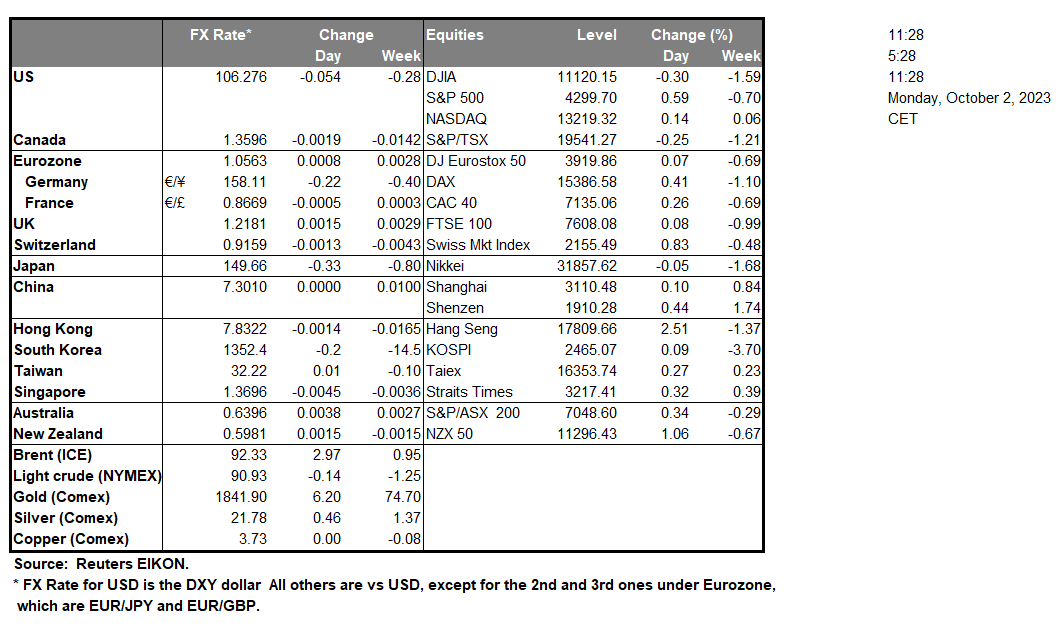

The USD tended to edge lower against its counterparts on Friday as consumption data slowed down, as did the core PCE price index growth rate, all being for August. The release tended to ease market worries about a possible overtightening of the Fed’s monetary policy and helped to solidify the market’s expectations that the bank has reached the end of its rate-hiking cycle. EUR/USD edged lower, remaining between the 1.0515 (S1) support line and the 1.0635 (R1) resistance line. Given that the pair’s price action remains below the downward trendline guiding it since the 18th of July, we tend to maintain our bearish outlook for EUR/USD. Yet we have to note that the RSI indicator remains near the reading of 50, implying a rather indecisive market that may allow the pair to stabilise somewhat. Recent global central-bank expectations including developments around the RBA may also contribute to the current cautious tone. Should the bears maintain control over the pair, we expect it to break the 1.0515 (S1) support line and aim for the 1.0445 (S2) support level. Should the bulls take over, we may see EUR/USD rising, breaking the prementioned downward trendline in a first signal that the downward motion has been interrupted and continue higher, breaking the 1.0635 (R1) resistance line.

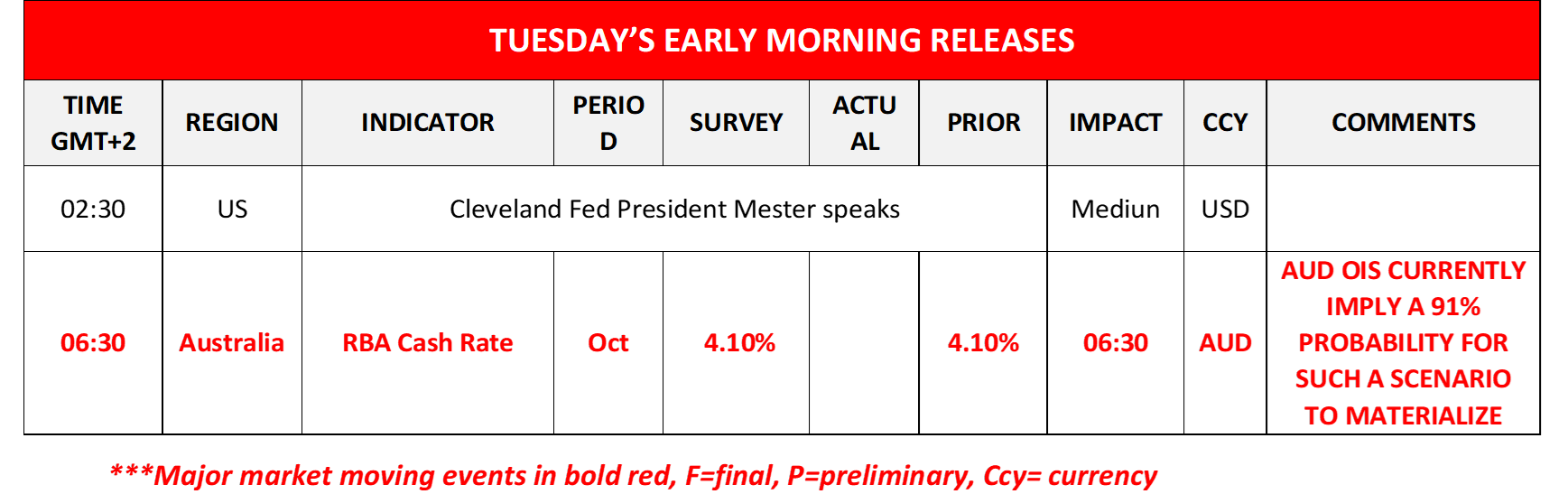

During tomorrow’s Asian session, we note the release of RBA’s interest rate decision and the bank is expected to remain on hold at 4.1% which may weigh somewhat on the Aussie unless it is accompanied by a hawkish statement of RBA’s new Governor Michelle Bullock. The possibility of the bank hiking rates, despite being considered in its last meeting, for the time being, is being viewed as remote given that the market prices in the bank to remain on hold by 91% according to AUDOIS.

On a technical level, we note that AUD/USD edged lower in the past two sessions, testing the 0.6400 (S1) support line. Given the pair’s movement since the last days of August, we expect the wide sideways motion to be maintained and note that the RSI indicator, despite edging lower, is still near the reading of 50. Recent shifts in RBA expectations may also be contributing to the pair’s muted tone. Should the selling interest intensify, we may see the pair breaking the 0.6400 (S1) support line and aim, if not break, the 0.6285 (S2) support level. Should buyers be in charge of the pair’s direction, we may see it rising, breaking the 0.6515 (R1) resistance line and setting in its sights the 0.6620 (R2) resistance level.

Otros puntos destacados del día:

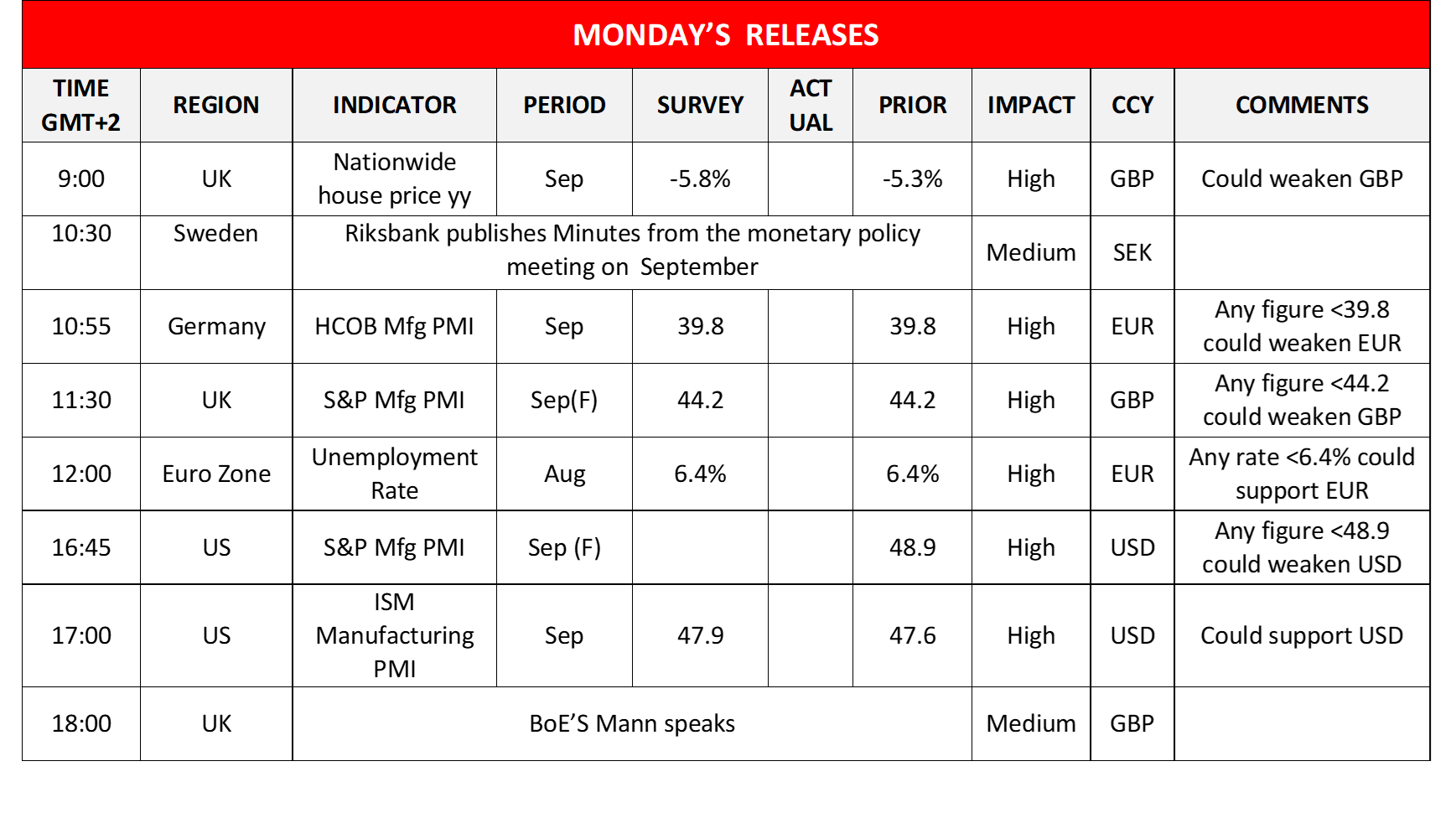

Today we note the release of the UK’s Nationwide house prices rate for September, Germany’s Manufacturing PMI figure for September, the UK’s final Manufacturing PMI figure for September, the Eurozone’s Unemployment rate for August and the US S&P final and ISM Manufacturing PMI figures for September. On a monetary level, we note that BoE’s Mann is expected to speak, while markets continue to compare global policy tones with recent RBA signals. In tomorrow’s Asian session, we note Cleveland Fed President Mester is speaking.

En cuanto al resto de la semana:

On Tuesday, we note Switzerland’s CPI rates for September and the US JOLTS Job Openings figure for August. On Wednesday, we make a start with France’s Services PMI figure for September, the Eurozone’s Final Composite PMI figure, the UK’s Final Composite figure, the US ADP National Employment figure and the US Final Composite PMI figure, all for the month of September, followed by the US factory orders rate for August and the US ISM Non-Manufacturing PMI figure for September. On Thursday, we note Australia’s trade balance figure and Germany’s export rate, both for the month of August data that may also influence expectations around future RBA decisions followed by the UK’s Composite PMI figure for September, the US weekly initial jobless claims figure and Canada’s trade balance figure for August. Finally, on Friday we note Germany’s industrial orders rate for August, followed by the UK’s Halifax House Prices rate for September, the US Non-Farm Payrolls figure, the Unemployment rate, Average Hourly Earnings and Canada’s Employment data, all for the month of September.

EUR/USD 4 Hour Chart

Support: 1.0515 (S1), 1.0415 (S2), 1.0315 (S3)

Resistance: 1.0635 (R1), 1.0735 (R2), 1.0835 (R3)

AUD/USD 4 Hour RBA Chart

Support: 0.6400 (S1), 0.6285 (S2), 0.6170 (S3)

Resistance: 0.6515 (R1), 0.6620 (R2), 0.6725 (R3)

Si tiene preguntas generales o comentarios relacionados con este artículo, envíe un correo electrónico directamente a nuestro equipo de investigación a research_team@ironfx.com

Descargo de responsabilidad:

Esta información no debe considerarse asesoramiento o recomendación sobre inversiones, sino una comunicación de marketing. IronFX no se hace responsable de datos o información de terceros en esta comunicación, ya sea por referencia o enlace.