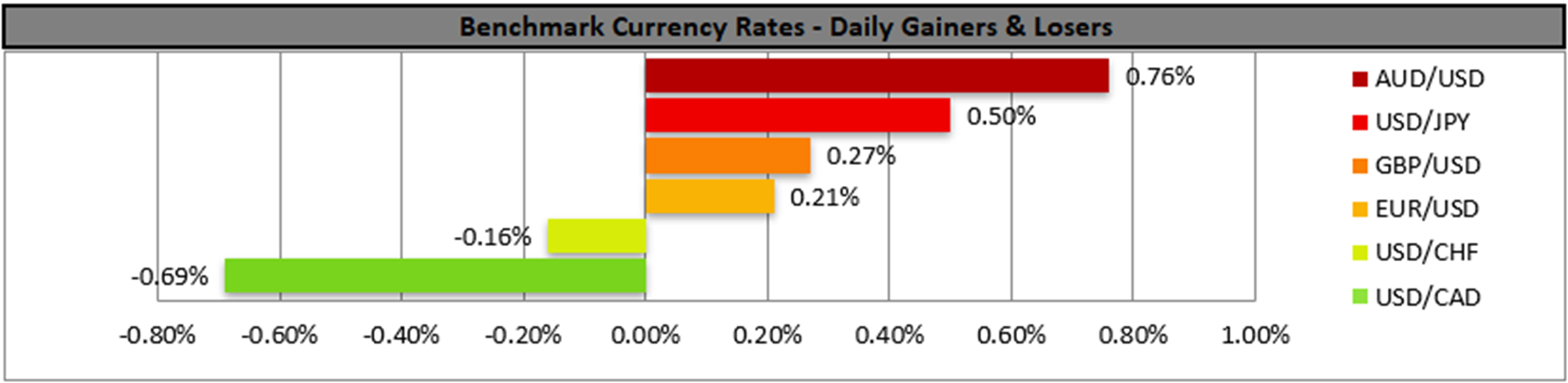

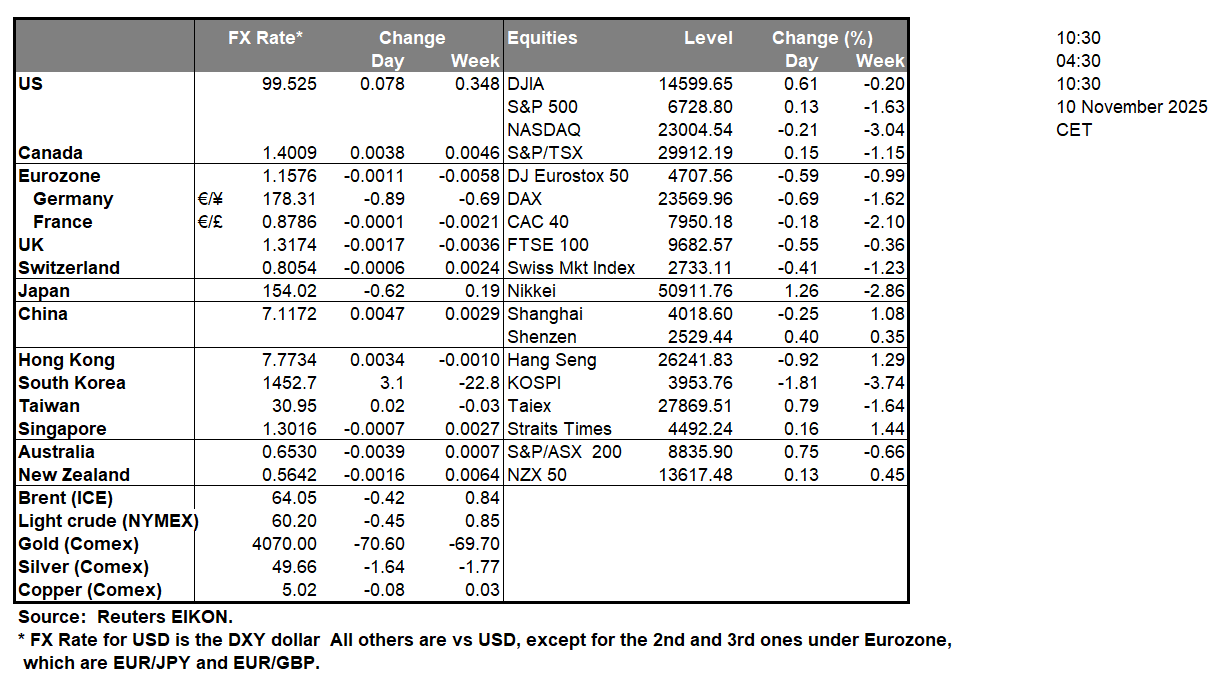

In the US some Democrats in the Senate seem to have come to an agreement with the Republicans, which in turn may temporarily end the US Government shutdown. Despite the whole deal being in a preliminary stage, as it will require also the approval of the House of Representatives, if seems to be securing funding for the US government until and including January, in a first step towards the resolution of the political deadlock. The development allowed for riskier assets to get some support while safe havens like JPY tended to suffer. Similarly, China’s decision to start easing restrictions on rare earth exports seems to boost the market sentiment, yet China’s easing may fall short of US President Trump’s expectations which could lead to renewed tensions. Should the tensions continue to thaw away, we may see riskier assets such as the Aussie getting additional support and vice versa. In Japan the release of BoJ’s summary of opinions of the October meeting, revealed that the bank sees a growing case for a rate hike in the near term, which tends to be supportive for the Yen on a monetary level. On the precious metals front, gold’s price reached a two week high in today’s Asian session as the market’s worries for the US economic outlook tended to intensify.

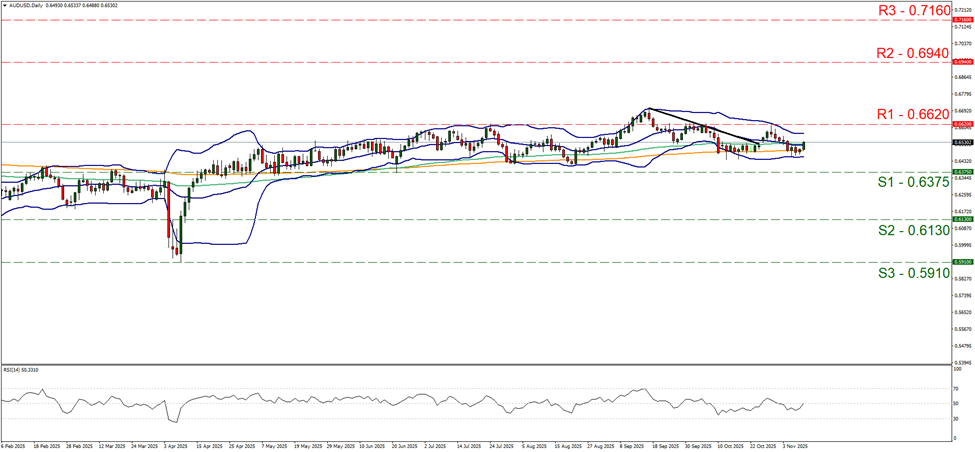

AUD/USD remained relatively stable on Friday and in today’s Asian session, well between the 0.6620 (R1) resistance line and the 0.6375 (S1) support level. We maintain a bias for the pair’s sideways motion within the corridor set by the prementioned levels to be continued. Supporting our opinion are the Bollinger bands which are narrow and converging slightly implying lower volatility for the pair and the RSI indicator which reached the reading of 50 implying a rather indecisive market for the pair’s direction. Should the bulls take over, AUD/USD may break the 0.6620 (R1) line and start aiming for the 0.6940 (R2) level. Should the bears be in charge, we may see the pair breaking the 0.6375 (S1) line and start aiming for the 0.6130 (S2) base.

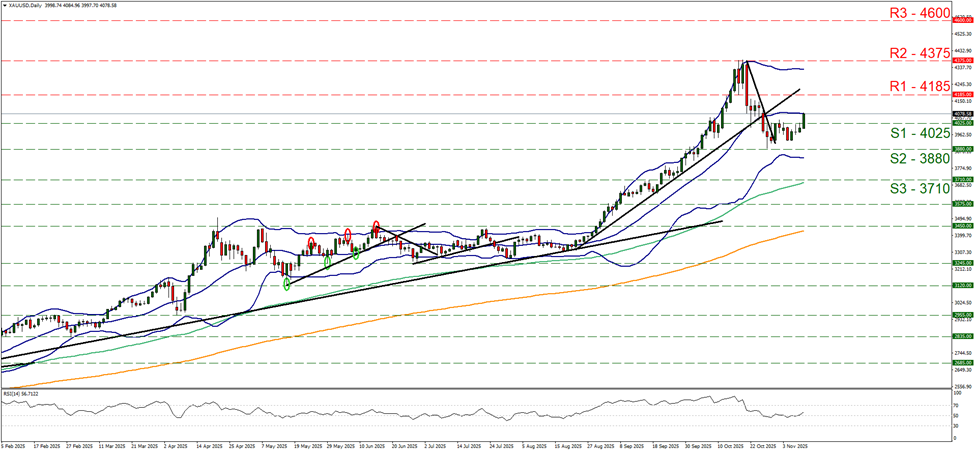

Also on a technical level, we note that gold’s price rose breaking the 4025 (S1) resistance line, now turned to support. Given the precious metal’s upward movement we switch our sideways movement bias in favour of a bullish outlook for now. For the time being, the RSI indicator seems to be escaping the restraints of the reading of 50 to the upside, which could imply a slight awakening of a bullish tendency, yet we would want to see it rising further. For the bullish outlook to be maintained, we would require gold’s price to start actively aiming for the 4185 (R1) resistance line, while even higher we note the 4375 (R2) resistance level, which marks an All Time High for the precious metal’s price. For a bearish outlook to be adopted we would require gold’s price to break the 4025 (S1) support line and thus pave the way for the 3880 (S2) support level.

Otros puntos destacados del día:

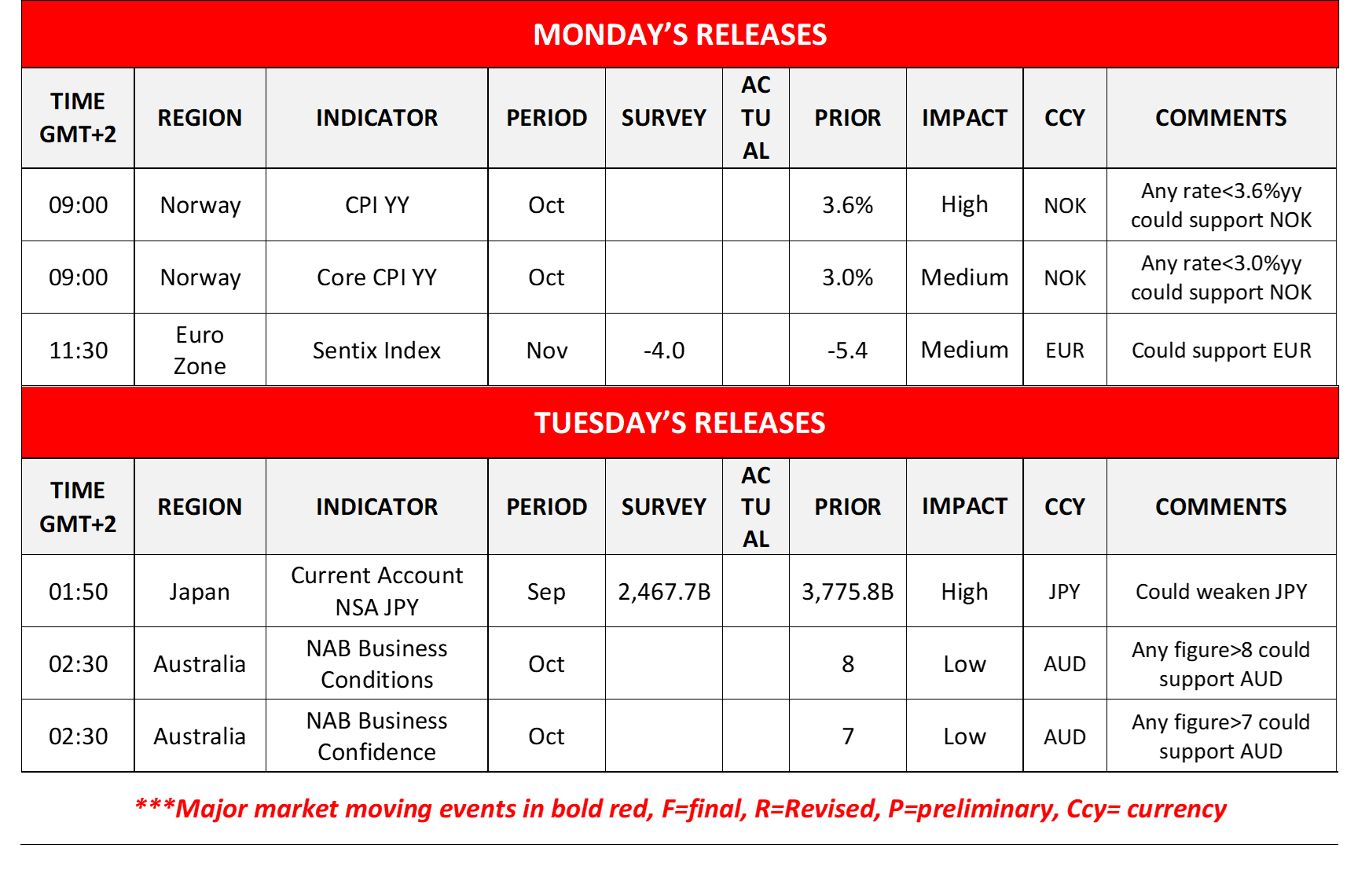

Today we get Norway’s CPI rates for October and Euro Zone’s Sentix index for November, while in tomorrow’s Asian session, we get Japan’s current account balance for September and Australia’s NAB business conditions and confidence for October.

En cuanto al resto de la semana:

On Tuesday we get UK’s employment data for September, Norway’s GDP rate for Q3, the Czech Republic’s CPI rates for October and Germany’s ZEW indicators for November. On Wednesday we note the release of New Zealand’s electronic card sales for October and on Thursday we get Japan’s corporate goods prices for October, Australia’s employment data for the same month, UK’s preliminary GDP rate for Q3, Euro Zone’s industrial output for September and normally we should get the US CPI rates for October, yet the release will probably be delayed given the ongoing US Government shutdown. Finally on Friday we note the release of China’s industrial output and urban investment rates for October, Euro Zone’s GDP estimate rate for Q3, Canada’s manufacturing sales and from the US the calendar notes the release of the PPI rates and the retail sales growth rates for October, again both could be delayed.

AUD/USD Gráfico diario

- Support: 0.6375 (S1), 0.6130 (S2), 0.5910 (S3)

- Resistance: 0.6620 (R1), 0.6940 (R2), 0.7160 (R3)

XAU/USD Gráfico Diario

- Support: 4025 (S1), 4185 (S2), 4600 (S3)

- Resistance: 4185 (R1), 4375 (R2), 4600 (R3)

Si tiene usted alguna pregunta o comentario sobre este artículo, escriba un correo directamente a nuestro equipo de investigación research_team@ironfx.com

Descargo de responsabilidad:

Esta información no debe considerarse asesoramiento o recomendación sobre inversiones, sino una comunicación de marketing. IronFX no se hace responsable de datos o información de terceros en esta comunicación, ya sea por referencia o enlace.