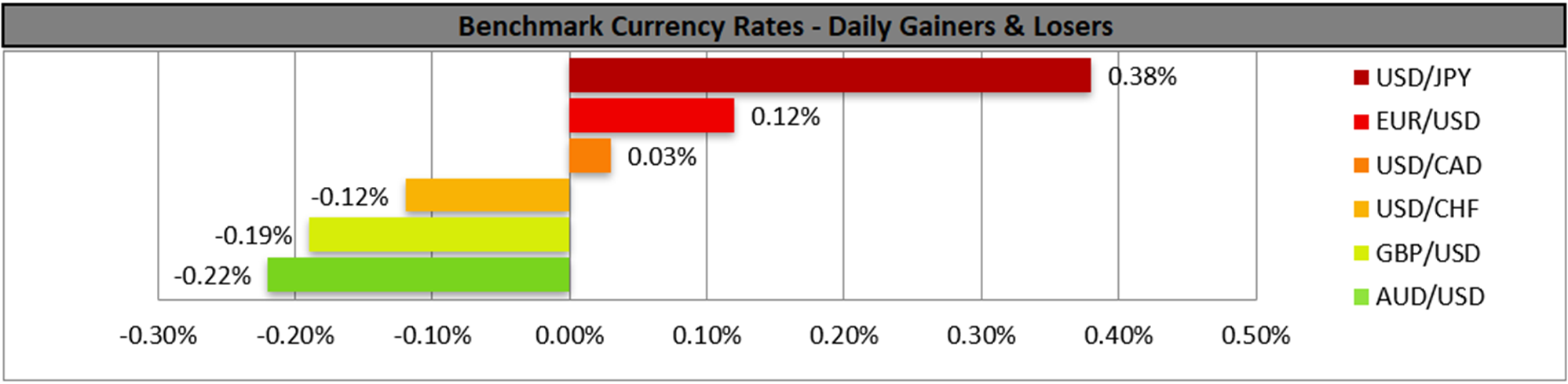

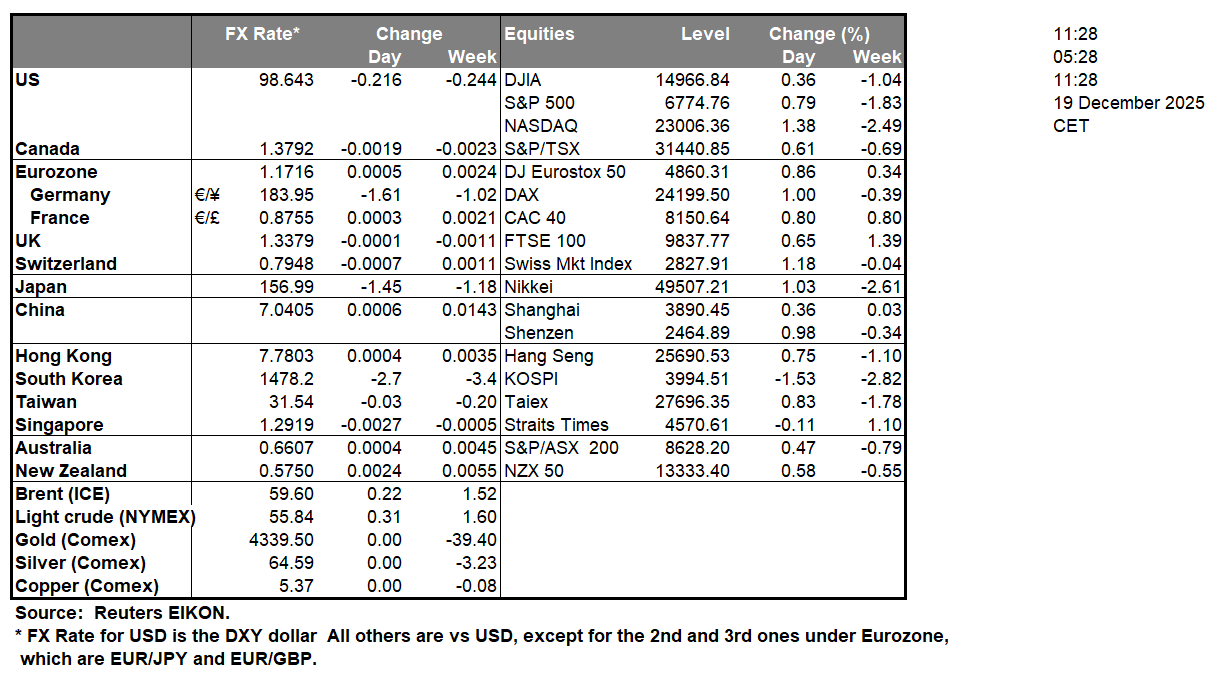

The BOJ earlier on today hiked interest rates by 25 basis points to their highest level in 30 years. The bank’s decision could possibly provide support for the JPY as the year comes to an end. In their accompanying statement the bank noted that it may continue rising interest rates, which could further provide support to the JPY. The US PCE rates for October are set to be released during today’s American trading session. Should the PCE rates showcase an acceleration of inflationary pressures, the hawkish sentiment from Fed policymakers may be intensified and could reduce the market’s expectations of a rate cut by the Fed next year. In turn this could provide support for the dollar and vice versa.Washington’s oil blockade of Venezuela is continuing and the longer it is maintained the more support oil prices may find as the supply of oil into the global market is hindered. Moreover, considering the ongoing economic pressures imposed by Washington, we wouldn’t be surprised to see matters escalating over the weekend or next week, which in turn could further aid oil prices. Nonetheless, such a scenario at this point in time remains a hypothetical.Russian President Vladimir Putin is set to speak today. Considering the ongoing developments in regards to a possible peace deal between Russia and Ukraine, analysts may be looking closely to see if there is any indication that progress has been made or that the two sides are close to a deal. Hence the comments made by the Russian President could influence gold’s price considering its safe haven asset status. Per Bloomberg, “China reiterated that US weapons sales to Taiwan raise the chances of a clash between the superpowers”, which is currently just rhetoric. Yet should an escalation truly occur, gold prices may find newfound support.

GBP/USD appears to be moving in a sideways fashion. We opt for a sideways bias for the pair and supporting our case is the pairs failure to clear our 1.3475 (R1) resistance level. For our sideways bias to be maintained we would require the pair to remain confined between our 1.3335 (S1) support level and our 1.3475 (R1) resistance line. On the other hand, for a bullish outlook we would require a clear break above our 1.3475 (R1) resistance line with the next possible target for the bulls being our 1.3625 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below our 1.3335 (S1) support level with the next possible target for the bears being our 1.3195 (S2) support line.

EUR/USD appears to be moving in a sideways fashion after failing to clear our 1.1815 (R1) resistance line. We opt for a sideways bias for the pair and supporting our case is the pair’s failure to clear our aforementioned R1 resistance level. For our sideways bias to be maintained we would require the pair to remain confined between our 1.1685 (S1) support level and our 1.1815 (R1) resistance line. On the other hand, for a bearish outlook we would require a clear break below our 1.1685 (S1) support level with the next possible target for the bears being our 1.1560 (S2) support line. On the other hand, for a bullish outlook we would require a clear break above our 1.1815 (R1) resistance line with the next possible target for the bulls being our 1.1917 (R2) resistance level.

Autres faits marquants de la journée :

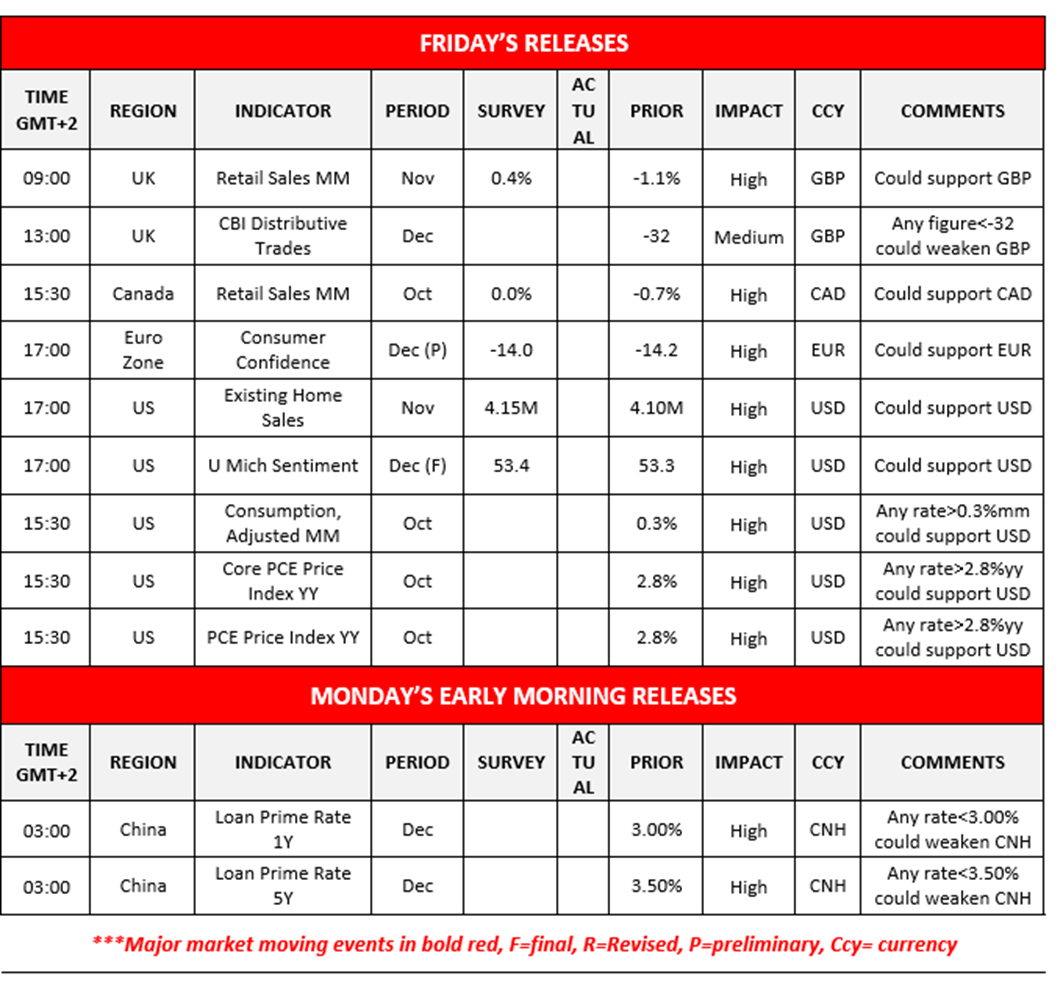

Today, we get the UK’s retail sales rate for November, UK distributive trades figure for December, Canada’s retail sales rate for October,the Eurozone’s preliminary consumer confidence figure for December, the US existing home sales rate for November. The US University of Michigan final consumer sentiment figure for December, the US consumption rate for October, the US PCE rates for October. In tomorrow’s Asian session we note the PBOC’s interest rate decision .

GBP/USD Daily Chart

- Support: 1.3335 (S1), 1.3195 (S2), 1.3050 (S3)

- Resistance: 1.3475 (R1), 1.3625 (R2), 1.3785 (R3)

EUR/USD DAILY Chart

- Support: 1.1685 (S1), 1.1560 (S2), 1.1460 (S3)

- Resistance: 1.1815 (R1), 1.1917 (R2), 1.2000 (R3)

Si vous avez des questions d'ordre général ou des commentaires concernant cet article, veuillez envoyer un email directement à notre équipe de recherche à l'adresse research_team@ironfx.com

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing. IronFX n'est pas responsable des données ou informations fournies par des tiers référencés, ou en lien hypertexte, dans cette communication.