Gold’s price suffered a substantial hit last Tuesday and despite some stabilisation the following days, the bearish tendencies for the precious metal were renewed yesterday. In today’s report we are to discuss the prospect of an improvement of the US-Sino trade relationships, the Fed’s upcoming interest rate decision and have a look at upcoming financial releases and examine the validity of the negative correlation of the USD with gold’s price over the past week. For a rounder view we are to provide a technical analysis of gold’s daily chart.

Prospect of an improvement of US-Sino trade relationship weighs on gold’s price

The possibility of an improvement in the US-Sino trade relationship tends to weigh on gold’s price as market worries seem to ease, reversing the picture described in our last report.

US Trade Secretary Bessent stated that the scenario of the US applying an additional 100% tariffs on Chinese products entering the US has been eliminated, while the Americans seem to be expecting an easing of China’s restriction on the exports of rare earths. Bessent also stated that the two sides were able to set a framework for the meeting of US President Trump and Chinese President Xi in South Korea, next Thursday.

Yet there is still a certain degree of uncertainty for the outcome of the meeting. Should the two leaders be able to set the basis of a thawing of the tensions in the US-Chinese trade relationships, we may see the meeting weighing on gold’s price as market worries may ease further. On the flip side should the meeting disappoint the markets in the sense that it may deliver too little, too late, we may see gold getting some safe haven inflows.

The Fed is expected to cut rates, will it signal more rate cuts to come?

Tomorrow we get the Fed’s interest rate decision and the bank is widely expected to cut rates by 25 basis points. Fed Fund Futures (FFF) imply that the market seems to expect the bank to deliver another rate cut in the December meeting and to continue to ease its monetary policy in the next year which underscores a dovish predisposition of the market for the Fed’s intentions.

Hence a mere rate cut may not be sufficient to move gold’s price, market attention may also be placed on the bank’s forward guidance which is to be included in the bank’s accompanying statement and Fed Chairman Powell’s press conference. For the time being the loosening of the US employment market adds more pressure on the bank to continue cutting rates yet the persistence of inflationary pressures in the US economy, as expressed by the release of the US CPI rates for September last Friday, tends to advise caution in further easing of the Fed’s monetary policy.

Also we note the divide among Fed policymakers for the banks’ intentions. Fed Board Governor Miran seems to be pressing for a faster pace in the bank’s monetary policy, while other like Kansas Fed President Schmid seem to remain sceptic. For the time being there seems to be a majority of doves among voting members of the Fed.

Should the bank highlight the possibility of further easing down the line intensifying possibly the market’s dovish expectations, we may see gold’s price getting some support. On the other hand, should a hesitation for further easing of the banks’ monetary policy be highlighted we may see gold’s price weakening.

Negative correlation of the USD with gold’s price inactive

Another issue that gold traders tend to keep under monitoring is the negative correlation of the USD with gold’s price. We note that the USD Index, which measures the movement of the USD against a basket of other currencies in the FX market, edged a bit higher last Tuesday and stabilised, edging a bit lower yesterday.

On the other hand, gold’s price dropped considerably last Tuesday and despite some stabilisation in the following days continued to fall since yesterday. Hence the negative correlation of the two trading instruments over the past week has been inactive.

Upcoming financial releases

Before we start we note that the release of the US employment report for September is long overdue and could be released in the coming week. Should the employment data, including the NFP figure, show further loosening of the US employment market in the past week, we may see gold’s price getting some support, while signs of a considerably tightening US employment market could weigh on the USD.

Also on Thursday we get the US GDP advance rate for Q3. Should the rate slow down beyond market expectations we may see gold’s price getting some support as market worries for the US economic outlook intensifying, while an unexpected acceleration of the rate implying a faster expansion of the US economy could weigh on gold’s price, as market worries may ease.

Gold Technical Analysis

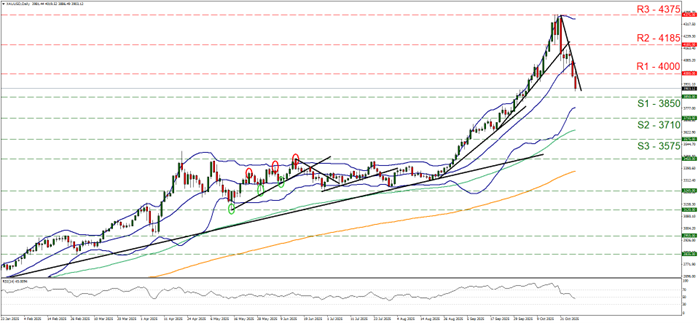

XAU/USD Daily Chart

- Support: 3850 (S1), 3710 (S2), 3575 (S3)

- Resistance: 4000 (R1), 4185 (R2), 4375 (R3)

Gold’s price renewed its bearish tendencies yesterday by breaking the 4000 (R1) support line, now turned to resistance. The stabilisation and then dropping of gold’s price, allowed us to draw a downward trendline in an effort to show the limitations of the downward movement. As long as the downward trendline remains intact, we intend to maintain our bearish outlook for gold’s price.

We note that the RSI indicator has just dropped below the reading of 50, implying that the bearish market sentiment may still be weak, while the distance between the price action and the lower Bollinger band, implies that there is still some room for the bears to play. Should the bears maintain control over gold’s price we may see it breaking the 3850 (S1) support line and start aiming for the 3710 (S2) support level.

For a bullish outlook to emerge, we would require gold’s price to reverse direction, break the prementioned downward trendline in a first signal of an interruption of the downward motion and then continue to break the 4000 (R1) resistance line and start aiming for the 4185 (R2) resistance level.

Disclaimer:

This information is not considered investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced or hyperlinked in this communication.