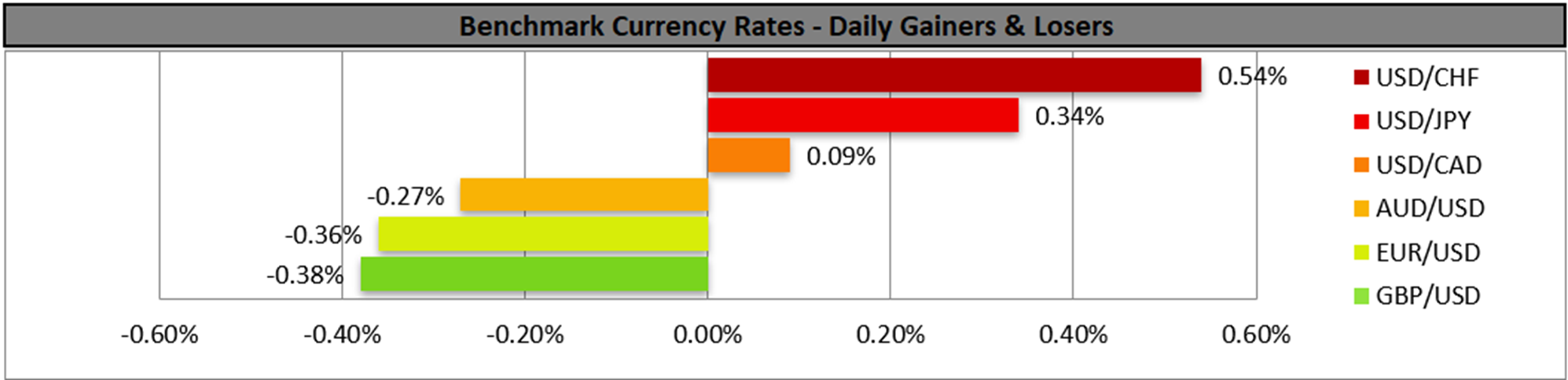

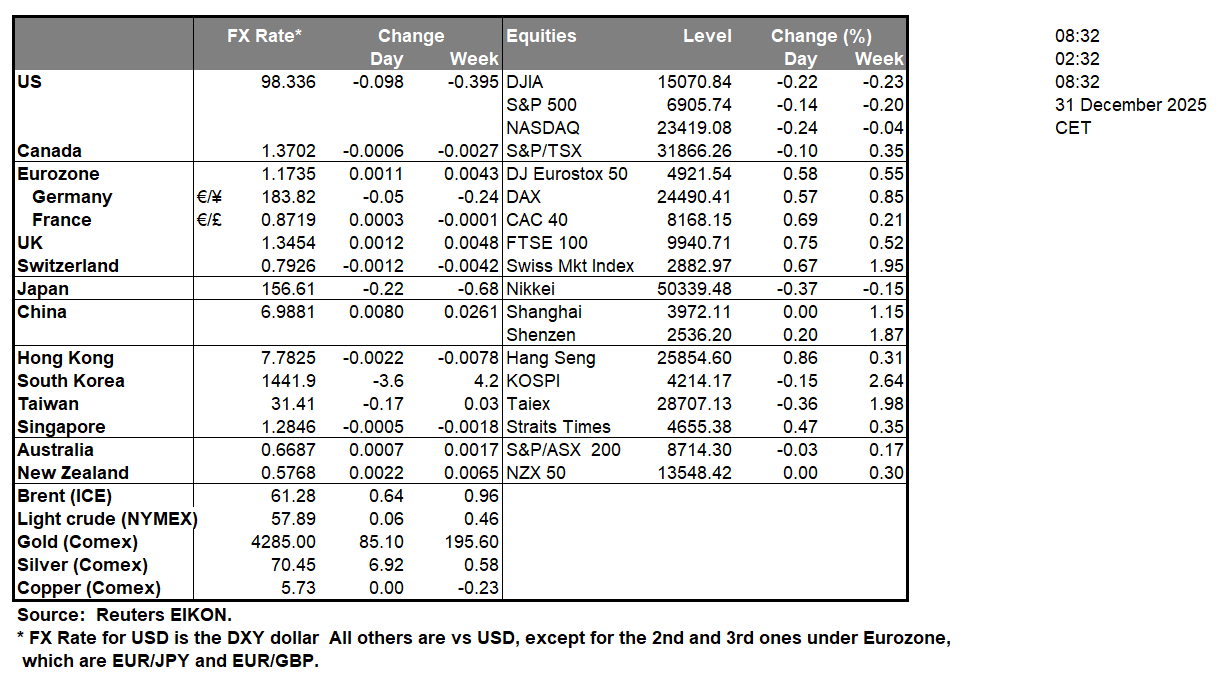

The USD gained somewhat yesterday against its counterparts in the FX market. The release of the Fed’s December meeting minutes highlighted the deep division among Fed policymakers for the bank’s way forward. It should be noted that Fed policymakers agreed to cut rates in the December meeting yet that was heavily debated in regards to the risks surrounding the US economy at the current stage. It seems that the decision could have been different as some Fed policymakers who at the end voted in favour of the rate cut could have supported keeping the target range unchanged. It should be noted that the new dot plot which was included in the Fed’s new projections had signaled the intention of Fed policymakers to proceed only once with a rate cut in the coming year. The wide deviation of the dots in the vertical shape of the dot plot, reflects also the wide division among Fed policymakers showing also how intense the opinions are among Fed policymakers. On the one hand the doves, possibly also partially affected by US President Trumps wishes, rely on the weakness of the US employment market, while on the flip side the hawks highlight how inflationary pressures have failed so far to reach the bank’s 2% target. It should be noted that the release failed to alter the market’s expectations for the bank to cut rates twice in the coming year, which implies that the market continues to maintain a dovish inclination. The release tended to provide moderated support for the greenback as mentioned at the beginning, given that the chasm among Fed policymakers may have been allready largely priced in by the markets. At the same time seems gold’s price and US stock markets seem to have retreated as the prospect of a tighter monetary policy by the Fed tends to weigh. As the year is coming to an end, we note that the USD is in the reds, while US stock markets are still near record highs, yet the most impressive rally may have been in the precious metals markets with gold reaching new record highs time after time.

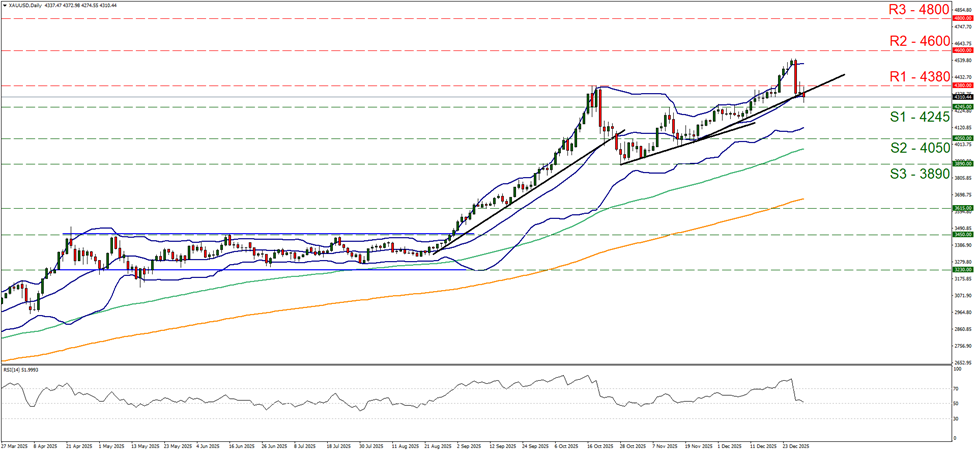

Gold’s price was rather stable yesterday and today, well between the 4380 (R1) resistance line and the 4245 (S1) support level. The precious metal’s price action in its stability seems to have broken the upward trendline guiding it since the 28th of October and has steepened its slope since the 20th of November, allowing us to switch our bullish outlook in favour of a sideways motion bias for the time being. Please note though that the RSI indicator remained close to the reading of 50, implying a rather indecisive market. Should the bulls regain control over gold’s price we may see it breaking the 4380 (R1) resistance line and start aiming for the 4600 (R2) resistance level. Should the bears take over we may see gold’s price the 4380 (S1) support line, paving the way for the 4245 (S2) support level.

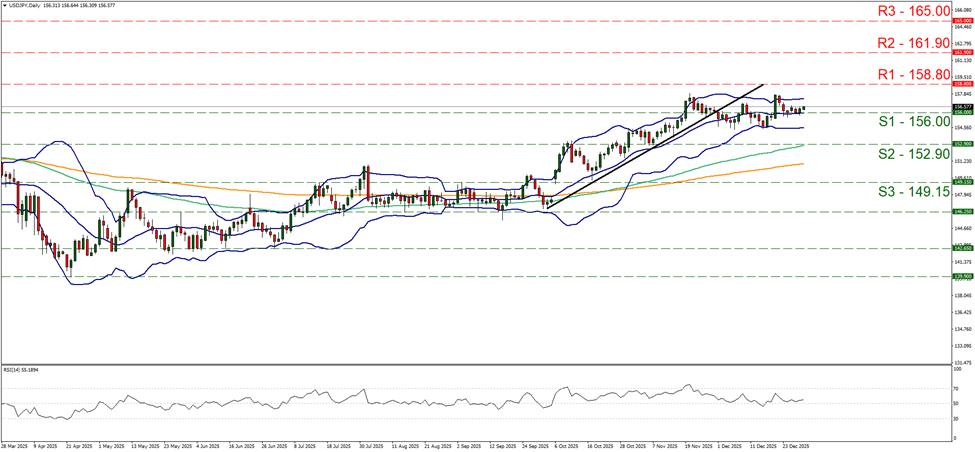

USD/JPY remained stable just above the 156.00 (S1) support line. We tend to maintain a bias for the pair’s sideways motion to continue given that the RSI indicator remains near the reading of 50 implying a rather indecisive market but we also note how narrow the Bollinger bands are, implying lower volatility for the pair, which may in turn allow the sideways motion of the pair to continue. For a bullish outlook to emerge we would require USD/JPY to break the 158.80 (R1) resistance line and start aiming for the 161.90 (R2) resistance level. For a bearish outlook to be adopted, we would require the pair’s price action to break the 156.00 (S1) support line and continue lower breaking also the 152.90 (S2) support level, while even lower we note the 149.15 (S3) support barrier.

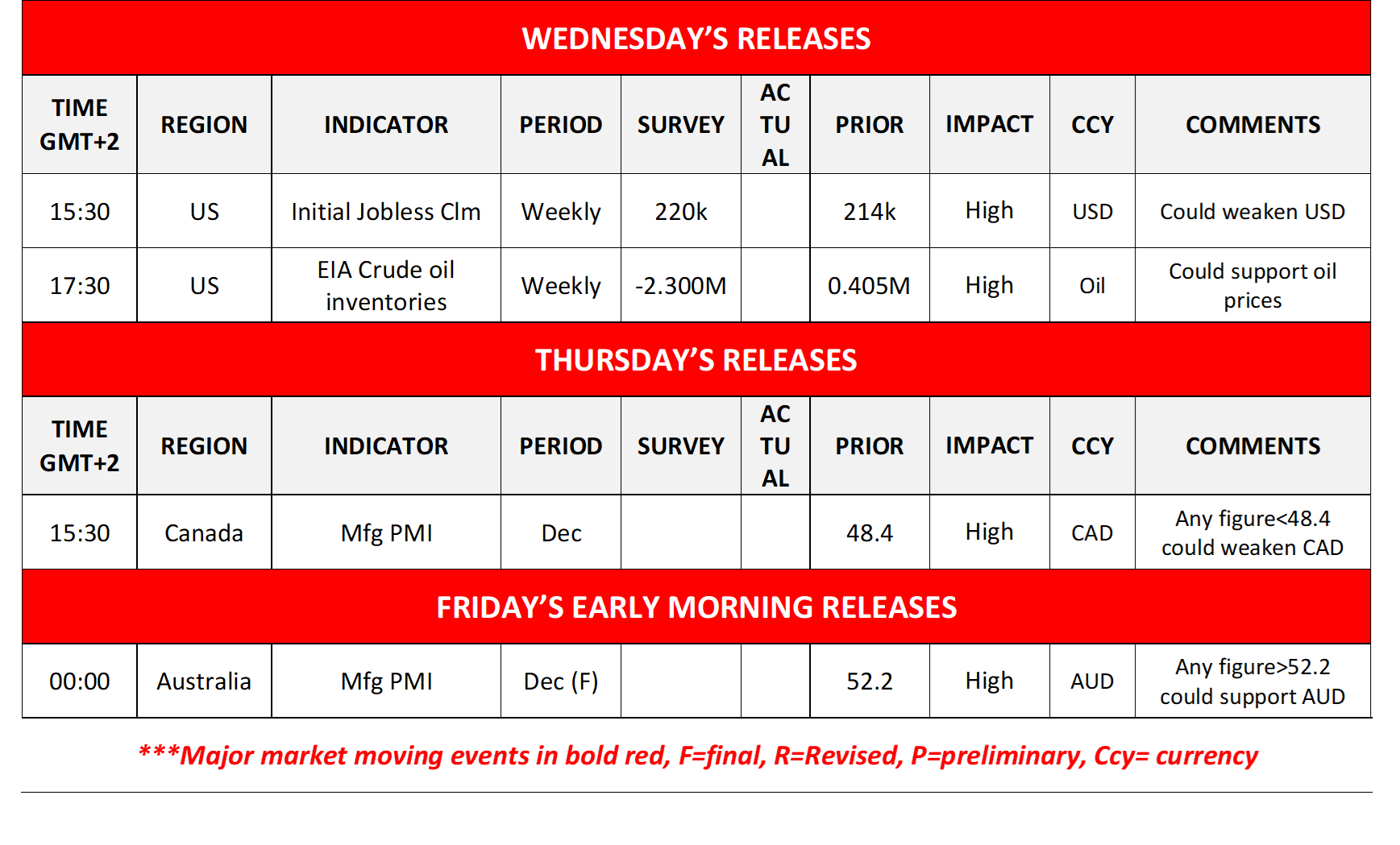

Other highlights for the day:

Today we get the US API weekly crude oil inventories and in tomorrow’s Asian session, we get China’s NBS manufacturing and non-manufacturing PMI figures for December.

XAU/USD Daily Chart

- Support: 4245 (S1), 4050 (S2), 3890 (S3)

- Resistance: 4380 (R1), 4600 (R2), 4800 (R3)

USD/JPY Daily Chart

- Support: 156.00 (S1), 152.90 (S2), 149.15 (S3)

- Resistance: 158.80 (R1), 161.90 (R2), 165.00 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.