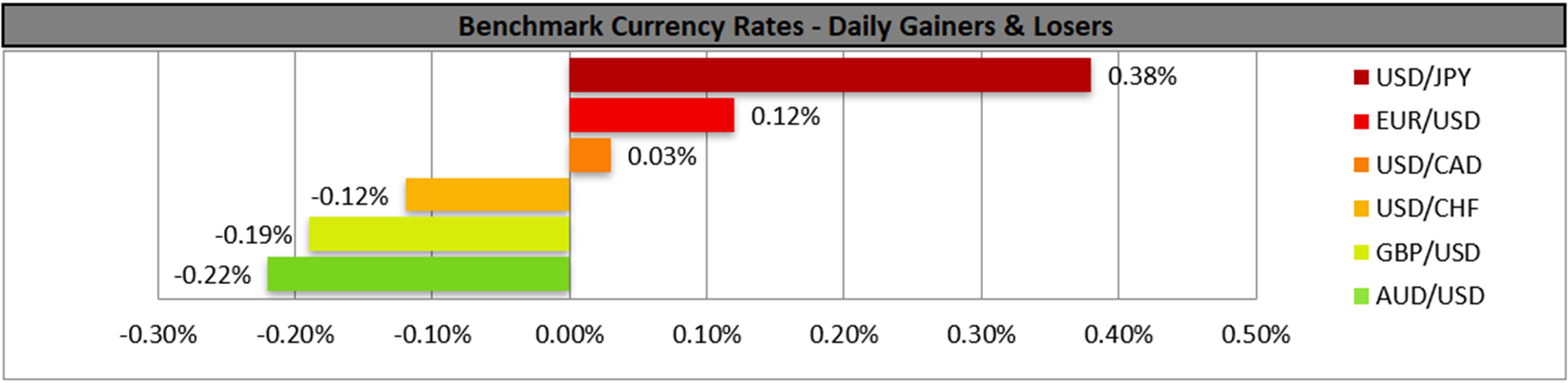

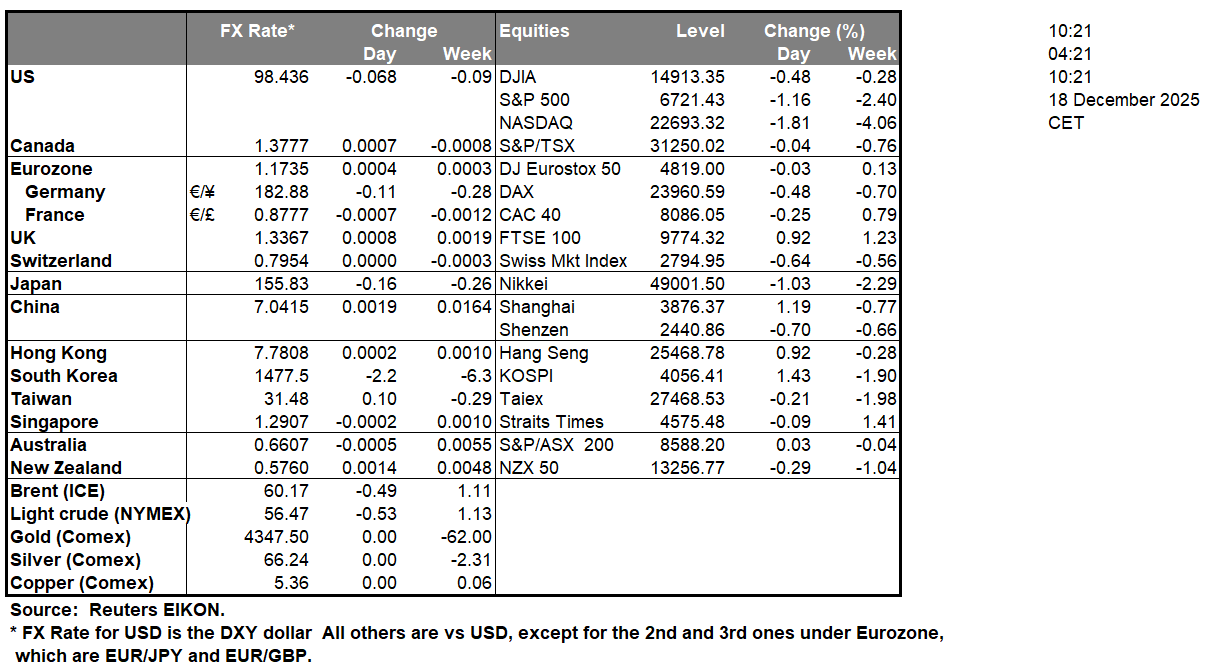

The USD edged higher against its counterparts yesterday and today we note from the US the release of the US CPI rates for November, a release that could complete the picture after the release of the US employment data for the same month. Should the CPI rates accelerate, implying a resilience of the inflationary pressures in the US economy and could support for the USD.

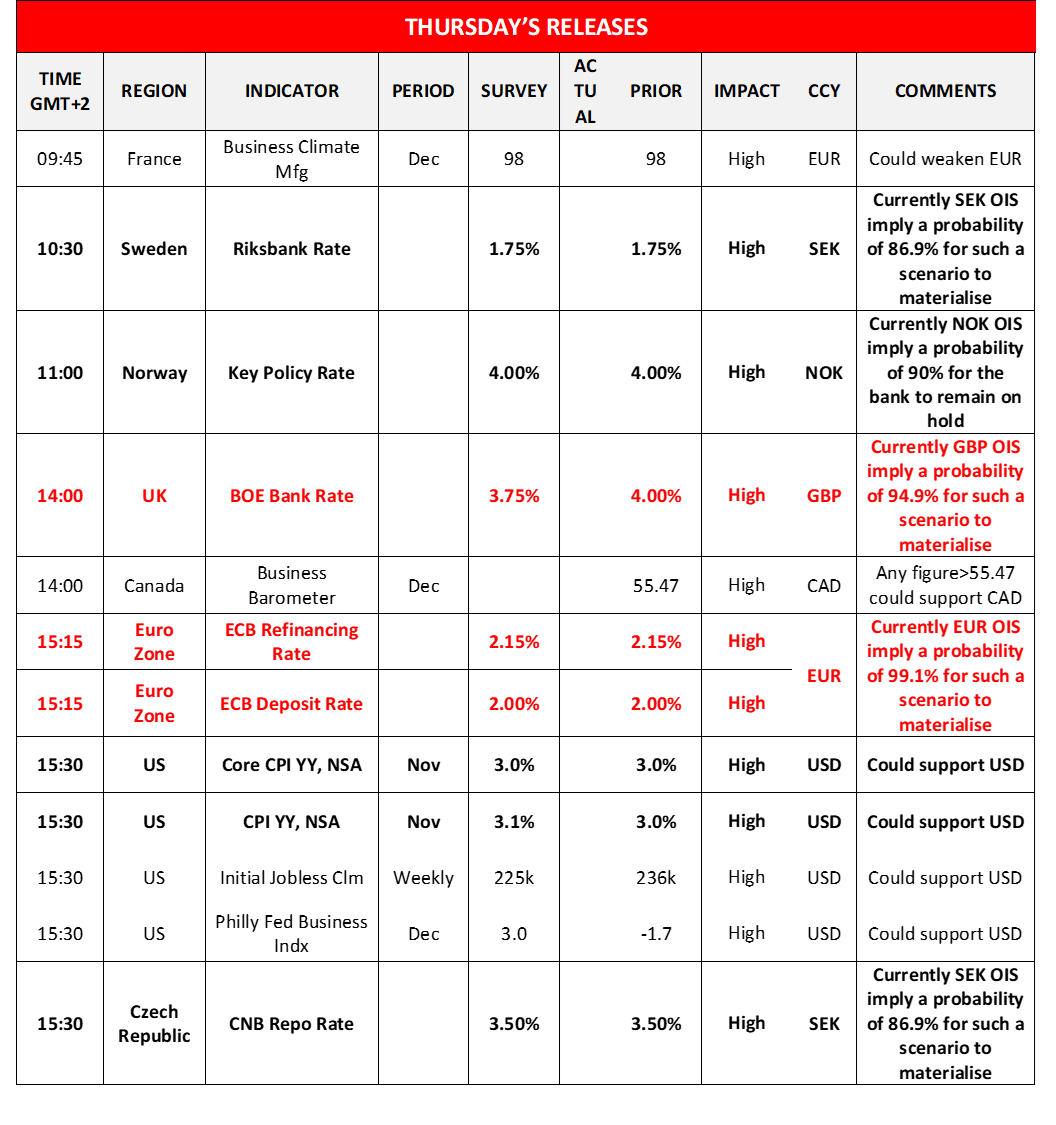

Today, we note the release of BoE’s interest rate decision. The bank is widely expected to proceed with a 25 basis points rate cut and if so, we may see the market’s attention turning towards the bank’s forward guidance and should the bank enhance market expectations for a possible continuation of the easing of its monetary policy we may see the pound retreating, yet should the bank signal that it’s entering an extended pause in its easing cycle we may see the pound getting some support.

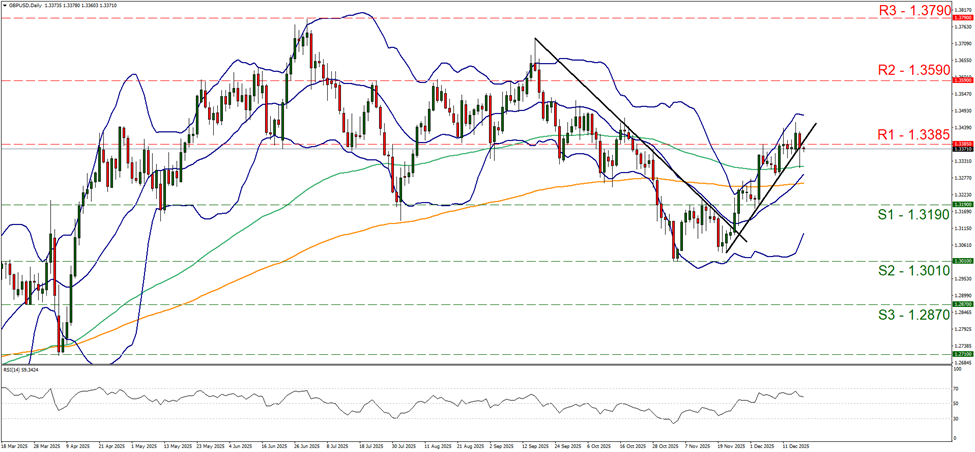

Despite some correction GBP/USD continued to drop yesterday and in today’s Asian and today’s early European session, placing some distance between its price action and the 1.3385 (R1) resistance line. We maintain our bias for a sideways motion as expressed yesterday’s report, and note that the RSI indicator neared the reading of 50, signaling an easing of the bullish sentiment of the market for the pair. Should the bears maintain control over the pair, we may see the pair aiming if not breaching the 1.3190 (S1) support line. Should the bulls take over we may see the pair breaking the 1.3385 (R1) resistance line and start aiming for the 1.3590 (R2) resistance level.

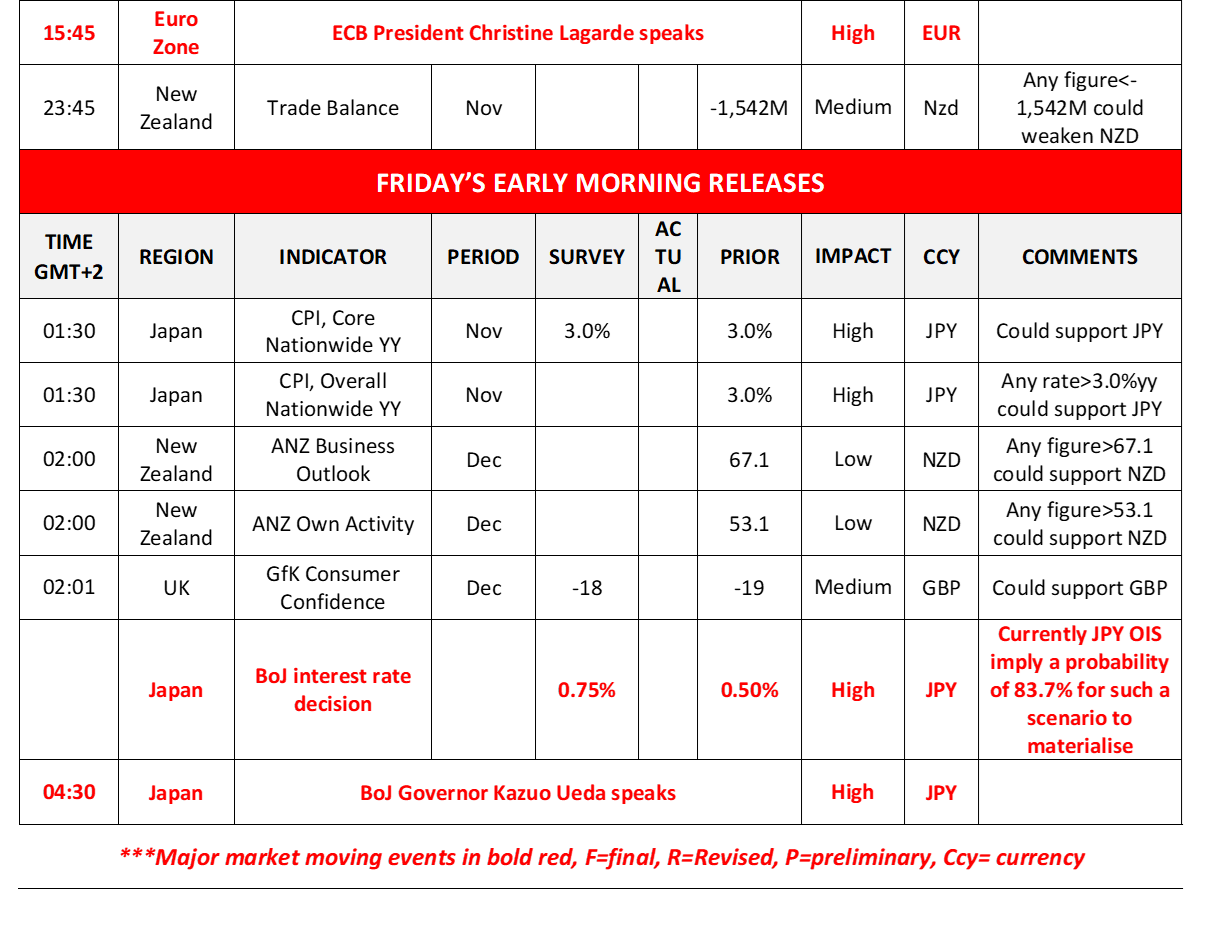

Also in the FX market on a monetary level, we note today the release of the ECB’s interest rate decision, and the bank is widely expected to remain on hold, and we expect the bank to keep its forward guidance unchanged with ECB President Lagarde possibly stressing that its monetary policy is in a “good place”, which in turn may provide some support for the common currency. In tomorrow’s Asian session, we highlight in Japan the release of BoJ’s interest rate decision. The bank is expected to hike rates by 25 basis points, while the market is expecting the bank to hike rates again mid next year and once more in December 26. At this point we have to note that the bank’s hawkish intentions had faced headwinds from the Japanese Government. Yet the weakening of JPY against the USD since the midst of September and the relative inflationary pressures may allow the Japanese government to tolerate a possible rate hike, yet the negative growth for Q3, tends to add more pressure on the bank to keep rates low. Hence our base scenario is that the bank is to hike rates on Friday and we also expect the bank to issue a forward guidance possibly leaning on the hawkish side and both elements could provide support for the JPY.

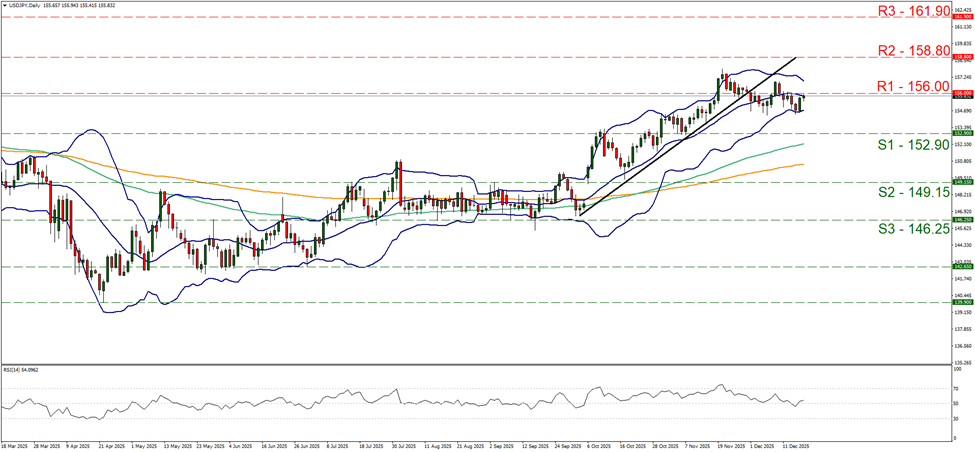

USD/JPY rose yesterday and in today’s Asian session flirted with the 156.00 (R1) resistance line. We maintain a bias for a sideways motion of the pair as despite the pair’s price action forming lower peaks it seems unable to form lower troughs and the RSI indicator remain near the reading of 50, implying a rather indecisive market which could allow the sideways motion to continue. Should the bulls take over we may see the pair breaking the 156.00 (R1) resistance line and start aiming for the 158.80 (R2) resistance level. Should the bears take over, we may see the pair aiming if not breaching the 152.90 (S1) support line.

Otros puntos destacados del día:

Today, we get France’s business climate, Canada’s business barometer, the US Philly Fed Business index all for December, the weekly US initial jobless claims figure, and New Zealand’s trade data for November. On a monetary level, we get Sweden’s Riksbank, Norway’s Norgesbank’s and the Czech Republic’s CNB’s interest rate decisions. In tomorrow’s Asian session, we get Japan’s CPI rates for November, New Zealand’s business outlook and UK’s consumer confidence for December.

GBP/USD Daily Chart

- Support: 1.3190 (S1), 1.3010 (S2), 1.2870 (S3)

- Resistance: 1.3385 (R1), 1.3590 (R2), 1.3790 (R3)

USD/JPY Daily Chart

- Support: 152.90 (S1), 149.15 (S2), 146.25 (S3)

- Resistance: 156.00 (R1), 158.80 (R2), 161.90 (R3)

Si tiene usted alguna pregunta o comentario sobre este artículo, escriba un correo directamente a nuestro equipo de investigación research_team@ironfx.com

Descargo de responsabilidad:

Esta información no debe considerarse asesoramiento o recomendación sobre inversiones, sino una comunicación de marketing. IronFX no se hace responsable de datos o información de terceros en esta comunicación, ya sea por referencia o enlace.