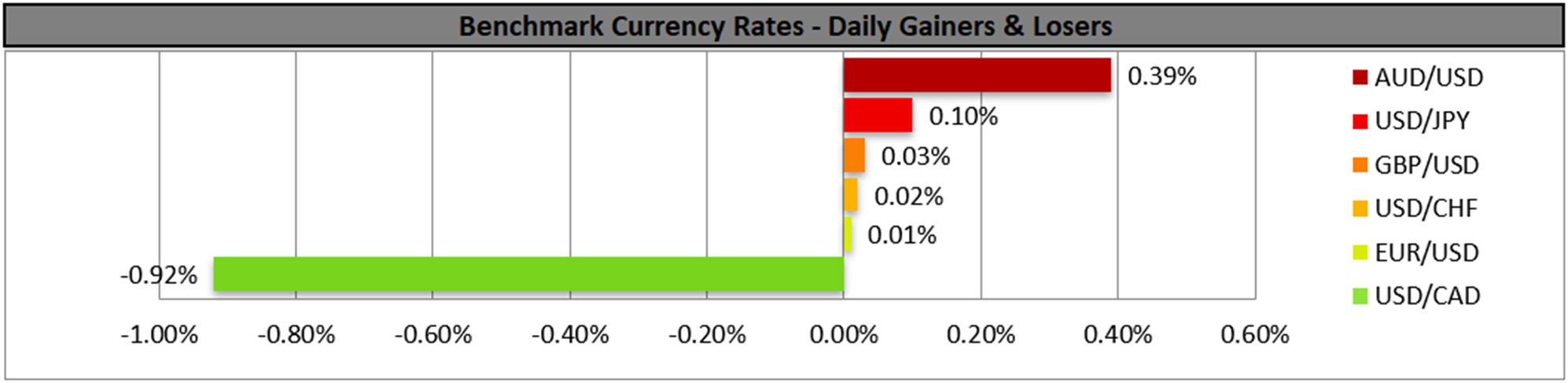

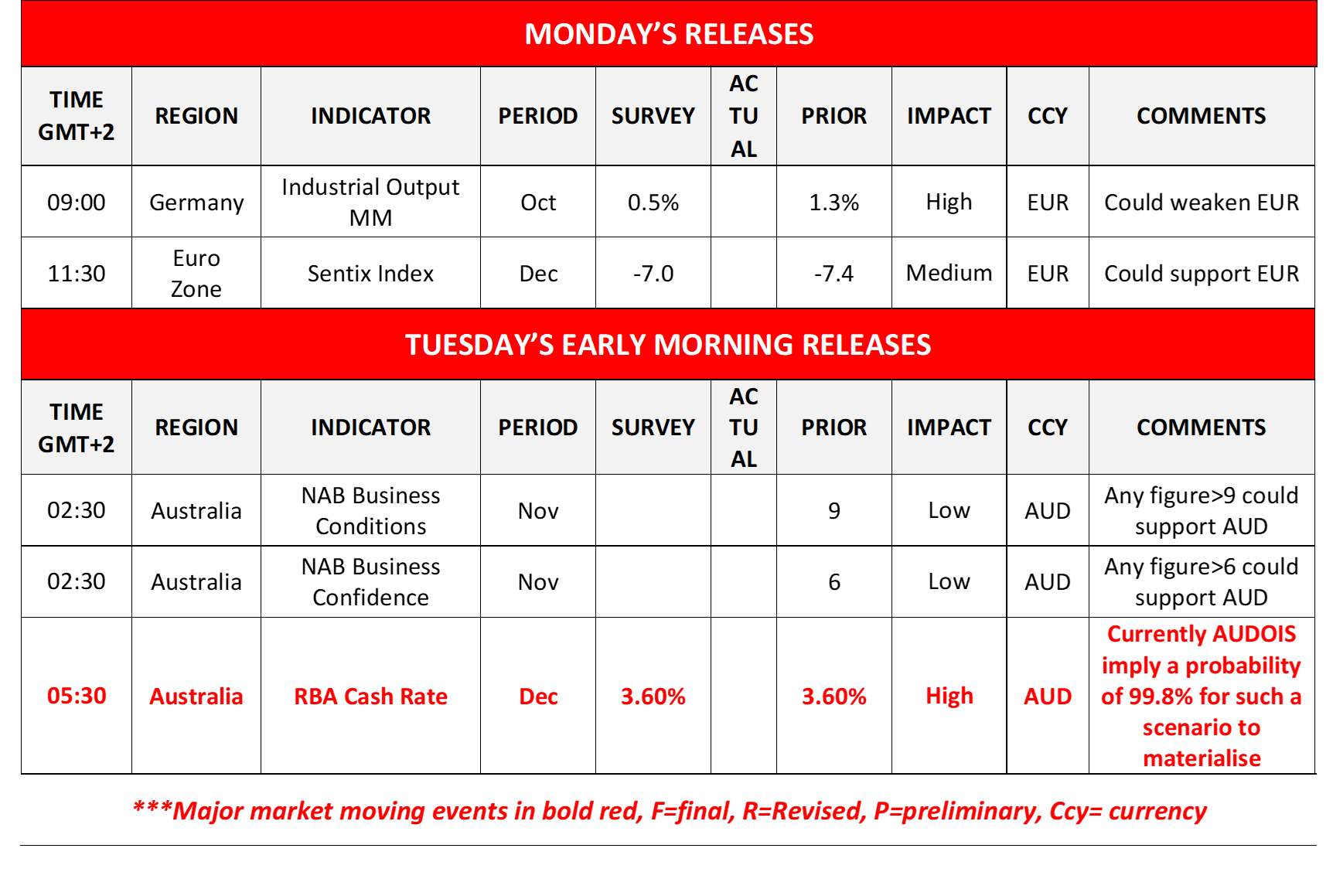

The USD remained relatively stable on Friday and during today’s Asian session and the market’s attention is placed on the Fed’s interest rate decision on Wednesday. We are to get a number of interest rate decisions this week, hence fundamentals are expected to move the markets. We make a start in tomorrow’s Asian session, with the release of Australia’s RBA interest rate decision. The bank is widely expected to remain on hold and currently, AUD OIS imply a probability of 96% for such a scenario to materialise, while they also imply that the market expects the bank to proceed with a rate hike near the end of H1 2026. Hence, we expect the market to shift its attention towards the bank’s forward guidance. Given the drop in the unemployment rate for October, to 4.3% and at the same time the acceleration of the CPI rates for the same month to 3.8%, which is above the bank’s inflation target range of 1%-3%, we expect the bank to maintain a hawkish tone that could provide some limited support for the AUD. On the flip side, a possible neutral tone could weigh on the Aussie and a hint of dovishness could weigh asymmetrically on AUD, as the market may be forced to readjust its expectations.

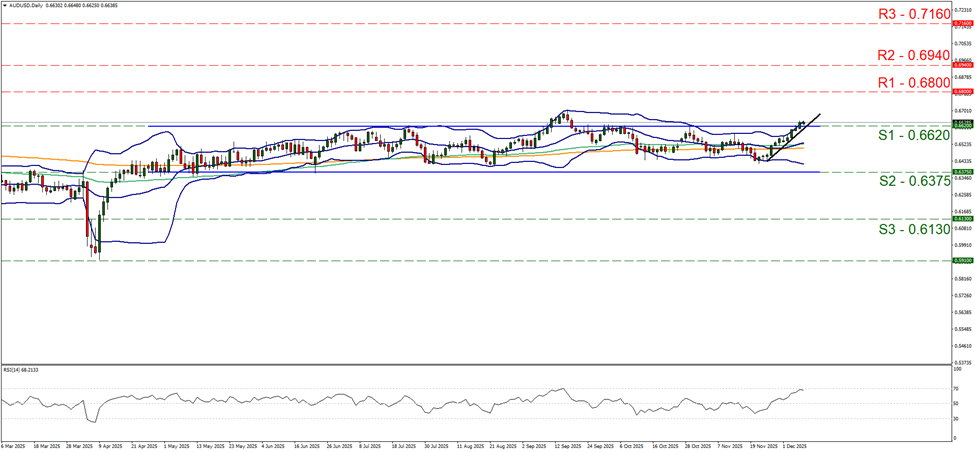

In the FX market we note that AUD/USD continued to edge higher on Friday and during today’s Asian session breaking the 0.6620 (S1) resistance line, now turned to support. Given that the pair has broken the upper boundary of its past sideways motion, we switch temporarily switch our bias for a sideways motion in favour of a bullish outlook and intend to keep as long as the upward trendline guiding the pair remains intact. Supporting our bullish outlook if the RSI indicator which has reached the reading of 70, implying a strong bullish market sentiment, yet at the same time implying that the pair may have reached overbought levels and may be ripe for a correction lower. We get similar signals by the fact that the pair’s price action has reached the upper Bollinger band. Should the bulls maintain control we may see the pair aiming for the 0.6800 (R1) resistance line, while should the bears take over, we may see the pair breaking the 0.6620 (S1) support line the prementioned upward trendline and start aiming for the 0.6375 (S2) support level.

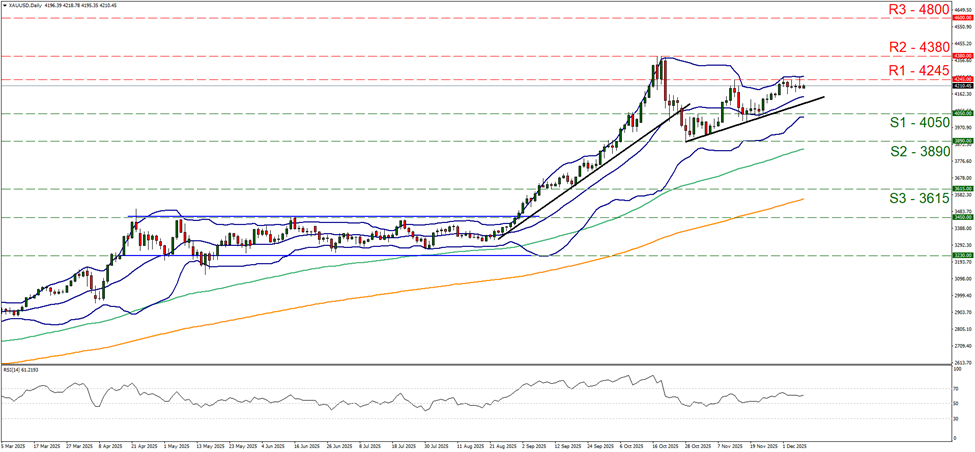

Also on a technical level, we note that gold’s price remained stable just below the 4245 (R1) resistance line. We maintain our bias for a sideways motion for the time being, yet note that the RSI indicator remains between the readings of 50 and 70 implying a bullish market predisposition. Should the bulls take over ,we may see gold’s price breaking the 4245 (R1) resistance line and start aiming for the 4380 (R2) resistance level, an All Time High (ATM) for gold. For a bearish outlook to emerge gold’s price would have to break the 4050 (S1) line and continue lower to start aiming the 3890 (S2) support level.

Autres faits marquants de la journée :

Today, we get Germany’s industrial output for October and Euro Zone’s Sentix index for December. In tomorrow’s Asian session, we get Australia’s NAB business conditions and confidence for November.

As for the rest of the week:

On Tuesday, we get the US JOLT’s job openings figure for September and on Wednesday we get China’s PPI and CPI rates for November, Sweden’s GDP rate for October, Norway’s inflation rate for November, speeches by BoE Governor Bailey and ECB President Lagarde and the highlights of the week which are the Bank of Canada’s and the Federal Reserve’s interest rate decisions. On Thursday, we get Australia’s employment data and Sweden’s CPI rates both for November, the SNB’s and CBT’s interest rate decisions. On Friday, we get Germany’s final HICP rate for November, the UK’s GDP rates and manufacturing output rate all for October, Sweden’s unemployment rate for November, France’s final HICP rate for November and the speeches by Philadelphia Fed President Paulson and Chicago Fed President Goolsbee.

AUD/USD Graphique H4

- Support: 0.6620 (S1), 0.6375 (S2), 0.6130 (S3)

- Resistance: 0.6800 (R1), 0.6940 (R2), 0.7160 (R3)

XAU/USD Daily Chart

- Support: 4050 (S1), 3890 (S2), 3615 (S3)

- Resistance: 4245 (R1), 4380 (R2), 4800 (R3)

Si vous avez des questions d'ordre général ou des commentaires concernant cet article, veuillez envoyer un email directement à notre équipe de recherche à l'adresse research_team@ironfx.com

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing. IronFX n'est pas responsable des données ou informations fournies par des tiers référencés, ou en lien hypertexte, dans cette communication.