A negative scenario for the Yen in our opinion would be a hung parliament or even worse should the opposition come to power, while a landslide win of Takaichi’s LDP could provide some support as uncertainty could be reduced.

Also please bear in mind that as JPY weakens the possibility of a market intervention to JPY’s rescue increases.

Bitcoin dominated by bears

The wider risk off sentiment, the heated discussion of US Treasury Bessent with US lawmakers on Wednesday about Bitcoin, his comments that the US would not be bailing out the cryptocurrency, all tended to intensify the drop of the cryptocurrency’s price over the past two days.

Overall we see the case for the current fundamentals to continue to weigh on the cryptocurrency, yet we may see some sort of verbal market intervention to ease crypto trader’s worries. We expect a long and worrying weekend for crypto traders.

US stock markets on the retreat

US equity markets were on the retreat yesterday with technology shares leading the drop. Concerns about high AI investment are understandable, given the high leverage of a number of companies.

Latest example was Amazon which delivered its earnings reports in yesterday’s aftermarket hours, as it plans an oversized investment of $200billion in AI, enhancing market worries for its outlook.

Overall, should market worries intensify further, we may see US equities continuing to retreat, as the risk-off sentiment could be enhanced, with special focus on the tech sector.

Charts to keep an eye out

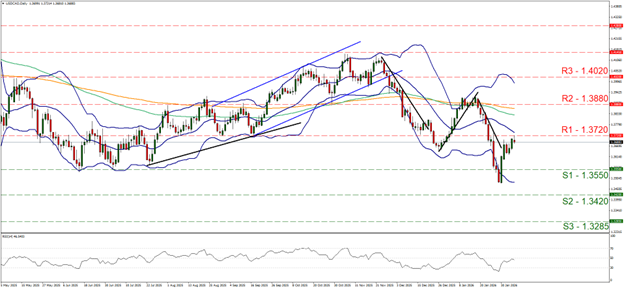

USD/CAD continued to rise yesterday teasing the 1.3720 (R1) resistance line. Yet we hesitate to adopt a bullish outlook yet as the RSI indicator is still near the reading of 50. For a bullish outlook to be adopted, we would require the pair to break the 1.3720 (R1) resistance line and start aiming for the 1.3880 (R2) resistance level.

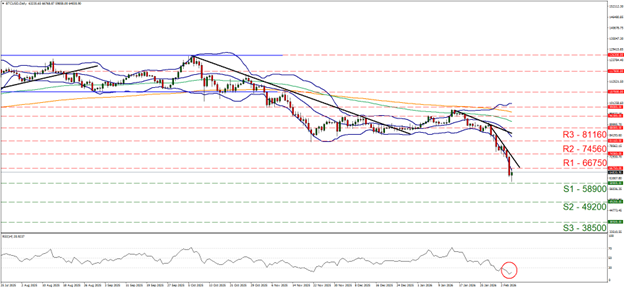

BTC/USD continued to tumble yesterday breaking the 66750 (R1) support line now turned to resistance and starting to aim for the 58900 (S1) support base.

We maintain our bearish outlook for the crypto, yet at the same time we issue a strong warning for a possible correction higher, as the cryptocurrency’s price, as the RSI indicator is indicating that it is in oversold territory.

その他の注目材料

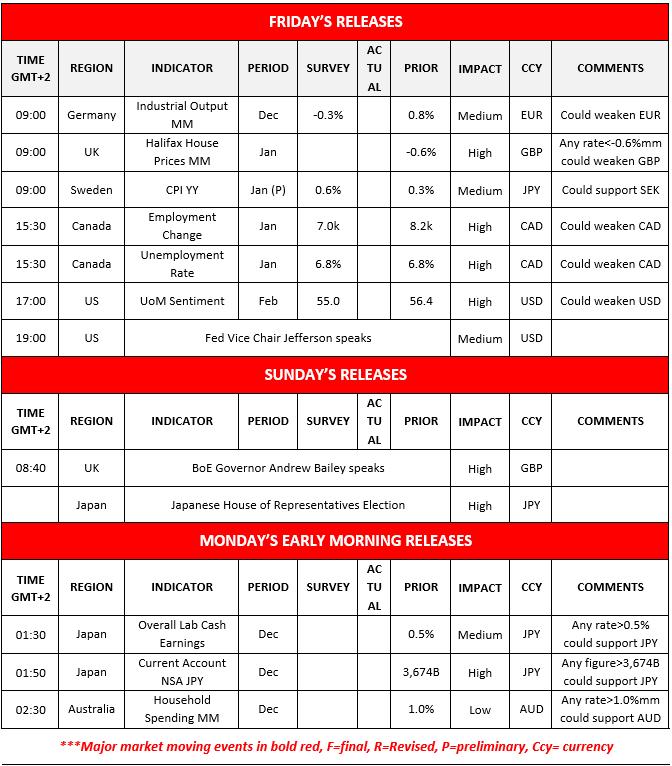

Today we get Germany’s industrial orders for December, UK’s Halifax House prices for January, Sweden’s preliminary CPI rates for also for January, and the US UoM Sentiment for February, while Fed Vice Chair Jefferson speaks.

On Monday’s Asian session, we get Japan’s December overall labour cash earnings and current account balance.

USD/CAD Daily Chart

- Support: 1.3550 (S1), 1.3420 (S2), 1.3285 (S3)

- Resistance: 1.3720 (R1), 1.3880 (R2), 1.4020 (R3)

BTC/USD Daily Chart

- Support: 58900 (S1), 49200 (S2), 38500 (S3)

- Resistance: 66750 (R1), 74560 (R2), 81160 (R3)

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。