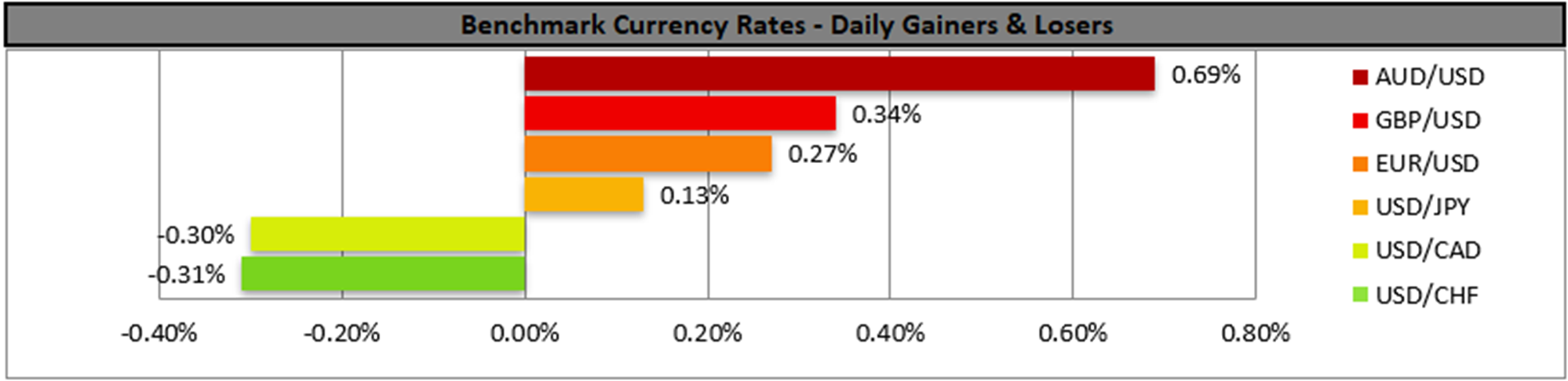

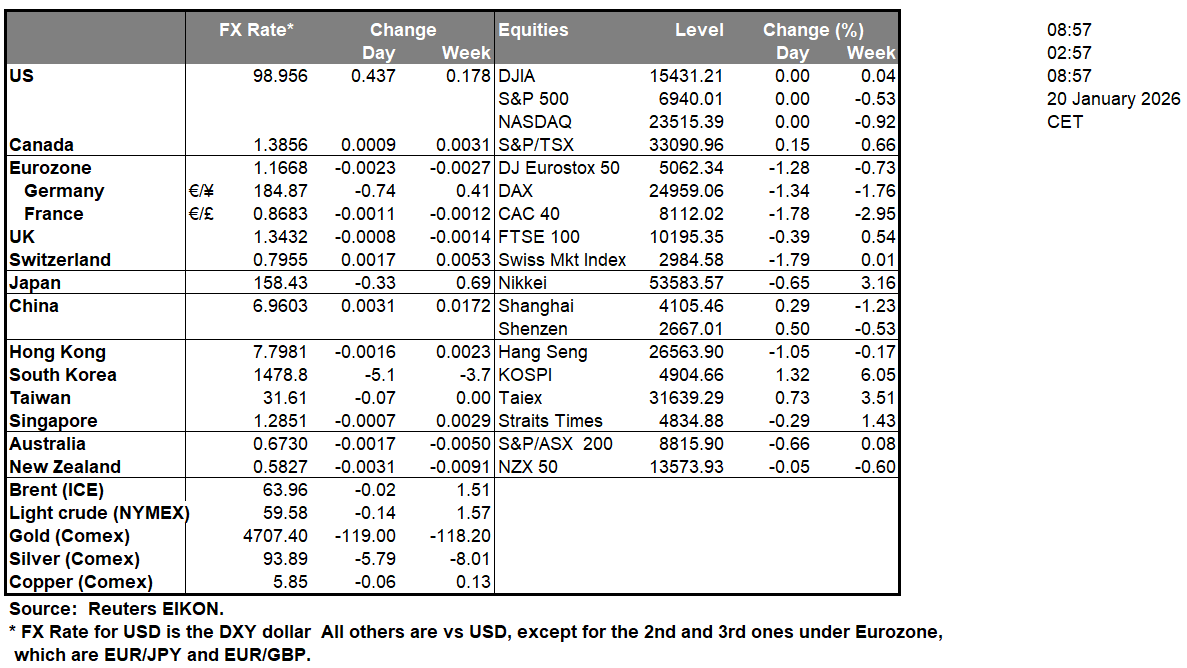

The USD continued to retreat against its counterparts, yet not against the JPY. On a fundamental level the threats of US President Trump to buy/annex Greenland continue to rattle the markets weighing on riskier assets such as US equities, while at the same time supports safe haven instruments such as gold. The Europeans seem willing to ease tensions and are preparing to respond to the US threats, contemplating also the usage of a its anti-coercion instrument, which is characterised as a “trading bazooka” a legislation that would practically sanction in one way or the other any sector of the US economy in various ways, whether that would be tariffs on US products, investment controls or even operation controls for large US tech companies. On the other hand the US stance on the issue seems to remain hard. Tensions are high and a possible further escalation may enhance the market reactions prementioned. Yet be aware, a possibly harsh US response could weigh on the EUR and European equities.

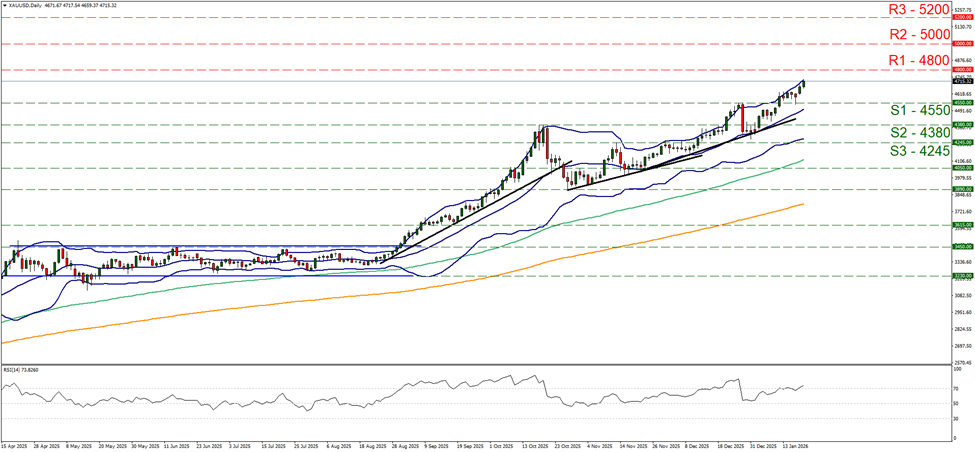

Gold’s price continued to rise reaching new All Time High levels in today’s Asian session. We have a bullish outlook for gold’s price and intend to keep it as long as the upward trendline guiding it since the 28th of October remains intact. Please note that the RSI indicator has surpassed the reading of 70, implying a strong bullish market sentiment on the one hand yet on the flip side may also imply that the precious metal’s price is near overbought levels and the possibility of a correction lower for gold’s price, is increasing. We set the $4800 (R1) as the next possible target for the bulls and expect the precious metal’s price to actively continue aiming it. A bearish outlook currently seems remote and for it to be adopted we would require gold’s price to break the 4550 (S1) support line and continue to break also the prementioned upward trendline in a first signal of an interruption of the upward movement and continue even lower to break the 4380 (S2) level.

JPY in troubled fundamentals

In the Far East, demand for Japanese bonds dropped with the relative yields rising notably, while we also saw Japanese equities and the Yen in the FX market losing ground. Japanese Prime Minister Takaichi’s snap elections on February 8th tend to create substantial uncertainty. Ms. Takaichi’s main pledge is for the sales tax on food to be cut. Market worries for Japan’s finances were enhanced from Ms. Takaichi’s intentions, turning the market sentiment more risk off. Furthermore the weakening of JPY over the past few months tends to enhance inflationary pressures in Japan, an issue that is expected to be addressed in BoJ’s next interest rate decision, on Friday. Yet given the weakness of JPY, especially against the USD, we highlight the possibility of a market intervention by Japan in its rescue.

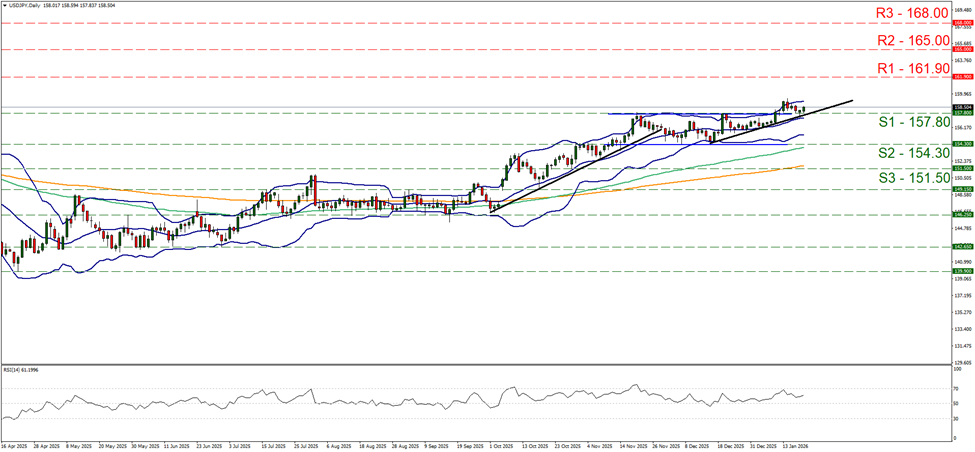

USD/JPY edged higher after bouncing on the 157.80 (S1) support line. For the time being, we maintain a bullish outlook for the pair’s price action, as long as the upward trendline guiding it remains intact. Furthermore the RSI indicator remains currently between the readings of 50 and 70, implying a bullish predisposition of the market for the pair. Should the bulls remain in control, we may see the pair aiming for the 161.90 (R1) resistance line. On the flip side, should the bears take over, we may see USD/JPY breaking the 157.80 (S1) support line and continue to break also the 154.30 (S2) support level.

Autres faits marquants de la journée :

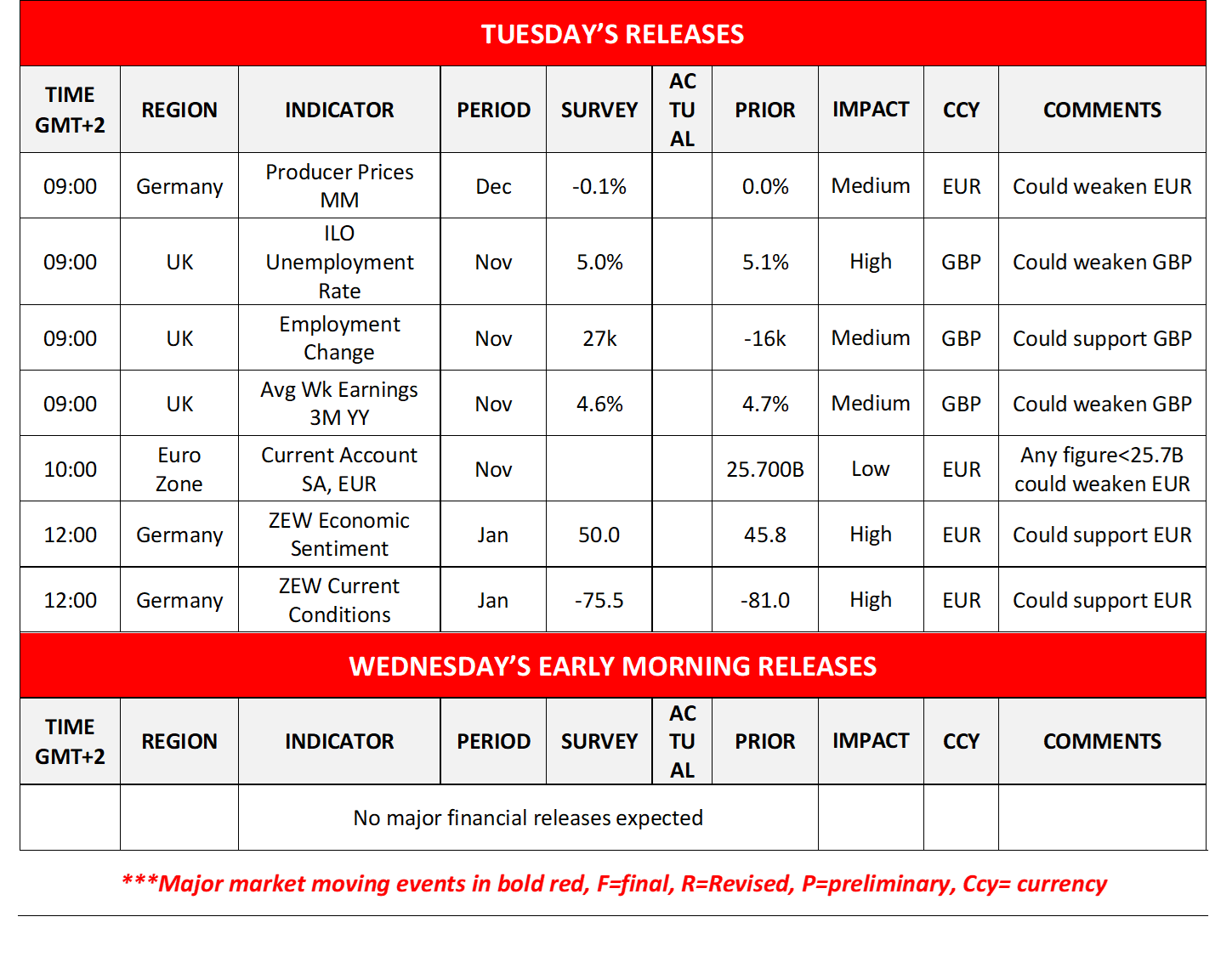

Today we note the release of Germany’s PPI rates for December, UK’s November employment data, Euro Zone’s November current account balance and Germany’s January ZEW indicators. As for US equities we note today the release of Netflix’s earnings report and despite better than expected revenue and EPS figures possibly providing some support, the company’s subscription figures and forward guidance may be the main market mover for Netflix’s share price.

XAU/USD Daily Chart

- Support: 4550 (S1), 4380 (S2), 4245 (S3)

- Resistance: 4800 (R1), 5000 (R2), 5200 (R3)

USD/JPY Daily Chart

- Support: 157.80 (S1), 154.30 (S2), 151.50 (S3)

- Resistance: 161.90 (R1), 165.00 (R2), 168.00 (R3)

Si vous avez des questions d'ordre général ou des commentaires concernant cet article, veuillez envoyer un email directement à notre équipe de recherche à l'adresse research_team@ironfx.com

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing. IronFX n'est pas responsable des données ou informations fournies par des tiers référencés, ou en lien hypertexte, dans cette communication.